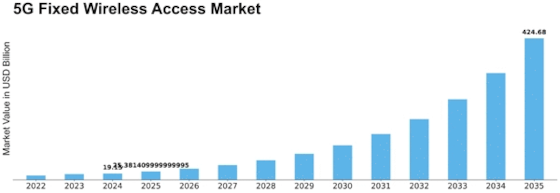

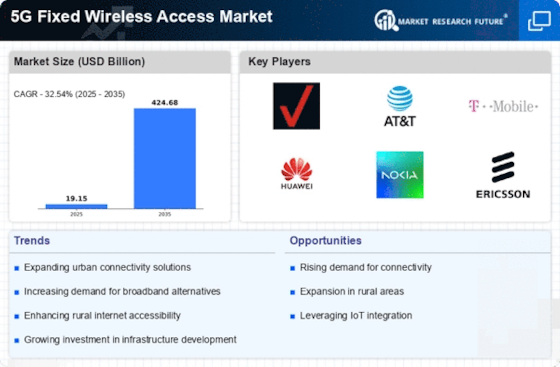

5g Fixed Wireless Access Size

5G Fixed Wireless Access Market Growth Projections and Opportunities

Due to several market dynamics that are influencing the 5G Fixed Wireless Access (FWA) industry and jointly determining its trajectory, the market is now experiencing tremendous change. The unquenchable need for high-speed Internet connection is one important aspect. Businesses and individuals alike are depending more and more on a reliable broadband Internet connection as the digital world changes. In order to meet these needs, 5G FWA offers very fast connections without the need for conventional wired infrastructure. In addition, the market for 5G FWA will be significantly influenced by the spread of Internet of Things (IoT) devices. With the rise of connected automobiles, smart homes, and industrial IoT applications, 5G FWA is well-positioned to offer a dependable, low latency network. 5G FWA is the perfect solution to support the growing ecosystem of connected devices, encourage linked devices, and create a more efficient society due to its scalability and efficiency. The dynamics of the 5G FWA market will be greatly impacted by regulatory measures in addition to consumer and industrial needs. Governments everywhere are actively formulating policies to hasten the introduction of 5G technology because they understand its strategic significance. These rules are meant to make spectrum distribution easier, lower deployment hurdles, and create an atmosphere that encourages telecom companies to spend money on 5G infrastructure. The 5G FWA market is expected to expand at a faster rate thanks to policies that are supportive of it as the regulatory environment becomes more established. In addition, the competitive landscape of telecoms service providers will influence the growth of the 5G FWA market. Telecom companies are making significant investments in infrastructure development as they compete to construct 5G networks globally. These operators will be able to increase the range of services they provide, benefit from fresh income sources, and obtain a competitive edge in the market with the rollout of 5G FWA. The competition amongst key providers is therefore a crucial element influencing the pace and scope of 5G FWA deployment. Another important factor influencing the dynamics of the 5G FWA market is cost. The cost of implementing 5G infrastructure, including FWA, is anticipated to go down as the technology advances and economies of scale become accessible. This cost decrease propels 5G FWA's market adoption by making it more affordable for a wider spectrum of enterprises and consumers. 5G FWA is an appealing option since it is more affordable, especially in areas where traditional fixed-line infrastructure is difficult to deploy.

Leave a Comment