- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

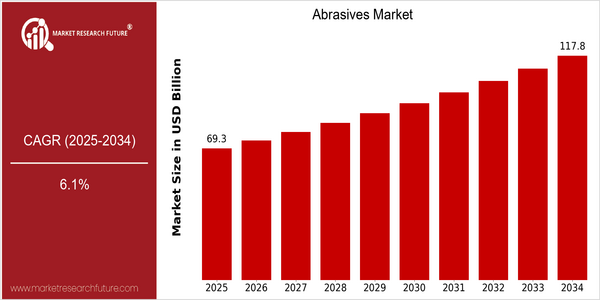

| Year | Value |

|---|---|

| 2025 | USD 69.35 Billion |

| 2034 | USD 117.78 Billion |

| CAGR (2025-2034) | 6.1 % |

Note – Market size depicts the revenue generated over the financial year

The abrasives market is growing at a considerable rate, with a projected market value of $69,356,000,000 in 2025, and expected to expand to $87,167,800,000 by 2034. This represents a CAGR of 6.1% during the forecast period. The key reason for this growth is the increasing demand for abrasives from industries such as the automotive, construction, and manufacturing industries. As industries continue to develop, the need for high-performance materials that enhance the efficiency and precision of the manufacturing process becomes more and more important. The development of superabrasives and environmentally friendly abrasives is also driving the growth of the abrasives market. The development of new manufacturing methods and the increasing automation of industrial processes are also driving the demand for advanced abrasives. Various companies, such as 3M, Saint-Gobain, and Norton, are working to stay ahead of the competition by launching new products, forming strategic alliances, and investing in research and development. These efforts not only address the needs of the end users, but also respond to the growing trend of sustainable development, and help the companies to maintain their leading position in the abrasives market.

Regional Market Size

Regional Deep Dive

The abrasives market is characterized by its applications in various industries such as the automobile, construction, and manufacturing industries. Its dynamics are influenced by local demand, technological developments, and regulatory frameworks. The abrasives market is projected to grow at a CAGR of 5.6% from 2018 to 2023, owing to the increasing industrialization and the growing need for precision tools in manufacturing processes. The focus of the abrasives market in North America and Europe is on innovation and sustainability. However, the abrasives market in Asia-Pacific is expanding rapidly, owing to the rapid industrialization in the region.

Europe

- In Europe, the push for automation and Industry 4.0 is driving innovation in the abrasives market, with companies like Klingspor and Saint-Gobain developing smart abrasives that integrate with automated systems for enhanced efficiency.

- REACH, the European regulation regulating the registration, evaluation, authorization and restriction of chemicals, has forced manufacturers to reformulate their products and thus to increase the demand for non-toxic and biodegradable abrasives.

Asia Pacific

- The demand for abrasives is increasing as a result of the growing industrialization in the Asia-Pacific region. The demand is especially strong in China and India, where Fujimi Incorporated is expanding its production capacity to meet the growing market.

- Abrasive products, especially in the field of advanced ceramics and composites, have benefited from the research and development of local universities and scientific institutions, and the performance and life of the abrasive products have been improved in many aspects.

Latin America

- Latin America is seeing a growing interest in abrasives due to the expansion of the automotive and aerospace industries, with companies like Abrasivos de Mexico investing in new technologies to enhance product offerings.

- Regulatory frameworks in countries like Brazil are evolving to promote the use of safer and more sustainable abrasive materials, influencing manufacturers to adapt their product lines accordingly.

North America

- The North American abrasives market is undergoing a change towards greener products, with 3M and Norton abrasives investing in sustainable manufacturing processes to meet the requirements of government regulations and the demand of consumers for greener products.

- The American National Standard Institute (ANSI) is the leading organization promoting the development of abrasives, superabrasives in particular. ANSI is establishing new standards of performance and safety in the industry.

Middle East And Africa

- In the Middle East and Africa, the market for abrasives is influenced by the current construction boom, especially in the Gulf Cooperation Council (GCC) countries, where companies like Al Ain Co. for Tools and Hardware are benefiting from the increasing demand for high-quality abrasives in the construction industry.

- Government initiatives aimed at diversifying economies away from oil dependency are fostering growth in manufacturing sectors, leading to increased investments in abrasive technologies and materials.

Did You Know?

“Did you know that the global abrasives market is expected to see a significant shift towards the use of superabrasives, which are capable of cutting harder materials like ceramics and composites, making them essential in high-tech industries?” — Market Research Future

Segmental Market Size

The abrasives market is currently growing steadily, thanks to the increasing demand from various industries, such as automobile, construction, and manufacturing. The main driving forces are the rising need for surface finishing and material removal in the manufacturing process, and the increasingly stringent regulations to ensure the quality and safety of production. Further, technological advancements in abrasives, such as the development of superabrasives, have improved the efficiency and productivity of abrasives, thus driving the demand further. Currently, the penetration of superabrasives is in the process of escalation, with 3M and Norton as the leading companies in this field. The superabrasives are used mainly in the metalworking, woodworking, and electronics industries, where the need for precision and quality is very high. The market is also driven by several trends, such as the increasing focus on sustainable abrasives in the manufacturing process, and the ongoing digitalization of the manufacturing process. Further, the emergence of newer cutting and finishing techniques, such as waterjet cutting and laser cutting, is also shaping the abrasives market, as they enable more efficient and precise applications.

Future Outlook

The Abrasives Market is expected to see a significant growth between 2025 and 2034, with a CAGR of 6.1%. The growth will be driven by the growing demand for abrasives from end-use industries, such as the automobile, construction and manufacturing industries, where abrasives are used for surface preparation, finishing and polishing. As these industries become more and more concerned with improving productivity and quality, the penetration of advanced abrasives, such as superabrasives and ceramic abrasives, is likely to increase. The penetration of these abrasives will lead to enhanced performance and productivity in their respective applications. By 2034, it is expected that the penetration of high-performance abrasives will be approximately 40% of the total market. The development of new abrasives with enhanced properties, such as eco-friendly abrasives and synthetic abrasives, will also contribute to the market growth. A need for sustainable abrasives has led manufacturers to develop abrasives that are less harmful to the environment and are more biodegradable. The demand for these abrasives is largely driven by the growing concern for the environment and the resulting policies and consumer preferences. Also, the integration of automation and smart technology in manufacturing processes is expected to increase the efficiency of abrasive applications, which will increase their use. Moreover, the emergence of e-commerce platforms and the growing trend towards individualized solutions will also play an important role in increasing the reach and availability of the market. The abrasives market is therefore likely to see a significant evolution, driven by a combination of technological developments, sustainable initiatives and changing consumer preferences.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 54.8 billion |

| Growth Rate | 6.06% (2024-2032) |

Abrasives Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.