5g Capacitor Size

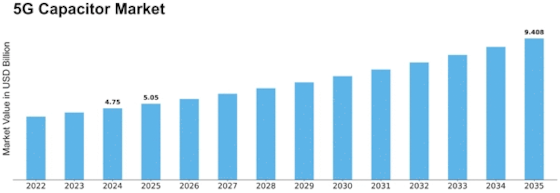

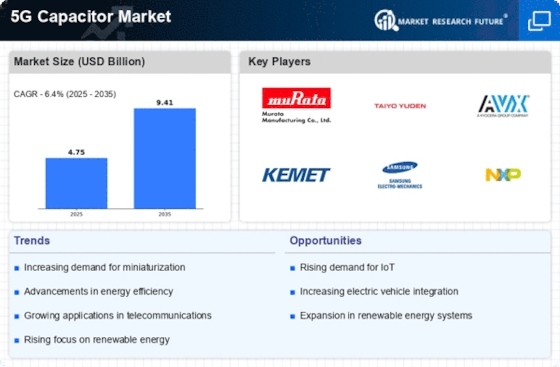

5G Capacitor Market Growth Projections and Opportunities

It is due to the factors that has been affecting the 5G Capacitor Market growth in significant ways. A critical aspect is the globe-wide adoption of 5G technology. With the coming of 5G, a period of fast and reliable data transfer has arrived, with higher speeds than before at lower latency and covering larger networks. As 5G-driven devices create space in the market, there is an increased possibility for specialized capacitors to advance and dwell due to enormous increase demands of this device. The development in 5G infrastructure and the devise which utilizes this technology all takes part in forming the market for the capacitator Which such as. The 5G ecosystem covers numerous applications such as smartphones, IoT sensors, smart city, and intelligent transport. The capacitors in 5G devices should able to support the data transfer rates that are increases and can accommodate the higher frequency bands operation used during 5G communication.

Consequently, the capacitor makers are channeling research and development funds for component manufacture with superior functionalities like increase in capacity level, reduction of size, and dependency enhancement to get hold of required specifications to cause 5G applications. The economic circumstances likewise affect the 5G Capacitor Market. Five key considerations are discussed, namely affordability; reliability; accessibility; applicability and ecological sustainability. If periods of economic growth or wealth are considered, the demand for capacitors in 5G networks increases because telecommunication network infrastructure is more likely stimulated. On the contrary, economic decline may result in postponement or modification of investment implementation schedule which immediately affects market dynamics. The initiative of government and the regulations also contribute significantly to the development of 5G Capacitor Market.

Governments in different parts of the world have understood the strategic impact that 5G technology has through investments into its economic benefit spree and competitiveness. The regulatory and policy initiatives that are geared toward promoting the roll-out of 5G networks have an impact on the need for capacitor product in 5G infrastructure. Further, government funding for telecommunication R & D research and development may also encourage innovation on capacitor technology type. The Competitor landscape also plays an important role in the drives of 5G Capacitor Market. As 5G technology requires products such as glass, fiber optic cables and devices that use some type of capacitor to function under harsh environmental conditions, suppliers must provide components that meet the requirements of the 5 G used applications or lose their demand. Strategic co operations and partnerships between capacitor manufactures and 5G device manufacturers are ubiquitous, enabling companies to remain competitive and provide flexible solutions in favor of the changing demands on consumer market.

Leave a Comment