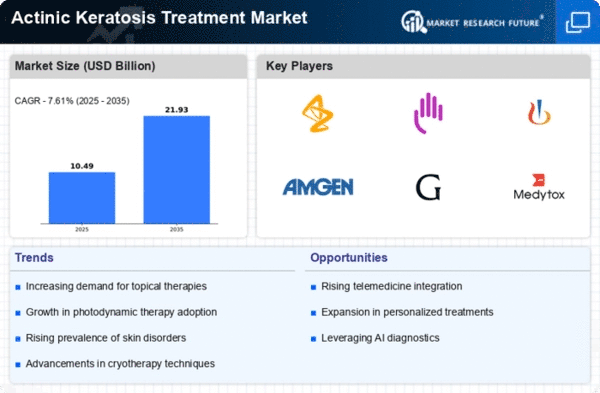

Market Analysis

In-depth Analysis of Actinic Keratosis Treatment Market Industry Landscape

The global economy faced some challenges between 2014 and 2016, but it's on track to grow by 3.6% by the end of 2018. Notably, the money spent on healthcare worldwide is going up. In 2014, the total global healthcare expenditure was about USD 7.82 trillion, and it's projected to reach approximately USD 9.2 trillion by 2018, showing a significant 17.64% increase. In North America, healthcare spending is also increasing. According to the Centers for Medicare & Medicaid Services, the U.S. national health spending is expected to grow by an average of 5.6% annually from 2016 to 2025, and on a per-person basis, it's anticipated to rise by 4.7%. The Affordable Care Act (ACA) and reforms in 2014 have played a role in reducing Medicare costs, and it's estimated to spend around USD 1 trillion from 2010 to 2020.

In the Asia Pacific region, not many people are getting treatment for actinic keratosis, a skin condition. But in recent times, more and more people in this part of the world are getting affected by it. In a study from 2015, it was found that Australia had the highest rate of actinic keratosis, with over 40% of Australians aged 40 or older having the condition. This increase in people having actinic keratosis means there's a growing need for treatments, and that's making the market for these treatments go up.

The healthcare sector in countries like India, China, and Australia is growing really fast. In India, for example, it was expected to be one of the quickest-growing industries. The healthcare sector in India was predicted to grow by 22.87% from 2015 to 2020, reaching a whopping USD 280 billion by 2020. This rapid growth in the healthcare sector provides a big opportunity for companies that make treatments for actinic keratosis. They can step into these developing markets and help more people who are dealing with this skin condition.

So, what does this mean for the companies making treatments for actinic keratosis? Well, it's a chance for them to expand their business to new places where not many people are getting treated yet. In simpler terms, they can reach out to more individuals in the Asia Pacific region who need help with actinic keratosis. It's like saying, "Hey, we have a solution for your skin problem, and we can bring it to you!"

In conclusion, the Asia Pacific region is seeing more cases of actinic keratosis, and this is creating a higher demand for treatments. Countries like India and China have rapidly growing healthcare sectors, providing a great opportunity for companies to expand their reach and help more people in these areas. It's a win-win situation where companies can grow their business, and people in the Asia Pacific region can get the treatments they need for actinic keratosis.

Leave a Comment