Acrylic Acid Size

Acrylic Acid Market Growth Projections and Opportunities

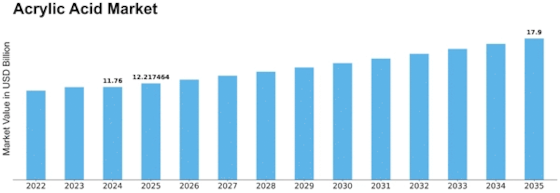

Acrylic Acid Market is projected to be worth USD 19.2 billion by 2030, registering a CAGR of 4.80% during the forecast period (2022-2030).

The Acrylic Acid market is profoundly influenced by various market factors that collectively shape its dynamics. One of the pivotal determinants is the demand from downstream industries such as adhesives, superabsorbent polymers, and coatings. As these industries experience fluctuations in production and consumption, the demand for acrylic acid, a key raw material, undergoes corresponding changes. The construction sector, in particular, significantly impacts the acrylic acid market through its influence on coatings and adhesives used in building materials. Economic conditions, urbanization trends, and construction activities thus play a crucial role in steering the acrylic acid market.

Global environmental regulations and sustainability concerns contribute to the evolving landscape of the acrylic acid market. Stringent environmental standards and the push towards eco-friendly products drive the demand for sustainable and bio-based acrylic acid derivatives. Companies that prioritize green chemistry and invest in the development of environmentally friendly acrylic acid products position themselves favorably in the market. As consumers increasingly seek sustainable options, the ability to offer eco-friendly alternatives becomes a key competitive advantage.

The feedstock market, particularly propylene, is another significant factor affecting the acrylic acid market. Propylene is a primary raw material in acrylic acid production, and its availability and pricing directly impact the overall production costs. Fluctuations in the global supply and pricing of propylene can lead to volatility in the acrylic acid market. Companies must closely monitor and adapt to changes in the propylene market to maintain cost competitiveness and profitability.

Technological advancements play a critical role in shaping the acrylic acid market. Innovations in production processes, catalyst technologies, and purification methods can enhance efficiency, reduce energy consumption, and improve the overall quality of acrylic acid. Companies that invest in research and development to optimize manufacturing processes and introduce innovative products gain a competitive edge in the market. Additionally, advancements in application technologies, such as improved formulations for adhesives or coatings, can open up new avenues for acrylic acid utilization.

Geopolitical factors and trade policies also influence the acrylic acid market. The global nature of the acrylic acid supply chain makes it susceptible to trade tensions, tariff changes, and geopolitical events. Shifts in international relations or trade agreements can impact the import and export dynamics of acrylic acid, affecting market prices and availability. Companies operating in the acrylic acid market need to navigate these geopolitical uncertainties to mitigate risks and ensure a stable supply chain.

Market competition is a constant factor in the acrylic acid sector. The presence of multiple players, each offering a range of acrylic acid derivatives, intensifies competition. Companies differentiate themselves through product quality, pricing strategies, and customer service. Mergers and acquisitions, as well as partnerships, are common strategies employed by companies to strengthen their market position and expand their product portfolios.

Consumer preferences and industry trends also contribute to the acrylic acid market's evolution. Changes in consumer preferences for sustainable products, increased awareness of environmental impact, and advancements in application technologies influence the demand for specific acrylic acid derivatives. Companies that anticipate and adapt to these trends are better positioned to meet market demands effectively and capitalize on emerging opportunities.

Leave a Comment