Research Methodology on Active Pharmaceutical Market

Introduction

The pharmaceutical industry is growing rapidly with the development of new drugs, technological advances in drug delivery, and increased demand for molecular drugs. Active Pharmaceutical Ingredients (APIs) are one of the principal components of medicinal products and are the chemically active components that interact and produce the desired therapeutic effect in the treatment of various diseases. APIs are most often produced through chemical synthesis, although the use of natural substances, such as those from plant sources, is increasing. Some of the key factors driving the growth of the API market are the increasing focus on disease diagnosis, the need for cost effective drugs, and the development of generic drugs.

Objective

The objective of this research is to analyze the market of Active Pharmaceutical Ingredients (APIs) and to provide a comprehensive and thorough market analysis, forecasting, and trends.

Research Methodology

The research methodology adopted for this study is based on desk research, secondary research, and primary research. Descriptive and analytic research approaches are used in order to develop the data base of strategies and analyses, and to identify key areas of significant research.

Desk Research

Desk research is conducted to identify global trends, innovative products and services, and industry structure in API Industry. Desk research involves the examination of industry reports, white papers, and secondary data sources such as Google searches, as well as industry databases, published materials, and magazines.

Secondary Research

Secondary research is conducted to gain data and market insights into global API Industry. This includes interviews from key stakeholders, industry sources, and senior management and various market intelligence studies, such as articles, magazines, and industry reports.

Primary Research

Primary research is conducted to gain in-depth insights into the various factors influencing the Active Pharmaceutical Ingredients (API) market. Primary research includes interviews from experts and industry sources, to gain an understanding about the current market and future trends.

Analysis of Findings

Once the data and information is collected, the analysis of the findings involved a series of steps:

- Summarising past, current and future trends in the Active Pharmaceutical Ingredients (API) market.

- Evaluating the present competitive environment and competitive dynamics, including market share analysis and the identification of key competitors.

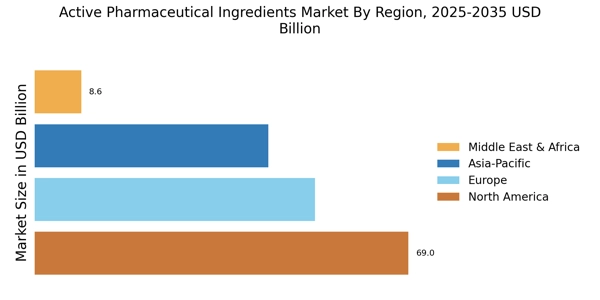

- Constructing market sizes and forecasting projections in terms of revenue, volume, drivers, challenges and trends.

- Performing a market attractiveness analysis to identify potential segments, and to provide insights into potential areas of opportunity.

- Identifying the potential players in the market and providing detailed analysis and insights into the market’s strategic approaches and the industry’s product and technology portfolios.

- Performing SWOT analysis to identify strengths, weaknesses, opportunities, and threats.

Data Collection & Interpretation

Data is collected for this research from various sources such as industry experts, market players and external sources. The data is collected from both primary and secondary sources. Primary sources includes interviews with industry leaders and representatives from organizations, which have direct influence on the active pharmaceutical ingredient market. Secondary sources includes statistical databases, published materials, industry magazines, and reports from market intelligence organizations.

The collected data is validated and triangulated using quantitative and qualitative analysis. A combination of systematic closed interviewing process, primary questionnaire and obtaining data from the secondary sources are used to ensure the credibility of the information gathered.

Conclusion

The research methodology adopted for this research providing a comprehensive and in-depth understanding of the API market. Desk research, secondary research and primary research have been used to identify current and future trends, innovations, market structure, and major players and to develop a market size and forecasts. The collected data is validated and triangulated using quantitative and qualitative analysis to ensure that the results are accurate and reliable. This in-depth research allows the reader to gain an understanding of the Active Pharmaceutical Ingredients (API) market, its dynamics, and potential opportunities.