Market Share

Introduction: Navigating the Competitive Landscape of Advanced Composites

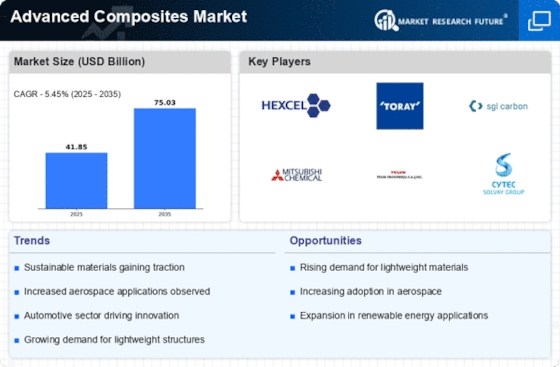

The advanced composites market is experiencing a change in the face of the rapid spread of technology, the emergence of strict regulations, and the growing demands of consumers for performance and sustainability. The key players, including manufacturers, IT systems integrators, and suppliers of the basic equipment, are competing with each other to lead the market by deploying solutions based on artificial intelligence, automation, and the Internet of Things. These solutions not only improve the performance of the production process, but also reshape the product range, and therefore the market position of the companies. The emerging disruptors, especially in the field of green energy and biometrics, are changing the competition in the market and forcing the established companies to change. In the long term, 2024–2025, the regional growth opportunities will continue to grow. The strategic deployment trends are mainly in North America and Asia-Pacific, where the demand for lightweight and high-performance materials is growing. This report analyzes the changing competition in this market and offers essential insights for C-level managers and strategic planners who need to master this complex landscape.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across the advanced composites value chain, integrating materials, technologies, and services.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| DuPont de Nemours | Innovative material science expertise | High-performance composites | Global |

| BASF SE | Broad chemical portfolio and sustainability focus | Advanced composite materials | Europe, Asia, Americas |

| 3M Company | Diverse technology applications | Adhesives and composite solutions | Global |

| Solvay SA | Strong R&D capabilities | Specialty polymers and composites | Global |

Specialized Technology Vendors

These companies focus on niche technologies and innovations within the advanced composites sector, providing specialized products and solutions.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Teijin Limited | Leader in aramid fibers and carbon fibers | High-performance fibers | Asia, Americas, Europe |

| Hexcel Corporation | Expertise in composite materials for aerospace | Carbon fiber composites | Global |

| Cytec Industries | Advanced resin systems for composites | Composite materials and technologies | Global |

| Hexion Inc. | Innovative epoxy resins and adhesives | Resin technologies for composites | Global |

Infrastructure & Equipment Providers

These vendors supply the necessary equipment and infrastructure to support the production and processing of advanced composites.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Mitsubishi Chemical Corporation | Diverse chemical and material solutions | Composite manufacturing technologies | Asia, Americas, Europe |

| Toray Industries | Vertical integration in carbon fiber production | Carbon fiber and composite materials | Global |

| Owens Corning | Strong in glass fiber composites | Glass fiber and composite solutions | Global |

| Royal DSM | Sustainability-driven innovation | Engineering plastics and composites | Global |

| Scott Bader Company | Specialized in polymer chemistry | Composite materials and adhesives | Global |

| SABIC | Strong polymer and chemical expertise | Advanced thermoplastic composites | Global |

Emerging Players & Regional Champions

- Hexcel (USA): Specializes in carbon fiber and resin systems for use in aeronautics and automobiles, and recently received a multi-year contract from Boeing to supply them with advanced composite materials, thereby threatening the leading suppliers such as Toray Industries by offering lighter weights.

- SGL CARBON (Germany): This company is developing industrial applications for carbon-fibre-reinforced plastics (CFRP). It has just entered into a partnership with BMW to develop lightweight components, thereby enabling the traditional suppliers to enhance the efficiency and the sustainability of the car-making process.

- The Japan-based chemical company Mitsubishi has developed a range of advanced composite materials for use in the electrical and automobile industries. The company has recently been involved in a project with Toyota to develop the next generation of composite materials. It is a serious challenger to the established player BASF.

- Axiom Materials (USA): Provides advanced composite materials for aerospace and defense, recently won a contract with Lockheed Martin for high-performance composite solutions, complementing larger firms by focusing on niche applications.

- The Japanese company Teijin, known for its aramid fibers and thermoplastic composites, has recently teamed up with Honda to make parts for electric vehicles, and is a leading manufacturer of new energy vehicles.

Regional Trends: By 2024, the Advanced Composites Market in North America and Europe is expected to grow significantly. This is mainly due to the growing demand from the aerospace and automobile industries. The companies are focusing on bio-based composites and on recyclability. In Asia-Pacific, especially in the automobile industry, light materials are increasingly being used to improve fuel efficiency and performance.

Collaborations & M&A Movements

- Solvay and Hexcel have joined together in the development of advanced composite materials for the aeronautical industry. The objective is to increase performance and reduce the weight of aircraft, thus strengthening their competitiveness in a growing market.

- Toray Industries acquired TenCate Advanced Composites in early 2024 to expand its portfolio in high-performance materials, significantly increasing its market share and reinforcing its leadership in the global advanced composites market.

- BASF and SGL Carbon announced a collaboration to innovate sustainable composite solutions for the automotive industry, focusing on reducing carbon footprints and meeting increasing regulatory demands for eco-friendly materials.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Material Innovation | Hexcel, Toray Industries | Hexcel has developed a carbon fiber which gives a high strength-to-weight ratio, which is essential for aircraft. Toray Industries is known for its thermoplastic composites, which are finding their way into automobiles because of their recyclability. |

| Manufacturing Efficiency | Solvay, SABIC | Solvay has implemented automated production lines that reduce cycle times for composite parts, improving overall efficiency. SABIC's use of additive manufacturing techniques allows for rapid prototyping and reduced waste in production. |

| Sustainability Practices | BASF, Mitsubishi Chemical | The new products of BASF meet the most stringent environmental standards. In order to achieve the goal of sustainable development, Mitsubishi is investing in the development of a technology to reclaim and reuse composite materials. |

| End-Use Applications | General Electric, Airbus | General Electric utilizes advanced composites in its jet engines, significantly improving fuel efficiency. Airbus has integrated composite materials in its A350 aircraft, showcasing their commitment to lightweight structures for better performance. |

| Research and Development | 3M, DuPont | 3M is heavily investing in R&D for new adhesive technologies that enhance composite bonding. DuPont's focus on developing high-performance polymers is setting new standards in the composites market, particularly for automotive applications. |

Conclusion: Navigating the Advanced Composites Landscape

In 2024, the advanced composites market will be characterized by intense competition and significant fragmentation, with both the old and new players vying for market share. Regional trends are characterized by an increased focus on innovation and sustainable development, particularly in North America and Europe, where regulatory frameworks are increasingly favoring eco-friendly materials. Suppliers must strategically position themselves to take advantage of opportunities in artificial intelligence, automation, and flexibility, to enhance production efficiency and meet changing customer demands. Leading suppliers will be those that embrace sustainable development and invest in advanced technology. The rest will be left behind in the rapidly evolving environment.

Leave a Comment