Market Analysis

In-depth Analysis of AI Audio Video SoC Market Industry Landscape

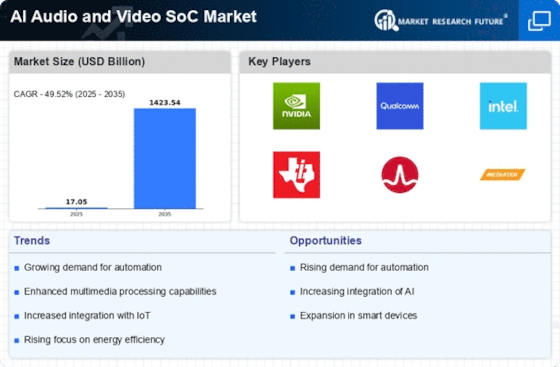

The market dynamics of the AI Audio Video System on Chip (SoC) industry are characterized by a complex interplay of factors that collectively shape the growth, trends, and competitiveness of the market. One of the prominent dynamics is the increasing consumer demand for smart devices with enhanced multimedia capabilities. As consumers seek more immersive audio and video experiences, the adoption of AI Audio Video SoCs becomes pivotal for manufacturers to meet these evolving expectations. This demand-driven dynamic is a driving force behind the consistent growth of the market, prompting companies to innovate and deliver cutting-edge solutions.

Technological advancements in artificial intelligence (AI) contribute significantly to the market dynamics. The continuous evolution of AI algorithms and machine learning techniques directly impacts the performance and capabilities of AI Audio Video SoCs. As AI technology progresses, SoCs can leverage more sophisticated algorithms for audio processing, video rendering, and other multimedia applications. This dynamic relationship between AI advancements and SoC capabilities creates a cycle of innovation, with each technological leap opening up new possibilities and applications within the market.

The global communication landscape plays a crucial role in shaping the dynamics of the AI Audio Video SoC market. The transition to 5G technology is a transformative force, as it enables faster data transfer rates and lower latency. The integration of AI Audio Video SoCs with 5G technology enhances the overall performance of smart devices, ensuring seamless and high-quality multimedia experiences. This dynamic synergy between communication infrastructure and SoC capabilities not only fuels market growth but also facilitates the development of novel applications in areas like augmented reality (AR), virtual reality (VR), and live streaming.

The dynamics of the market are further influenced by the growing trend of edge computing. Edge computing involves processing data closer to the source, reducing latency and enhancing real-time processing capabilities. AI Audio Video SoCs optimized for edge computing applications find relevance in devices such as smart cameras, drones, and IoT devices. This shift towards edge computing reflects the industry's response to the demand for quicker and more efficient processing of audio and video data, thereby influencing the market dynamics.

Market dynamics are also responsive to environmental considerations, with a growing emphasis on energy efficiency. As sustainability becomes a key focus across industries, manufacturers of AI Audio Video SoCs are compelled to design energy-efficient solutions. This dynamic aligns with global efforts to reduce energy consumption and minimize the environmental impact of electronic devices. Consequently, market players are driven to develop SoCs with optimized power consumption, fostering a more sustainable and eco-friendly approach to technology.

Competitive dynamics within the semiconductor industry are pivotal in shaping the AI Audio Video SoC market. Intense competition among key players drives continuous innovation, with companies investing heavily in research and development to stay ahead. Strategic partnerships, mergers, and acquisitions are common as companies vie for a stronger market position. The competitive dynamics create an environment where technological advancements are rapid, leading to a steady stream of new and improved AI Audio Video SoC solutions entering the market.

Leave a Comment