-

Executive Summary

-

Scope of the Report

-

Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

-

Markets Structure

-

Market Research

-

Methodology

-

Research Application

-

Secondary Research

-

Primary

-

Research

-

Forecast Model

-

Market Landscape

-

Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Threat of Substitutes

- Segment Rivalry

-

Bargaining Power of Buyers

-

Value Chain/Supply Chain of Global Aerospace Maintenance Chemicals Market

-

Industry Overview of Global Aerospace Maintenance Chemicals Market

-

Introduction

-

Growth Drivers

-

Impact Analysis

-

Market Challenges

-

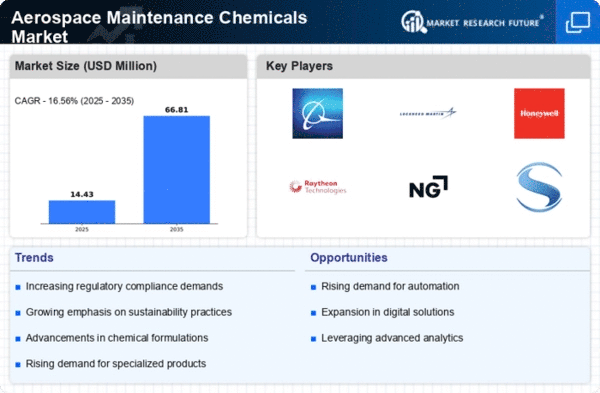

Market Trends

-

Introduction

-

Growth Trends

-

Impact

-

Analysis

-

Global Aerospace Maintenance Chemicals Market, by Nature

-

Introduction

-

Organic

- Market Estimates & Forecast, 2022-

- Market Estimates & Forecast, by Region, 2022- 2030

- Market Estimates & Forecast, 2022- 2030

- Market

-

Inorganic

-

Estimates & Forecast, by Region, 2022- 2030

-

Global Aerospace Maintenance

-

Chemicals Market, by Product

-

Introduction

-

Aircraft Cleaning Chemicals

- Market Estimates & Forecast, 2022- 2030

- Market Estimates

-

& Forecast, by Region, 2022- 2030

-

Aircraft Leather Cleaners

- Market Estimates & Forecast,

-

Market Estimates & Forecast, 2022- 2030

-

by Region, 2022- 2030

-

Aviation Paint Removers

- Market Estimates

- Market Estimates & Forecast, by Region,

-

& Forecast, 2022- 2030

-

Aviation Paint Strippers

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2022- 2030

-

Specialty Solvents

- Market Estimates & Forecast, 2022- 2030

- Market Estimates & Forecast, by Region, 2022- 2030

-

Degreasers

- Market Estimates & Forecast, 2022- 2030

- Market Estimates

-

& Forecast, by Region, 2022- 2030

-

Aircraft Wash & Polishes

- Market Estimates & Forecast,

-

Market Estimates & Forecast, 2022- 2030

-

by Region, 2022- 2030

-

Aluminum Brighteners

- Market Estimates

- Market Estimates & Forecast, by Region,

-

& Forecast, 2022- 2030

-

Others

- Market Estimates & Forecast, 2022- 2030

- Market Estimates & Forecast, by Region, 2022- 2030

-

Global Aerospace

-

Maintenance Chemicals Market, by Application

-

Introduction

-

Aircraft

- Market Estimates & Forecast, 2022- 2030

- Market Estimates

-

Parts

-

& Forecast, by Region, 2022- 2030

-

MRO (Maintenance, Repair, and Overhaul)

- Market Estimates & Forecast, 2022- 2030

- Market Estimates

-

& Forecast, by Region, 2022- 2030

-

Global Aerospace Maintenance Chemicals

-

Market, by Aircraft

-

Introduction

-

Commercial

- Market

- Market Estimates & Forecast,

-

Estimates & Forecast, 2022- 2030

-

by Region, 2022- 2030

-

Business

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2022- 2030

-

General

- Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Region, 2022- 2030

-

Military

- Market Estimates & Forecast,

-

Market Estimates & Forecast, 2022- 2030

-

by Region, 2022- 2030

-

Helicopter

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Region, 2022- 2030

-

Spacecraft

- Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Region, 2022- 2030

-

Others

- Market Estimates & Forecast,

-

Market Estimates & Forecast, 2022- 2030

-

by Region, 2022- 2030

-

Global Aerospace Maintenance Chemicals Market, by

-

Region

-

Introduction

-

North America

- Market Estimates

- Market Estimates & Forecast, by Nature,

- Market Estimates & Forecast, by Product, 2022- 2030

- Market Estimates & Forecast, by Application, 2022- 2030

-

& Forecast, 2022- 2030

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Market Estimates & Forecast, 2022- 2030

-

Forecast, by Nature, 2022- 2030

-

Product, 2022- 2030

-

U.S.

-

Market Estimates &

-

Market Estimates & Forecast, by

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Canada

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

& Forecast, by Product, 2022- 2030

-

by Application, 2022- 2030

-

Estimates & Forecast, by Product, 2022- 2030

-

Forecast, by Application, 2022- 2030

-

by Aircraft, 2022- 2030

-

Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Aircraft,

-

Europe

- Market Estimates & Forecast, 2022- 2030

- Market Estimates & Forecast, by Nature, 2022- 2030

- Market

- Market Estimates &

- Market Estimates & Forecast,

- Germany

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Estimates & Forecast, by Aircraft, 2022- 2030

-

Market Estimates & Forecast, 2022- 2030

-

Forecast, by Nature, 2022- 2030

-

Product, 2022- 2030

-

Market

-

France

-

Market Estimates &

-

Market Estimates & Forecast, by

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Italy

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

& Forecast, by Product, 2022- 2030

-

by Application, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Aircraft,

-

Spain

-

Market Estimates & Forecast, 2022-

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

Forecast, by Aircraft, 2022- 2030

-

& Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates &

-

U.K.

-

Market Estimates

-

Market Estimates & Forecast, by Nature,

-

Market Estimates & Forecast, by Product, 2022- 2030

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Asia-Pacific

- Market Estimates & Forecast, 2022- 2030

- Market Estimates

- Market Estimates & Forecast,

- Market Estimates & Forecast, by Application,

- Market Estimates & Forecast, by Aircraft, 2022- 2030

- China

-

& Forecast, by Nature, 2022- 2030

-

by Product, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

& Forecast, by Product, 2022- 2030

-

by Application, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Aircraft,

-

India

-

Market Estimates & Forecast, 2022-

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

Forecast, by Aircraft, 2022- 2030

-

& Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates &

-

Japan

-

Market Estimates

-

Market Estimates & Forecast, by Nature,

-

Market Estimates & Forecast, by Product, 2022- 2030

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

& Forecast, by Nature, 2022- 2030

-

by Product, 2022- 2030

-

Australia

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

New Zealand

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

11.4.10.5Market Estimates &

-

Forecast, by Aircraft, 2022- 2030

-

Market Estimates & Forecast, 2022- 2030

-

Forecast, by Nature, 2022- 2030

-

by Product, 2022- 2030

-

Market Estimates

-

Rest of Asia-Pacific

-

Market Estimates &

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Middle East & Africa

- Market Estimates & Forecast, 2022-

- Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

by Aircraft, 2022- 2030

-

Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Turkey

-

Market Estimates &

-

Market Estimates & Forecast, by Nature, 2022-

-

Market Estimates & Forecast, by Product, 2022- 2030

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Estimates & Forecast, by Aircraft, 2022- 2030

-

Market Estimates & Forecast, 2022- 2030

-

Forecast, by Nature, 2022- 2030

-

Product, 2022- 2030

-

Market

-

Israel

-

Market Estimates &

-

Market Estimates & Forecast, by

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

North Africa

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

11.5.8.5Market Estimates & Forecast,

-

by Aircraft, 2022- 2030

-

Market Estimates

-

GCC

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Estimates & Forecast, by Aircraft, 2022- 2030

-

East & Africa

-

Market

-

Rest of the Middle

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

11.5.10.5Market Estimates &

-

Forecast, by Aircraft, 2022- 2030

-

& Forecast, 2022- 2030

-

Market Estimates

-

Latin America

- Market Estimates

- Market Estimates & Forecast, by Nature,

- Market Estimates & Forecast, by Product, 2022- 2030

- Market Estimates & Forecast, by Application, 2022- 2030

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

& Forecast, by Nature, 2022- 2030

-

by Product, 2022- 2030

-

Brazil

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Application,

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

Argentina

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

Market Estimates & Forecast, by Product, 2022- 2030

-

& Forecast, by Application, 2022- 2030

-

Forecast, by Aircraft, 2022- 2030

-

& Forecast, 2022- 2030

-

Market Estimates

-

Market Estimates &

-

Mexico

-

Market Estimates

-

Market Estimates & Forecast, by Nature,

-

Market Estimates & Forecast, by Product, 2022- 2030

-

Market Estimates & Forecast, by Application, 2022- 2030

-

Market Estimates & Forecast, by Aircraft, 2022- 2030

-

America

-

Rest of Latin

-

Market Estimates & Forecast, 2022- 2030

-

Market Estimates & Forecast, by Nature, 2022- 2030

-

& Forecast, by Product, 2022- 2030

-

by Application, 2022- 2030

-

Market Estimates

-

Market Estimates & Forecast,

-

Market Estimates & Forecast, by Aircraft,

-

Company Landscape

-

Company Profiles

-

3M

- Company Overview

- Product/Business Segment Overview

- Key Developments

-

Financial Updates

-

Royal Dutch Shell

- Product/Business Segment Overview

- Financial

- Key Developments

-

Company Overview

-

Updates

-

Aerochemicals

- Company

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Overview

-

Arrow Solutions

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Aviation Chemical Solutions

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Callington Haven Pty Ltd.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Eastman Chemical Company

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Exxon Mobil Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Florida Chemical Supply, Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Hansair Logistics Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Henkel AG & Co., KGaA

- Company Overview

- Product/Business Segment Overview

- Financial Updates

-

Key Developments

-

Nexeo Solutions

- Company Overview

- Financial Updates

- Key

-

Product/Business Segment Overview

-

Developments

-

KLX Inc.

- Company Overview

- Product/Business

- Financial Updates

- Key Developments

-

Segment Overview

-

Krayden, Inc.

- Company Overview

- Product/Business

- Financial Updates

- Key Developments

-

Segment Overview

-

Conclusion

-

LIST OF TABLES

-

World Population in

-

Major Regions (2020–2030)

-

Global Aerospace Maintenance Chemicals

-

Market, by Region, 2022- 2030

-

North America: Aerospace Maintenance

-

Chemicals Market, by Country, 2022- 2030

-

Europe: Aerospace Maintenance

-

Chemicals Market, by Country, 2022- 2030

-

Asia-Pacific: Aerospace Maintenance

-

Chemicals Market, by Country, 2022- 2030

-

Middle East & Africa:

-

Aerospace Maintenance Chemicals Market, by Country, 2022- 2030

-

Latin

-

America: Aerospace Maintenance Chemicals Market, by Country, 2022- 2030

-

Table

-

Global Aerospace Maintenance Chemicals Nature Market, by Region, 2022- 2030

-

North America: Aerospace Maintenance Chemicals Nature Market, by Country,

-

Table10 Europe: Aerospace Maintenance Chemicals Nature Market,

-

by Country, 2022- 2030

-

Table11 Asia-Pacific: Aerospace Maintenance Chemicals

-

Nature Market, by Country, 2022- 2030

-

Table12 Middle East & Africa: Aerospace

-

Maintenance Chemicals Nature Market, by Country, 2022- 2030

-

Table13 Latin

-

America: Aerospace Maintenance Chemicals Nature Market, by Country, 2022- 2030

-

Table14 Global Aerospace Maintenance Chemicals Product Market, by Region, 2022-

-

Table15 North America: Aerospace Maintenance Chemicals Product Market,

-

by Country, 2022- 2030

-

Table16 Europe: Aerospace Maintenance Chemicals Product

-

Market, by Country, 2022- 2030

-

Table17 Asia-Pacific: Aerospace Maintenance

-

Chemicals Product Market, by Country, 2022- 2030

-

Table18 Middle East &

-

Africa: Aerospace Maintenance Chemicals Product Market, by Country, 2022- 2030

-

Table19 Latin America: Aerospace Maintenance Chemicals Product Market, by Country,

-

Global Aerospace Maintenance Chemicals Application Market,

-

by Region, 2022- 2030

-

North America: Aerospace Maintenance Chemicals

-

Application Market, by Country, 2022- 2030

-

Europe: Aerospace Maintenance

-

Chemicals Application Market, by Country, 2022- 2030

-

Asia-Pacific:

-

Aerospace Maintenance Chemicals Application Market, by Country, 2022- 2030

-

Table

-

Middle East & Africa: Aerospace Maintenance Chemicals Application Market,

-

by Country, 2022- 2030

-

Latin America: Aerospace Maintenance Chemicals

-

Application Market, by Country, 2022- 2030

-

Table26 Global Aerospace Maintenance

-

Chemicals Aircraft Market, by Region, 2022- 2030

-

Table27 North America: Aerospace

-

Maintenance Chemicals Aircraft Market, by Country, 2022- 2030

-

Table28 Europe:

-

Aerospace Maintenance Chemicals Aircraft Market, by Country, 2022- 2030

-

Table29

-

Asia-Pacific: Aerospace Maintenance Chemicals Aircraft Market, by Country, 2022-

-

Table30 Middle East & Africa: Aerospace Maintenance Chemicals Aircraft

-

Market, by Country, 2022- 2030

-

Table31 Latin America: Aerospace Maintenance

-

Chemicals Aircraft Market, by Country, 2022- 2030

-

Table32 Global Nature Market,

-

by Region, 2022- 2030

-

Table33 Global Product Market, by Region, 2022- 2030

-

Table34 North America: Aerospace Maintenance Chemicals Market, by Country

-

Table35 North America: Aerospace Maintenance Chemicals Market, by Nature

-

Table36 North America: Aerospace Maintenance Chemicals Market, by Product

-

Table37

-

North America: Aerospace Maintenance Chemicals Market, by Application

-

Table38

-

North America: Aerospace Maintenance Chemicals Market, by Aircraft

-

Table39

-

Europe: Aerospace Maintenance Chemicals Market, by Country

-

Table40 Europe:

-

Aerospace Maintenance Chemicals Market, by Nature

-

Table41 Europe: Aerospace

-

Maintenance Chemicals Market, by Product

-

Table42 Europe: Aerospace Maintenance

-

Chemicals Market, by Application

-

Europe: Aerospace Maintenance Chemicals

-

Market, by Aircraft

-

Table44 Asia-Pacific: Aerospace Maintenance Chemicals Market,

-

by Country

-

Table45 Asia-Pacific: Aerospace Maintenance Chemicals Market, by

-

Nature

-

Table46 Asia-Pacific: Aerospace Maintenance Chemicals Market, by Product

-

Table47 Asia-Pacific: Aerospace Maintenance Chemicals Market, by Application

-

Asia-Pacific: Aerospace Maintenance Chemicals Market, by Aircraft

-

Table49 Middle East & Africa: Aerospace Maintenance Chemicals Market, by Country

-

Table50 Middle East & Africa: Aerospace Maintenance Chemicals Market,

-

by Nature

-

Table51 Middle East & Africa: Aerospace Maintenance Chemicals

-

Market, by Product

-

Table52 Middle East & Africa: Aerospace Maintenance

-

Chemicals Market, by Application

-

Table53 Middle East & Africa: Aerospace

-

Maintenance Chemicals Market, by Aircraft

-

Table54 Latin America: Aerospace

-

Maintenance Chemicals Market, by Country

-

Table55 Latin America: Aerospace

-

Maintenance Chemicals Market, by Nature

-

Table56 Latin America: Aerospace Maintenance

-

Chemicals Market, by Product

-

Table57 Latin America: Aerospace Maintenance Chemicals

-

Market, by Application

-

Table58 Latin America: Aerospace Maintenance Chemicals

-

Market, by Aircraft

-

LIST OF FIGURES

-

Global Aerospace Maintenance

-

Chemicals Market Segmentation

-

Forecast Methodology

-

Five

-

Forces Analysis of Global Aerospace Maintenance Chemicals Market

-

Value

-

Chain of Global Aerospace Maintenance Chemicals Market

-

Share of Global

-

Aerospace Maintenance Chemicals Market in 2020, by Country (%)

-

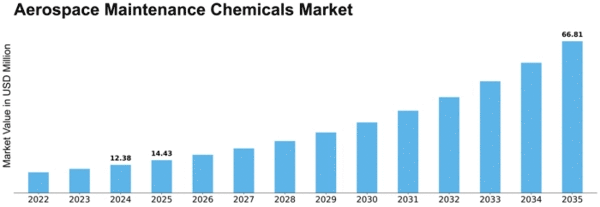

Global

-

Aerospace Maintenance Chemicals Market, 2022- 2030,

-

Sub-Segments of

-

Aerospace Maintenance Chemicals Market, by Nature

-

Global Aerospace

-

Maintenance Chemicals Market Size, by Nature, 2020

-

Share of Global

-

Aerospace Maintenance Chemicals Market, by Nature, 2022- 2030

-

Global

-

Aerospace Maintenance Chemicals Market Size, by Product, 2020

-

Share

-

of Global Aerospace Maintenance Chemicals Market, by Product, 2022- 2030

-

FIGURE

-

Global Aerospace Maintenance Chemicals Market Size, by Application, 2020

-

FIGURE

-

Share of Global Aerospace Maintenance Chemicals Market, by Application, 2022-

-

Global Aerospace Maintenance Chemicals Market Size, by Aircraft,

-

Share of Global Aerospace Maintenance Chemicals Market,

-

by Aircraft, 2022- 2030

Leave a Comment