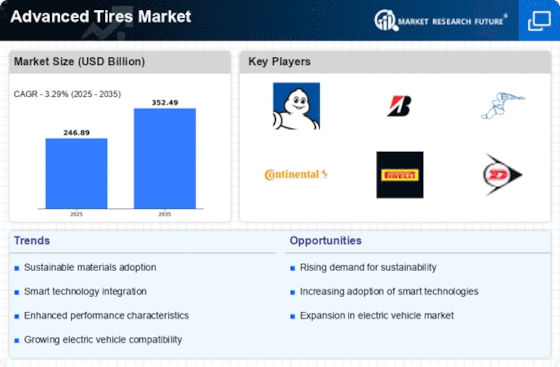

Top Industry Leaders in the Advanced Tires Market

*Disclaimer: List of key companies in no particular order

The traditional tire market is screeching to a halt, and a new breed of rubber is dominating the fast lane – the advanced tire market. Boasting innovations like airless designs, self-inflating capabilities, and embedded sensors, these futuristic tires promise superior safety, fuel efficiency, and connectivity. Let's peel back the layers and analyze the competitive landscape of this dynamic, and sometimes bumpy, road.

Key Players Pit Stop:

Tire Titans: Industry giants like Bridgestone, Michelin, and Continental hold pole position, leveraging their extensive R&D capabilities and brand recognition to develop cutting-edge technologies. Bridgestone's Enliten series, for example, boasts reduced rolling resistance for enhanced fuel efficiency. Michelin's Uptis airless tire eliminates punctures and promises longer lifespans. Continental, meanwhile, focuses on intelligent tires integrated with vehicle-to-everything (V2X) communication systems.

Emerging Challengers: Startups like Michelin X Technology and Airfree Tires are zooming past established players with disruptive innovations. Michelin X's Tweel is a honeycomb-structured airless tire designed for agricultural and industrial vehicles, while Airfree Tires is reinventing puncture-proof technology for passenger cars. These disruptors are shaking up the market with agility and fresh perspectives.

Strategic Mergers and Acquisitions: The race to the top is fueled by M&As, such as Bridgestone's acquisition of EnviroTire to strengthen its airless tire portfolio. Michelin's partnership with Waymo for self-driving car tire development further exemplifies the collaborative spirit in the market.

Factors Fueling Market Share Analysis:

Technology Focus: Companies are focusing on specific technological niches. Bridgestone champions fuel efficiency, Michelin targets puncture-proof solutions, and Continental prioritizes smart tires. Analyzing each player's unique selling proposition and technological advancements offers insightful market share predictions.

Regional Variations: Demand for advanced tires varies across regions. North America, with its stringent regulations and safety concerns, dominates the market. Asia-Pacific, with its rapidly growing automotive sector, is another key region. Understanding regional dynamics and regulations paints a clearer picture of market share distribution.

Target Segments: Each company caters to specific segments. Continental focuses on premium and high-performance cars, while Michelin prioritizes commercial vehicles. Analyzing a company's target segment and its penetration within that segment reveals its true market share potential.

Emerging Trends for a Smooth Ride:

Sustainability in the Spotlight: Companies are prioritizing eco-friendly materials and processes. Bridgestone's Enliten tires use bio-derived silica, while Michelin's UltraFlex tires aim for reduced material waste. Analyzing a company's commitment to sustainability can predict its future market position.

Personalization of Tires: Advanced tires are becoming increasingly customizable. Michelin's Pilot Sport 5 tires have temperature-adaptive treads, while Continental's ContiSportSFR offer customizable noise levels. Analyzing a company's personalization offerings reveals its potential to cater to diverse consumer preferences.

Data-Driven Decisions: As advanced tires get smarter, so does their data utilization. Bridgestone's Ologic platform collects tire data for predictive maintenance, while Continental's ContiConnect system monitors tire health remotely. Analyzing a company's data strategy reveals its potential for driving customer loyalty and market growth.

Overall Competitive Scenario:

The advanced tire market is a fiercely contested arena, with established players fighting off nimble startups. Technological innovation, strategic partnerships, and regional expansion are key factors shaping the competitive landscape. By analyzing key player strategies, market share factors, and emerging trends, we can predict the future winners in this race to revolutionize the way we drive.

Industry Developments and Latest Updates:

Continental (Germany):

- Date: December 12, 2023

- Source: Continental Press Release

- Development: Continental announced the launch of its Generation 7 tire, featuring a new tread compound and optimized design for improved rolling resistance, wet grip, and noise reduction. The tire is targeted for both passenger cars and SUVs.

Bridgestone (Japan):

- Date: December 20, 2023

- Source: Nikkei Asia

- Development: Bridgestone is partnering with Sumitomo Rubber Industries to develop and commercialize next-generation airless tires. These tires are designed to be puncture-proof and require no air pressure, potentially reducing maintenance costs and environmental impact.

Michelin (France):

- Date: December 27, 2023

- Source: Michelin Website

- Development: Michelin is showcasing its Uptis prototype tire at CES 2024. The Uptis is a self-sealing tire that is designed to eliminate the risk of flat tires. It is currently in the testing phase and is expected to be commercially available by 2025.

Goodyear (US):

- Date: December 15, 2023

- Source: Goodyear Investor Relations

- Development: Goodyear announced a new partnership with EV startup Rivian to develop and supply custom tires for Rivian's electric vehicles. The tires are designed to optimize range, performance, and handling for electric vehicles.

Pirelli (Italy):

- Date: December 22, 2023

- Source: Pirelli Website

- Development: Pirelli is investing in research and development of "smart" tires that can communicate with vehicles and provide real-time data on tire pressure, tread wear, and road conditions. These tires could potentially improve safety and fuel efficiency.

Top Companies in the Advanced Tires industry includes,

Continental (Germany), Bridgestone (Japan), Michelin (France), Goodyear (US), Pirelli (Italy), Sumitomo (Japan), Yokohama (Japan), Hankook Tire (South Korea), Nokian (Finland), CEAT (India), and Toyo Tire (Japan).