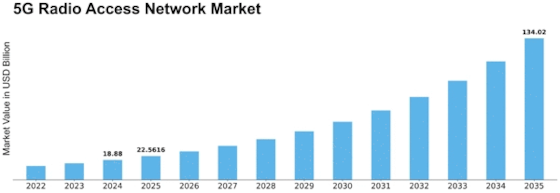

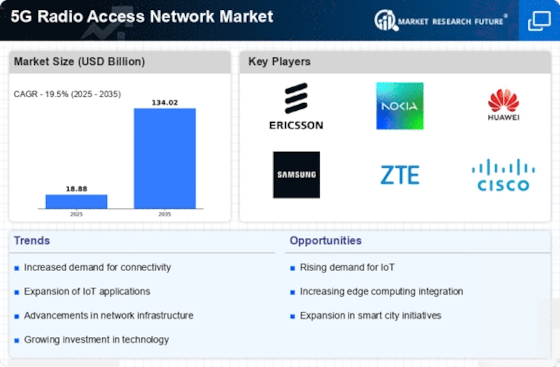

5g Radio Access Network Size

5G Radio Access Network Market Growth Projections and Opportunities

The 5G Radio Access Network (RAN) market is seeing a powerful change driven by different market factors that are moulding its development and improvement. One key element adding to the extension of the 5G RAN market is the rising interest for higher information velocities and low-dormancy availability. As buyers and organizations keep on depending on information escalated applications, like expanded reality, computer generated reality, and the Web of Things (IoT), the requirement for a hearty and proficient RAN becomes principal. Another critical market factor is the continuous mechanical headways in the media communications industry. The development from 4G to 5G addresses a significant jump regarding network capacities.

With 5G, clients can encounter essentially quicker download and transfer speeds, diminished inertness, and expanded network limit. This innovative jump is driving the reception of 5G RAN foundation as telecom administrators endeavour to remain cutthroat by offering predominant network administrations. The worldwide push for computerized change is likewise assuming an essential part in the development of the 5G RAN market. The transformative potential of 5G technology in enhancing operational efficiency and enabling innovative applications is being recognized by all industries. From savvy urban areas and independent vehicles to modern computerization and far off medical services, the adaptability of 5G is extending the skylines of what is conceivable, subsequently moving the interest for cutting edge RAN arrangements. Market factors are additionally affected by administrative drives and government arrangements pointed toward cultivating 5G sending. Legislatures all over the planet are perceiving the essential significance of 5G innovation in driving financial development and advancement.

Accordingly, they are executing approaches to work with the sending of 5G foundation, including the important RAN parts. These drives are establishing a helpful climate for sellers in the 5G RAN market to flourish and extend their tasks. Also, the developing pattern of organization virtualization and programming characterized organizing is influencing the 5G RAN market. Virtualized RAN solutions are increasingly being used by network operators because they are more cost-effective, flexible, and scalable than traditional hardware-based methods. This shift towards virtualization lines up with the more extensive industry pattern towards programming driven networks, giving administrators the spryness to adjust to changing business sector requests. In any case, challenges additionally exist in the 5G RAN market, remembering the requirement for significant ventures for framework advancement. The organization of 5G organizations requires critical capital uses, and the profit from venture might take time. Besides, concerns connected with security and protection in the 5G environment are impacting dynamic cycles for both organization administrators and end-clients.

Leave a Comment