- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

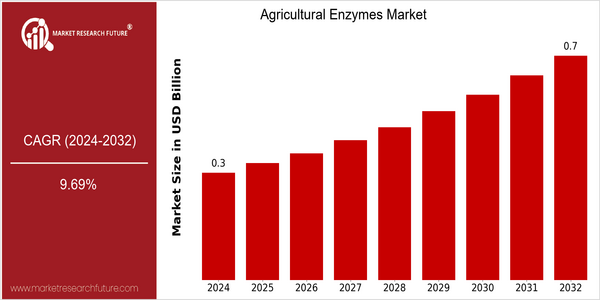

Agricultural Enzymes Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 0.3339 Billion |

| 2032 | USD 0.7 Billion |

| CAGR (2024-2032) | 9.69 % |

Note – Market size depicts the revenue generated over the financial year

The agricultural enzymes market is set to grow at a fast pace, with a current market size of USD 0.3339 billion in 2024, projected to reach USD 0.70 billion by 2032. The growth will be reflected in a strong compound annual growth rate (CAGR) of 9.69% during the forecast period. The growing demand for sustainable farming and the need to increase crop productivity are the major drivers of the market. Farmers and agribusiness companies are increasingly adopting agricultural enzymes to increase their yields and minimize their impact on the environment. Technological advances in the production and formulation of these products are also contributing to market growth. These advances, such as the development of more effective formulations and the integration of biotechnology in the application of these products, are increasing their effectiveness in soil management and crop production. The leading players in the agricultural enzymes market, such as BASF, Novozymes, and Syngenta, are actively launching new products, forming strategic alliances, and investing in research and development to capitalize on the growing demand for these products. The recent collaborations among these companies, which are aimed at developing tailored solutions for specific crops, show their commitment to meeting the changing needs of modern agriculture.

Regional Deep Dive

The Agricultural Enzymes Market is experiencing a significant growth in several regions, owing to the rising demand for sustainable agricultural practices and the need to increase crop yields. The North American, European, and Asian regions have been focusing on innovation and technological advancements, whereas the Middle East and Africa and Latin America are witnessing a gradual adoption of the agricultural enzymes market. Each region has a unique set of drivers, which include the local agricultural needs, government regulations, and the economic conditions.

North America

- The American Food and Drug Administration (FDA) has recently sped up the approval of biopesticides, including agricultural enzymes, which should facilitate the commercialization of new products.

- The large companies Novozymes and BASF are investing heavily in R & D to develop products that improve the soil and the crop yield, which is in line with the growing trend towards sustainable agriculture.

- The increased use of precision farming in North America is driving the demand for special enzymes that optimize the availability of nutrients and increase the resistance of plants.

Europe

- A Green Deal of the European Union aims at making agriculture more sustainable, and this aims at reducing the use of chemical fertilizers.

- With the help of research institutions, companies like Bayer and Syngenta are developing new formulations of enzymes that are adapted to the needs of specific crops. The trend towards tailor-made solutions is visible.

- Farmers are increasingly seeking more sustainable alternatives.

Asia-Pacific

- A great many countries in Asia are now adopting the use of enzymes in agriculture. This is due to the growing need for increased food production, and also to the growing awareness of the necessity of sustaining the soil.

- Bioworks and Novozymes are establishing themselves in the region, developing enzymes for various crops and climates.

- Farmers are increasingly looking for effective solutions to increase the fertility of their soils and crop yields.

MEA

- Agriculture in the Middle East and Africa is slowly beginning to make use of the new discoveries in enzymatic technology.

- Food and Agriculture Organizations like the FAO are promoting the use of biotechnological methods such as enzymes in the region.

- The special climatic conditions of the Middle East and Africa are promoting the development of new applications for enzymes, especially in the area of drought-resistant crops, which is expected to positively influence the market.

Latin America

- Brazil and Argentina are at the forefront in the use of enzymes in agriculture. The need to increase yields and reduce the use of chemical fertilizers and pesticides has driven them to embrace the use of these products.

- In the cooperatives, the farmers have begun to invest in enzyme technology to improve the health of the soil and the yield of the crops. This reflects a move towards sustainable agriculture.

- The Government's policy of promoting sustainable agriculture is expected to provide a favorable environment for the growth of the agricultural enzymes market in the region.

Did You Know?

“Farming enzymes increase the nutrient content of the soil by up to 30 per cent, which increases the yield and reduces the need for chemical fertilizers.” — International Journal of Agricultural Science and Research

Segmental Market Size

The Agricultural Enzymes Market is experiencing a steady growth, driven by the growing demand for sustainable agricultural practices and enhanced crop yields. Regulatory mandates in support of organic farming methods are also a major growth driver for this market. Also, technological advancements in the production and application of enzymes are bringing them within reach of farmers.

Agricultural enzymes are now in the commercialization stage. In many countries, especially in Europe and North America, the likes of Novozymes and BASF are already in the lead. These companies are developing a range of products, including biopesticides and biofertilizers. In the future, the industry will continue to grow, as it is shaped by the trend towards sustainable development and a growing demand for fewer chemicals.

Future Outlook

The agricultural enzymes market is expected to increase from $33,397,000 to $7,000,000,000, at a CAGR of 9.69%. The growth of the market is driven by the increasing demand for sustainable agriculture and the need to increase crop yields to meet the food security needs of a growing world population. Moreover, as farmers and agribusinesses adopt precision agriculture, the use of agricultural enzymes is expected to penetrate deeper into the various market segments such as soil health, crop protection, and nutrient management, with the penetration rate reaching over 30% in the major markets by 2032.

The use of special enzymes in the brewing of the most important fermented beverages is a further indication of the importance of the development of this branch. In addition, the emergence of government policies aimed at reducing the use of chemical fertilizers and pesticides is expected to encourage the use of biological solutions, including agricultural enzymes. In the future, the development of biopesticides and the fusion of biotechnology with the production of enzymes will also have a significant influence on the market. In view of the growing acceptance of the use of enzymes in the agricultural industry as a means of improving the quality of soil and plant resistance, the agricultural enzymes market is expected to be a key element in the modernization of agricultural practices and will bring about significant economic and social benefits.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 0.3 Billion |

| Growth Rate | 11.30% (2023-2032) |

Agricultural Enzymes Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.