Aerospace Bearing Size

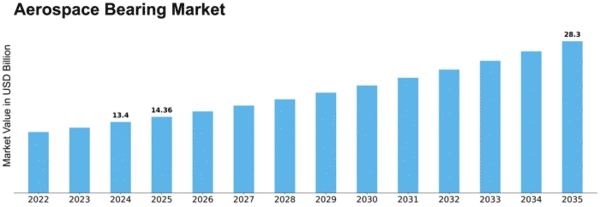

Aerospace Bearing Market Growth Projections and Opportunities

Various market factors comprise basic determinants in impacting the elements of the aerospace bearing business sector. A fundamental component to consider is the remarkable development and change of the aviation area. Powered by extending cargo transportation and a developing worldwide traveler populace, air head out request keeps on heightening. Accordingly, the aerospace business is unendingly faced with the test of working on functional adequacy and security. This request requires the use of refined aviation headings, which are key components in a large number of airplane frameworks.

Also, mechanical advances considerably impact the market's direction. Consistent advancement describes the airplane business, as makers constantly produce new airplane models that consolidate state of the art innovations. These headways habitually require the execution of higher-tech and more productive orientation to fulfill the thorough particulars of contemporary airplane. Thus, the nonstop quest for upgraded materials, plans, and assembling cycles to work on the general execution and reliability of heading in aviation applications drives the aerospace bearing market.

Also, international and worldwide financial circumstances affect the aerospace bearing market. Improved interests in the avionic business are a consequence of monetary development and solidness, which thus expands the interest in aerospace bearing. Alternately, monetary slumps and international pressures might affect safeguard financial plans and business flight, in this way impacting the development direction of the market. Subsequently, the aerospace bearing market is impacted by the more extensive monetary and world of politics.

Also, basic market factors in the aerospace bearing market incorporate thorough wellbeing norms and guidelines. Because of the basic job direction play in guaranteeing the protected and reliable activity of airplane, administrative bodies implement rigid necessities for aerospace bearing market, assembling, and testing. Adherence to these principles is not exclusively a lawful commitment, yet in addition a fundamental part for producers trying to develop certainty and dependability in the commercial center. To successfully answer rising difficulties and advances, aviation bearing producers should keep up with their adaptability to adjust to the steadily changing consistency climate.

Additionally, the rising accentuation on eco-friendliness and lightweight materials in airplane configuration impacts the aerospace bearing market. To advance eco-friendliness and by and large execution, airplane producers are unendingly participated in endeavors to diminish the heaviness of part parts. Because of this progress toward lightweight materials, aviation bearing producers are defied with the errand of creating courses that are powerful as well as lightweight, ready to persevere through the outrageous states of aviation applications.

Notwithstanding unrefined substance costs and worldwide production network elements, these factors affect the aerospace bearing market. A complex overall store network characterizes the market, wherein producers rely upon a broad organization of providers to secure natural substances and parts. The aerospace bearing market can be essentially affected by disturbances like the Coronavirus pandemic, changes in unrefined substance costs, and international occasions that influence the store network. These variables can bring about store network difficulties and finally influence the elements of the market in general.

In outline, the aerospace bearing market is affected by a broad cluster of elements, enveloping mechanical advancement, monetary conditions, administrative systems, materials development, production network elements, and the extension of the aviation area. To really explore this unpredictable territory, producers of aviation direction should remain refreshed on industry improvements, designate assets towards innovative work, and support a flexible methodology to take care of the steadily changing requests of the aviation area.

Leave a Comment