- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

AI in Insurance Market Size Snapshot

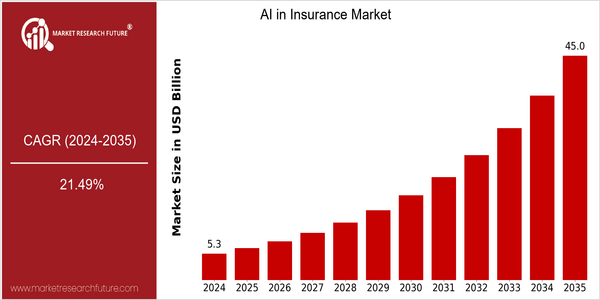

| Year | Value |

|---|---|

| 2024 | USD 5.29 Billion |

| 2035 | USD 45.0 Billion |

| CAGR (2025-2035) | 21.49 % |

Note – Market size depicts the revenue generated over the financial year

The AI in insurance market is expected to grow significantly from $ 5.29 billion in 2024 to $ 45 billion by 2035. Its CAGR from 2025 to 2035 is 21.4 percent, which shows the growing demand for AI in the insurance industry. The insurance industry is changing, and the rapid development of new technology such as machine learning and big data is reshaping the traditional business model, reducing costs and improving customer experience. There are many reasons for this growth, such as the increasing demand for insurance products, the need for improved risk assessment, and the need for a unified system of claims. The use of artificial intelligence in the insurance industry can analyze large amounts of data, which can help the insurance company achieve a more accurate underwriting and pricing strategy. The key players in the industry, such as IBM, Microsoft, and Lemonade, are investing in the development of AI and establishing strategic alliances to use these technologies. For example, tech companies and insurance companies are working together to develop platforms that use artificial intelligence to optimize customer interaction and automation, which will also drive the market growth.

Regional Deep Dive

The market for Artificial Intelligence in Insurance is gaining momentum across the globe, driven by technological advancements, rising demand for a plethora of insurance products, and the need for improved operational efficiency. North America is the largest market for Artificial Intelligence in Insurance, with the highest rate of adoption of AI-based solutions amongst the insurers, owing to the high competition and the strong focus on innovation. Europe is witnessing a surge in the number of regulations that encourage the use of AI, while ensuring the protection of consumers. The Asia-Pacific region is rapidly emerging as a hub for Artificial Intelligence in Insurance, with a growing number of start-ups and investments in digital transformation. Latin America is gradually adopting AI-based solutions, owing to the need for improved risk assessment and fraud detection.

North America

- Artificial intelligence (AI) is already being used by many large insurance companies, such as State Farm and Allstate, to improve the handling of claims and customer service, thereby increasing both efficiency and customer satisfaction.

- The National Association of Insurance Commissioners (NAIC) has introduced a regulatory framework for the implementation of AI in the insurance industry, ensuring that these developments are carried out in an ethical and transparent manner.

- The insurtechs Lemonade and Root are shaking up the traditional insurance industry with the help of artificial intelligence in their underwriting and actuarial functions.

Europe

- The new European Data Protection Regulation (GDPR) has influenced the way insurance companies are using artificial intelligence, with a focus on data protection and ethical AI practices.

- In the field of risk assessment and fraud detection, companies like Zurich Insurance and Allianz are demonstrating the value of AI with the help of novel use cases.

- The European Insurance and Occupational Pensions Authority (EIOPA) is promoting the integration of artificial intelligence into insurance, and has drawn up guidelines which encourage responsible innovation while safeguarding the rights of consumers.

Asia-Pacific

- AI is now being widely used in the insurance industry in China and India. The two companies Ping An and PolicyBazaar are leading the way in the digital transformation of the insurance industry.

- The Government of India has launched the Digital India programme, which is creating an enabling environment for the insurance industry to adopt digital technology to provide better service.

- Insurtech companies are sprouting up in the region, using artificial intelligence to provide a variety of insurance products for a rapidly growing middle class.

MEA

- The UAE Insurance Authority is promoting the use of artificial intelligence in insurance to enhance the customer experience and improve operational efficiency. This is in line with the country's vision to become a digital economy.

- AXA and Allianz are investing in AI to improve the processing of claims and the way they communicate with customers, thereby responding to the growing demand for digital solutions.

- The penetration of mobile telephony in Africa is increasing, which is enabling insurance companies to use AI to develop micro-insurance products.

Latin America

- The development of fintech and insurtech in Brazil and Mexico is driving the adoption of AI in insurance. Companies such as QuintoAndar and Creditas are leading the way.

- The regulatory authorities of the region are beginning to recognize the importance of artificial intelligence. They are making efforts to create a favorable climate for the development of this technology in the insurance industry.

- In the case of the risk assessment and fraud detection in emerging markets, the need for improved performance in this area is pushing traditional insurers to adopt artificial intelligence and thus increase their competitiveness.

Did You Know?

“Some eighty per cent of the Directors of Insurance Companies consider that the development of Artificial Intelligence will have a great effect on the industry within five years, and they recognize the need to respond to this new technological change.” — Accenture Insurance Technology Vision 2023

Segmental Market Size

Artificial intelligence in the insurance industry is experiencing considerable growth, especially in the underwriting and claims-handling segments. These areas are becoming more important to the industry as it seeks to enhance its efficiency and improve customer service. Artificial intelligence is increasingly used to make faster decisions and to help assess risks more accurately.

At present, the application of artificial intelligence to the insurance industry is at the stage of implementation. At the forefront are companies like Lemonade and Allstate. These companies are using artificial intelligence to automate the handling of claims and the underwriting of policies. Fraud detection, chatbots, and risk management are the most important areas of application. The development of digital insurance platforms and the regulatory support for innovation will further boost this trend. Machine learning, natural language processing, and data mining are the key to the development of this sector. They will enable the industry to take full advantage of data and respond more quickly to the market.

Future Outlook

From 2024 to 2035, the global artificial intelligence insurance market is expected to grow at a CAGR of 21.49%. This growth is mainly due to the increased use of artificial intelligence in various insurance functions, such as underwriting, claims, and customer service. Artificial intelligence will be able to penetrate about 60% of the insurance market by 2035, which is much higher than the current level.

The insurance industry has been a major beneficiary of the technological revolution. The use of machine learning, natural language processing, and data mining has changed the way in which the industry is organized and operates. Artificial intelligence is also transforming the regulatory environment. The growth of bespoke insurance products and the use of artificial intelligence to combat fraud will further accelerate the market. Artificial intelligence in insurance will not only transform the industry’s traditional practices but also change the way it interacts with customers, thereby laying the foundation for a data-driven future.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 4.2 Billion |

| Market Size Value In 2023 | USD 7.5 billion |

| Growth Rate | 40.1% (2022-2030) |

AI in Insurance Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.