Aerospace Coatings Size

Aerospace Coatings Market Growth Projections and Opportunities

The Aerospace Coating market is significantly influenced by various factors that collectively shape its dynamics. One of the primary determinants is the growth of the aerospace industry, particularly the production and maintenance of commercial and military aircraft. Aerospace coatings play a critical role in protecting aircraft surfaces from corrosion, UV radiation, and harsh environmental conditions. Consequently, the market is closely tied to the global demand for new aircraft, as well as the need for coating solutions in the maintenance and refurbishment of existing fleets. Fluctuations in the aviation industry, driven by factors like airline profitability, defense budgets, and global travel trends, directly impact the demand for aerospace coatings.

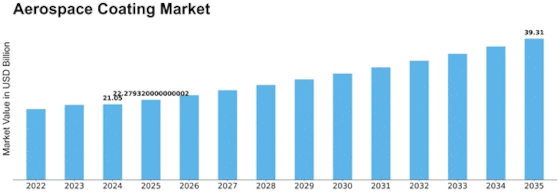

Aerospace Coating Market Size was valued at USD 18.5 billion in 2022. The Aerospace Coating industry is projected to grow from USD 19.73 Billion in 2023 to USD 33.16 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 6.70% during the forecast period (2023 - 2032).

Technological advancements in coating formulations and application processes are instrumental in shaping the aerospace coating market. Innovations such as environmentally friendly, low-VOC (volatile organic compounds) coatings, anti-icing coatings, and advanced nanotechnology-based coatings enhance the performance and durability of aerospace coatings. Companies that invest in research and development to introduce cutting-edge coatings with improved resistance to wear and corrosion gain a competitive edge in a market where technological innovation is highly valued.

Stringent regulatory standards and environmental considerations significantly influence the aerospace coating market. The aviation industry is subject to rigorous safety and environmental regulations, and coatings must comply with stringent requirements to ensure the integrity of aircraft structures and minimize environmental impact. The increasing emphasis on sustainable and eco-friendly coatings, along with the development of chromate-free coatings, reflects the industry's commitment to environmental responsibility. Companies that proactively align their products with these regulatory and environmental considerations position themselves favorably in the market.

Raw material pricing and availability are critical factors affecting the aerospace coating market. The cost and availability of key raw materials, including resins, pigments, and additives, can impact the overall production costs of coatings. Fluctuations in crude oil prices, geopolitical events, and changes in supply chain dynamics can lead to price volatility in the aerospace coating market. Companies in the sector must employ strategic sourcing and risk management strategies to navigate these challenges and maintain cost competitiveness.

Global economic conditions and airline industry trends play a pivotal role in shaping the aerospace coating market. Economic factors such as GDP growth, air travel demand, and airline profitability directly impact the investment in new aircraft and, consequently, the demand for aerospace coatings. Changes in airline fleet expansion plans, aircraft retirements, and shifts in the global aviation landscape influence the market dynamics, making it essential for coating manufacturers to stay attuned to broader economic trends.

Market competition is a constant consideration in the aerospace coating sector. The presence of multiple players, each offering a range of coating solutions for various aerospace applications, intensifies competition. Companies differentiate themselves through factors such as product quality, compliance with industry standards, technological innovation, and customer service. Strategic partnerships, collaborations, and acquisitions are common strategies employed by companies to strengthen their market position and expand their product portfolios.

Consumer preferences, in this case, the preferences of aircraft manufacturers and maintenance providers, also contribute to the aerospace coating market's evolution. Changes in the design preferences of aircraft manufacturers, advancements in coating technologies, and the demand for coatings that enhance fuel efficiency and reduce maintenance costs influence the choice of coatings in the aerospace industry. Companies that anticipate and adapt to these preferences are better positioned to meet market demands effectively and capitalize on emerging opportunities.

Leave a Comment