Regulatory Compliance

Regulatory compliance is increasingly influencing the Global Accounts Receivable (AR) Automation Software Market Industry as businesses navigate complex financial regulations. Organizations are compelled to adopt AR automation solutions to ensure adherence to compliance standards, such as the Sarbanes-Oxley Act and GDPR. These regulations necessitate accurate record-keeping and timely reporting, which AR automation can facilitate. Companies that implement these solutions often experience enhanced audit readiness and reduced compliance risks. This growing emphasis on compliance is likely to propel market growth, as firms recognize the value of automated systems in maintaining regulatory standards.

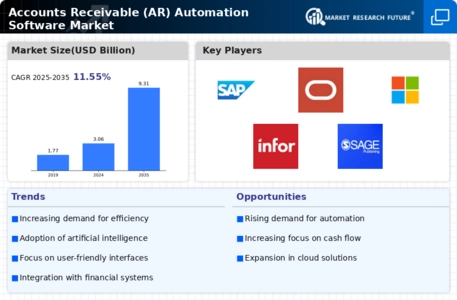

Market Growth Projections

Technological Advancements

Technological advancements play a pivotal role in driving the Global Accounts Receivable (AR) Automation Software Market Industry. Innovations such as artificial intelligence and machine learning are being integrated into AR solutions, enabling predictive analytics and improved decision-making. These technologies facilitate better forecasting of cash flows and enhance customer interactions. For instance, companies leveraging AI-driven AR solutions report a reduction in days sales outstanding (DSO) by up to 30 percent. This trend is expected to contribute to the market's growth, with projections indicating a rise to 9.31 USD Billion by 2035, highlighting the transformative impact of technology on financial operations.

Focus on Cash Flow Management

A heightened focus on cash flow management is driving the Global Accounts Receivable (AR) Automation Software Market Industry as organizations seek to optimize their financial health. Effective cash flow management is crucial for sustaining operations and funding growth initiatives. AR automation solutions enable businesses to monitor receivables in real-time, facilitating proactive decision-making regarding collections and credit management. Companies that prioritize cash flow management through automation often report improved liquidity and reduced financial stress. This trend underscores the importance of AR automation in fostering financial stability, further propelling market growth.

Increasing Demand for Efficiency

The Global Accounts Receivable (AR) Automation Software Market Industry is witnessing a surge in demand for efficiency as organizations strive to streamline their financial processes. Companies are increasingly adopting AR automation solutions to reduce manual errors and enhance cash flow management. This trend is particularly evident in sectors such as manufacturing and retail, where timely invoicing and collections are critical. As a result, the market is projected to reach 3.06 USD Billion in 2024, reflecting a growing recognition of the importance of efficient accounts receivable processes in maintaining competitive advantage.

Globalization of Business Operations

The globalization of business operations is a significant driver of the Global Accounts Receivable (AR) Automation Software Market Industry. As companies expand their reach across borders, they encounter diverse financial practices and regulations. AR automation solutions provide the necessary tools to manage these complexities, enabling organizations to standardize their invoicing and collections processes globally. This standardization not only improves operational efficiency but also enhances customer satisfaction by ensuring timely payments. The increasing need for global financial integration is expected to contribute to the market's growth trajectory, with a projected CAGR of 10.65% from 2025 to 2035.