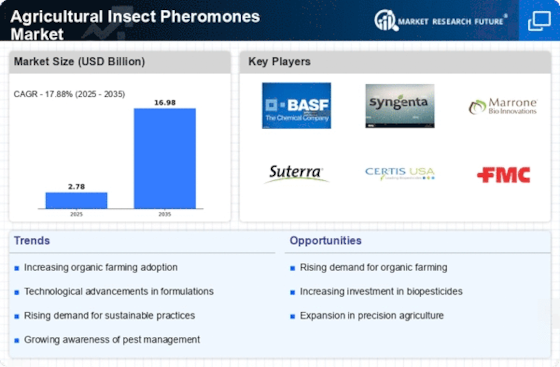

The Agricultural Insect Pheromones Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for sustainable agricultural practices and the need for effective pest management solutions. Key players such as BASF SE (Germany), Syngenta AG (Switzerland), and Marrone Bio Innovations Inc (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. BASF SE (Germany) focuses on innovation through research and development, aiming to expand its product portfolio with advanced pheromone-based solutions. Meanwhile, Syngenta AG (Switzerland) emphasizes regional expansion and strategic partnerships to bolster its market presence, particularly in emerging economies. Marrone Bio Innovations Inc (US) is leveraging digital transformation to optimize its operations and improve customer engagement, thereby shaping a competitive environment that increasingly values technological integration and sustainability.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance efficiency and reduce costs. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like FMC Corporation (US) and Suterra LLC (US) is notable, as they contribute to a competitive atmosphere that encourages innovation and collaboration.

In August 2025, FMC Corporation (US) announced a strategic partnership with a leading agricultural technology firm to develop next-generation pheromone products. This collaboration is expected to enhance FMC's capabilities in precision agriculture, allowing for more targeted pest control solutions. The strategic importance of this partnership lies in its potential to integrate advanced technologies, thereby improving product efficacy and aligning with the growing trend towards sustainable farming practices.

In September 2025, Suterra LLC (US) launched a new line of pheromone dispensers designed for use in organic farming. This initiative not only expands their product offerings but also positions Suterra as a leader in the organic segment of the market. The launch reflects a strategic focus on meeting the increasing consumer demand for organic produce, which is likely to drive sales and enhance brand loyalty.

In July 2025, Syngenta AG (Switzerland) unveiled a digital platform aimed at providing farmers with real-time data on pest activity and pheromone application. This platform is a significant step towards integrating digital solutions into pest management, allowing for more informed decision-making. The strategic importance of this initiative lies in its potential to enhance operational efficiency and improve crop yields, thereby reinforcing Syngenta's competitive edge in the market.

As of October 2025, current competitive trends in the Agricultural Insect Pheromones Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are playing a crucial role in shaping the landscape, as companies seek to combine resources and expertise to drive innovation. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based competition to a focus on innovation, technology, and supply chain reliability, reflecting the industry's shift towards more sustainable and efficient agricultural practices.

Leave a Comment