Market Share

Acrylic Surface Coating Market Share Analysis

In the competitive landscape of the Acrylic Surface Coating Market, positioning strategies play a pivotal role in determining a company's market share and overall success. These strategies encompass various approaches aimed at establishing a distinct identity and perceived value for a company's products or services within the market. One commonly employed strategy is differentiation, where companies strive to distinguish their offerings from competitors through unique features, quality, or branding. For instance, a company may focus on developing acrylic surface coatings with advanced durability, eco-friendly formulations, or innovative application techniques to set itself apart in the market. By highlighting these distinctive attributes, companies can attract customers seeking specific benefits or solutions, thereby capturing a significant portion of the market share.

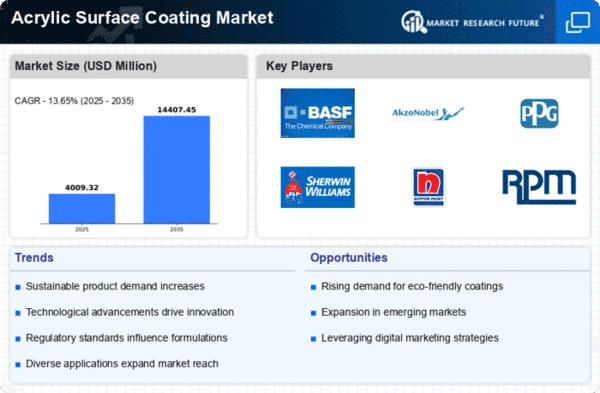

The growing demand for acrylic protective coatings on the industrial tools and equipment and decorative parts in building & construction industry is the prime factor driving the global market growth.

Another key positioning strategy in the Acrylic Surface Coating Market involves targeting specific market segments or niche markets. Rather than pursuing a broad, generalized approach, companies identify and cater to the needs of particular customer groups with specialized requirements or preferences. For example, a company may focus on providing acrylic surface coatings tailored for industrial applications, such as automotive coatings or protective coatings for infrastructure, thus carving out a niche within the broader market. By concentrating efforts on serving these specialized segments exceptionally well, companies can strengthen their market position and command a higher share of customer demand within their chosen niche.

Furthermore, companies in the Acrylic Surface Coating Market often utilize a pricing strategy to influence their market share positioning. Price positioning involves setting prices at levels that reflect the perceived value of the product or service relative to competitors. Some companies may opt for a premium pricing strategy, positioning their acrylic surface coatings as high-end products associated with superior quality or performance. This approach targets customers who prioritize quality and are willing to pay a premium for premium products. Conversely, other companies may adopt a value-based pricing strategy, offering cost-effective acrylic surface coatings that provide adequate performance at a lower price point. By aligning pricing with target customers' perceived value and willingness to pay, companies can effectively capture market share while maximizing profitability.

In addition to differentiation, targeting specific market segments, and pricing strategies, effective distribution channels also play a crucial role in market share positioning within the Acrylic Surface Coating Market. Companies must ensure that their products are readily available to customers through efficient distribution networks. This may involve partnering with distributors, retailers, or online platforms to reach a wide audience effectively. Moreover, companies may invest in marketing and promotional activities to raise awareness and visibility for their acrylic surface coatings, thus increasing demand and market share. By optimizing distribution channels and leveraging marketing initiatives, companies can enhance their competitive position and gain traction in the market.

Furthermore, innovation and product development are fundamental aspects of market share positioning in the Acrylic Surface Coating Market. Companies must continually invest in research and development to stay ahead of evolving customer needs and technological advancements. This may involve introducing new formulations, enhancing product performance, or incorporating novel features that address emerging trends or challenges in the industry. By innovating and staying at the forefront of technological advancements, companies can differentiate their offerings, attract customers seeking cutting-edge solutions, and secure a larger share of the market.

Leave a Comment