Research Methodology on Advanced Ceramics Market

Research Objectives

The main objective of this research project is to identify key trends, growth drivers, regions and future prospects of the global advanced ceramics market. The research also aims to identify and analyze key players’ strategies, key events and key technology trends impacting the Advanced Ceramics Market.

Scope of the Study

The scope of this research project covers the market by end-user industries and the type of ceramics estimated by combining primary and secondary research sources. The market size detailed in the scope is based on revenue generated across different geographies with forecasted estimations from 2023 to 2030.

Research Design

This research project involves an elaborate research design through primary and secondary research sources. The primary sources include well-structured telephone interviews and surveys conducted by a team of experienced analysts. The secondary sources include market statistics, company websites and press releases, reports, existing databases, searchable databases, and proprietary databases including Market Research Future in-house databases.

Primary data covers key trends and developments in the Advanced Ceramics Market, and quantitative data such as shares of different segments, end-user share, product type share, and other related information. This data has been used to quantify different parameters advocating the scope of the research project.

Secondary data covers market information related to market size, industry trends, value chain and company profiles. It also includes geographic segmentation and geopolitical factors giving readers a comprehensive overview of the global Advanced Ceramics Market.

Key Players

The key players in the Advanced Ceramics Market covered in this study are Saint-Gobain S.A. (US), CeramTec (Germany), NGK Spark Plugs (Japan), CoorsTek (US), Kyocera Corporation (Japan), Ceradyne (US), Rauschert (Germany), Morgan Advanced Materials Plc. (UK), Materion Corporation (US), -Rainbow Ceramics (Japan).

Data Collection and Analysis

The initial data collection was done from primary and secondary research sources to identify key companies in the global Advanced Ceramics Market, end-user industries and types of materials used. This data was categorized and analyzed to derive insights about the market and trends. In-depth interviews with key players were conducted to gain insights into their product portfolios, strategies, development plans, and other details.

Market Bifurcation

The global Advanced Ceramics Market has been classified based on end-user industries and the type of ceramics used.

By End-User Industries: Power Generation, Automotive, Aerospace and Defense, Medical and Healthcare, Electronics, and Others.

By Types of Ceramics: Alumina Ceramics, Zirconia Ceramics, Silicon Carbide Ceramics, and Others.

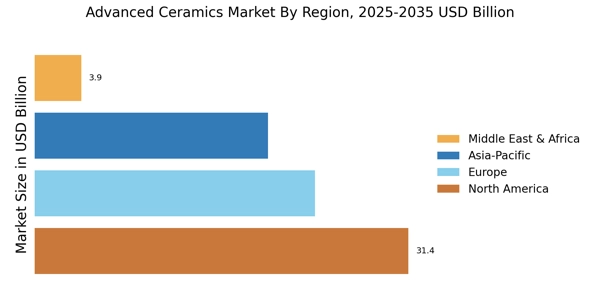

Geographical Analysis

The geographical analysis covered in the report includes key factors impacting the Advanced Ceramics Market growth across six regions: North America, Europe, Asia-Pacific, South America, Africa, and the Middle East.

Base Year & Forecast Period

The data collected from 2016 to 2021 is used to derive estimations of the market for the year 2022 and towards the forecast period of 2023-2030.

Assumptions & Dependencies

The market size and estimations noted in this study are based on assumptions related to key market information such as production, pricing, technological advancements, and other related factors. It also explains potential opportunities and risks associated with the Advanced Ceramics Market.

Discrepancy Analysis

The discrepancy analysis entailed in this research project covers the difference in the data derived from primary and secondary research sources. Gaps in the data owed to time lags, discrepancies, and other information were reconciled using this analysis.

Data Analysis

The analysis of the data collected from primary and secondary research sources, such as company information, industry reports, and press releases, was done using multiple sources. This included trends, company profiles, and product portfolio analysis along with a comparison among multiple vendors involved in the market.

The market potential is estimated based on the region's population, economic and political factors, consumer spending, customer behaviour, production capacity, and several other parameters.

The analysis also covered the future trends and projections in the Advanced Ceramics Market from 2023 to 2030.

Finally, for validation, the primary market analysis is verified by running the data through secondary sources.

Conclusion

The collected data from primary and secondary sources is analyzed to conclude the market position of the global Advanced Ceramics market at the time of the study. The research methodology utilized enables a thorough understanding of the market and its dynamics, product types, key players, regional analysis, and other factors affecting the market. The insights gained from this research will help stakeholders develop strategies for growth in the Advanced Ceramics Market.