- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

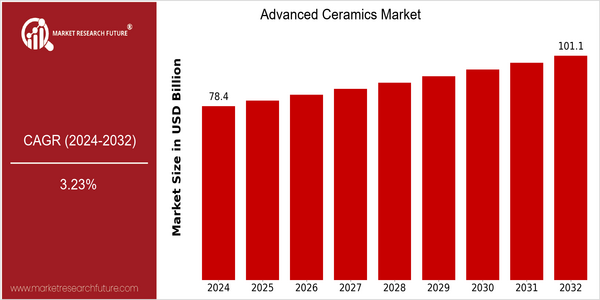

Advanced Ceramics Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 78.39 Billion |

| 2032 | USD 101.09 Billion |

| CAGR (2024-2032) | 3.23 % |

Note – Market size depicts the revenue generated over the financial year

The 'Advanced Ceramics' market is expected to grow steadily, reaching a size of $78.39 billion by 2024, and reaching $ 101.09 billion by 2032. This will be a CAGR of 3.07% from 2024 to 2032. The market is expanding due to the high demand for advanced ceramics in various industries, such as electronics, aeronautics and medical devices, where the superior properties of advanced ceramics, such as high temperature resistance, chemical resistance and lightness, are required. There are several trends driving this market, such as the growing use of advanced ceramics in the production of medical devices and electrical components. And the improvement of manufacturing processes, such as 3D printing and nanotechnology, has also increased the properties and application range of advanced ceramics. The market leaders, such as CeramTec, Kyocera, Morgan Advanced Materials and others, are investing in strategic collaborations and acquisitions to enhance their product offerings and market positions. In recent years, many companies have worked together to develop next-generation ceramic materials, which will help to develop the market and meet the needs of various industries.

Regional Deep Dive

In the meantime, the market for advanced ceramics has been growing strongly in all regions, mainly in the aviation, automobile, electrical and medical industries. In North America, the market is characterized by a high degree of innovation and technological development, with major players investing heavily in research and development. The region benefits from a strong industrial base and a favourable regulatory framework, which encourages the use of new materials. The market is expected to continue to grow as industry looks to improve performance and sustainability.

North America

- The United States Department of Energy has undertaken to promote the use of advanced ceramics in energy applications, particularly in fuel cells and batteries, and this is expected to drive innovation and market growth.

- The enlargement of the production capacity of CeramTec and CoorsTek, in order to meet the increasing demand for advanced ceramics in the field of aeronautics and defence, shows the importance of this industry to the region.

- Regulations aimed at reducing carbon dioxide emissions are pushing manufacturers to use advanced ceramics for their lightness and their strength, thereby increasing their market value.

Europe

- A number of projects have been initiated in the field of advanced ceramics, mainly in the field of biomedical and energy-saving applications, which are aimed at bringing innovation to the region.

- Leading companies like Saint-Gobain and NGK Insulators are investing in the development of advanced ceramics in line with the strictest of European regulations and the goal of sustainable development.

- The growing German automobile industry is increasingly using advanced ceramics for sensors and insulators. The demand for electric vehicles and smart technology is also growing.

Asia-Pacific

- China has a lot of advanced ceramics, which are mainly used in the fields of telecommunications and electronics. The government is putting a lot of money into this industry, and it is a big factory.

- And in Japan, Kyocera and Toshiba are pioneering in the development of advanced ceramics, especially in the field of microelectronics, and this is expected to further strengthen the position of the region as a leading technology center.

- India's rapid industrialization and urbanization have created a demand for advanced ceramics in the construction industry, thus opening up new opportunities.

MEA

- The demand for advanced ceramics in the Middle East is booming.

- The use of advanced ceramics in the construction industry is being encouraged by the regulations of the United Arab Emirates, in line with the country's sustainable development goals.

- The growing interest in the region’s energy projects is boosting the adoption of advanced ceramics in the region’s solar energy applications, further driving the market.

Latin America

- Brazil is now a major player in the advanced ceramics market. Brazilian companies are investing in R&D for the automobile and aeronautics industries.

- Among the materials that have attracted the attention of the authorities of the region are the so-called advanced ceramics. These are used in the environment for water purification and the exploitation of waste.

- Government initiatives to develop domestic industry are also promoting the development of advanced ceramics in various industries.

Did You Know?

“These advanced ceramics can resist temperatures of 1,600°C, making them particularly suited for use in the high-temperature applications of the aeronautical and automobile industries.” — Ceramic Materials: Science and Engineering, 2nd Edition, 2016

Segmental Market Size

The market for advanced ceramics is characterized by its rapid growth, which is mainly due to the growing demand for high-performance materials in various industries. In particular, this market is of paramount importance in the field of aviation, electronics and medicine, where the need for lightweight, durable and heat-resistant materials is crucial. The main driving forces are the increasing demand for advanced materials, which enhance the performance of products, and the growing regulatory emphasis on sustainable production, which encourages the substitution of traditional materials with advanced ceramics.

The ceramics industry has now entered a mature stage. CeramTec and CoorsTek are the leading firms. The versatility of advanced ceramics is demonstrated by the fact that they are used in such diverse products as biomedical and electrical applications. Moreover, the growing importance of sustainable development and the integration of smart technology into products will continue to drive growth. Industry will continue to seek materials that meet performance requirements as well as sustainable development goals. Additive manufacturing and advanced sintering are two important enabling processes that enable the production of complex shapes and enhanced material properties.

Future Outlook

The market for advanced ceramics is expected to grow steadily from 2024 to 2032. From an estimated market value of $78.39 billion in 2024, the market is expected to grow at a compound annual growth rate (CAGR) of 3.23% from the period 2024 to 2032. This growth is attributed to the rising demand for advanced ceramics in various applications, such as the aeronautics, electronics, and biomedical industries. Moreover, with the growing need for lightweight, durable, and high-performance materials, the use of advanced ceramics in the various industries is expected to increase significantly. The penetration of advanced ceramics in these industries is expected to reach 25% by 2032 from the current 18% by 2024.

The advance of newer materials and processes, such as the development of newer additive manufacturing techniques and improved sintering processes, are expected to be the key to driving innovation in the advanced ceramics market. Moreover, government initiatives to promote sustainable materials and reduce the carbon footprint will further support market growth. Emerging trends, such as the increasing use of advanced ceramics in the solar energy industry and the integration of smart materials, are expected to reshape the market landscape. The market is ripe for strategic alliances and investments in R&D to capitalize on these emerging opportunities.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 72.9 Billion |

| Market Size Value In 2023 | USD 75.59 Billion |

| Growth Rate | 3.70% (2023-2032) |

Advanced Ceramics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.