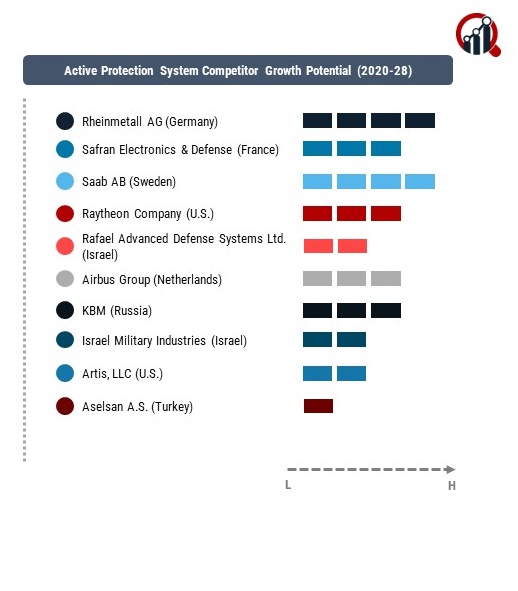

Top Industry Leaders in the Active Protection System Market

The Active Protection System (APS) market has witnessed significant growth in recent years, driven by the rising need for advanced defense mechanisms to counter evolving threats. As military technologies continue to advance, the demand for effective APS solutions has surged, creating a dynamic and competitive landscape within the industry.

Key Players in the Active Protection System Market

Rheinmetall AG (Germany)

Safran Electronics & Defense (France)

Saab AB (Sweden)

Raytheon Company (U.S.)

Rafael Advanced Defense Systems Ltd. (Israel)

Airbus Group (Netherlands)

KBM (Russia)

Israel Military Industries (Israel)

Artis, LLC (U.S.)

Aselsan A.S. (Turkey)

Strategies Adopted by Key Players

To maintain a competitive edge, key players in the APS market employ various strategic initiatives. Research and development activities play a crucial role, as companies invest heavily in creating innovative and technologically advanced APS solutions. Collaboration and partnerships with government agencies and defense organizations are also common strategies, facilitating knowledge exchange and enhancing the overall capabilities of APS systems.

Factors for Market Share Analysis

Market share analysis in the APS sector is influenced by several factors. Technological advancements and the ability to offer comprehensive protection solutions are key determinants. The successful integration of APS systems with existing military platforms and compatibility with diverse defense applications also contribute to market share. Additionally, factors such as reliability, cost-effectiveness, and the ability to meet stringent military standards play a significant role in establishing and maintaining a strong market presence.

New and Emerging Companies

While established players dominate the APS market, the industry has witnessed the emergence of new and innovative companies. These newcomers, such as Artis LLC and Iron Fist, are gaining attention for their unique approaches to active protection systems. These companies often bring fresh perspectives and novel technologies, challenging the traditional market leaders and contributing to the overall dynamism of the industry.

Industry News and Current Trends

Recent industry news and trends indicate a continued focus on improving APS capabilities. Advancements in sensor technologies, artificial intelligence, and machine learning are being incorporated into APS systems to enhance threat detection and response times. Additionally, the integration of APS with other defense systems, such as electronic warfare and countermeasure solutions, is becoming a prevalent trend. This convergence of technologies aims to create more comprehensive and resilient defense mechanisms.

Current Company Investment Trends

Investment trends in the APS market reflect the growing recognition of its strategic importance. Companies are allocating substantial resources to research and development, aiming to stay ahead of the technological curve. Strategic acquisitions and mergers are also prevalent, allowing companies to broaden their product portfolios and gain a competitive advantage. Furthermore, investments in manufacturing capabilities and global partnerships are key trends, enabling companies to strengthen their market presence and cater to the increasing demand for APS solutions worldwide.

Overall Competitive Scenario

The competitive scenario in the APS market is intense, with established players facing constant pressure to innovate and adapt to evolving threats. Market leaders continue to invest in research and development to enhance the capabilities of their APS systems, ensuring they remain at the forefront of technological advancements. The influx of new companies adds an element of unpredictability, as their innovative approaches challenge traditional norms and create opportunities for disruption.

Recent News :

Rheinmetall AG:

January 20, 2024: Successfully completed live-fire tests of its ActiveGuard System (AGS) against simulated missile attacks, showcasing its efficacy and reliability.

November 22, 2023: Secured a major contract with the German Bundeswehr to supply AGS units for their Puma infantry fighting vehicles, solidifying its market position.

Raytheon Technologies:

December 21, 2023: Unveiled its next-generation "Trophy HV" APS specifically designed for heavy armored vehicles like tanks and main battle tanks, offering enhanced protection against advanced threats.

September 29, 2023: Partnered with an Israeli defense company to develop and integrate AI-powered threat detection and interception algorithms into future APS systems.

Leonardo S.p.A.:

January 17, 2024: Launched its "Shield" APS variant tailored for light armored vehicles and combat reconnaissance platforms, addressing the need for adaptable protection across different vehicle types.

October 25, 2023: Announced a collaboration with a European research consortium to develop next-generation APS technology based on directed energy weapons, focusing on increased precision and energy efficiency.