Research Methodology on AI in Insurance Market

1. Introduction

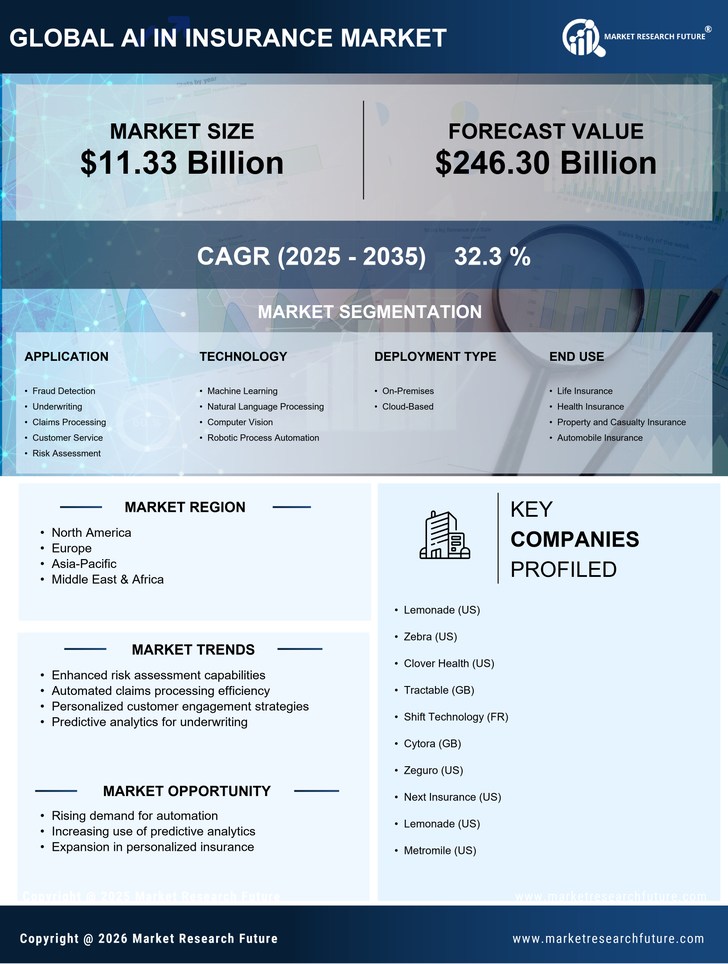

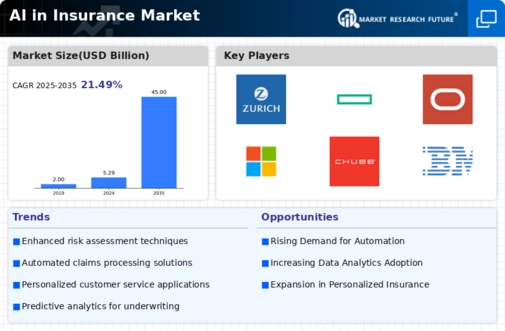

The Artificial Intelligence in Insurance Market report provides an in-depth analysis of the current state of affairs in the market and examines the factors driving competitive dynamics along with the growth opportunities of the market rising from them. The primary objective of this report is to identify the key factors driving the market growth and their relative impact, to quantify the size and potential of this market.

The research methodology used in this report is based on primary and secondary sources of information, market surveys, interviews with industry participants, and key opinion leaders. In the secondary data source, MRFR collected information from published publications, government websites, proprietary databases, and other published reports. In the primary data source, data is collected from C-level executives and industry professionals from relevant sectors who are engaged directly or indirectly in Artificial Intelligence in the Insurance market.

2. Research Design

Data is sourced from reliable and valid sources from both primary and secondary sources. The research involves both qualitative and quantitative perspectives. Interviews were conducted using structured questionnaires with participants from different levels of the industry. The primary data is trusted and verified against other available sources for triangulation purposes and to have a more comprehensive view of the market. The research process involves data collection and analysis through a variety of procedures, including interviews and surveys, as well as secondary research.

MRFR conducted interviews with key industry players and performed in-depth analysis and validation of data collected through such interviews to identify the key trends and opinions in the market. The research team conducted ten in-depth interviews with key executives, industry experts, and potential market players in order to gain their insights and validate their perspectives.

The quantitative analysis used in the research is based on secondary and primary data gathered from reliable sources. Statistically relevant conclusions were drawn from the data gathered through primary research interviews, survey studies and from secondary sources from reliable sources. Descriptive and analytical information is collected from industry experts, industry players, and other stakeholders.

3. Market Segmentation

Artificial Intelligence in the Insurance market has been segmented based on component, technology, deployment mode, insurance sector, and region. The component segment is further categorized into solutions, platforms, and services. The technology segment is further segmented into machine learning, natural language processing, context awareness, computer vision, and others. The deployment mode is further segmented into cloud and on-premise. The insurance sector segment is further segmented into property and casualty insurance, health insurance, life insurance, and others.

4. Geographical Scope

The research report considers the global Artificial Intelligence in the Insurance market to be segmented into North America, Europe, Asia-Pacific, and the Rest of the World.

North America region consists of the U.S., Canada, and Mexico.

The European region comprises Germany, France, the U.K., Italy, Spain, Netherlands, and the Rest of Europe.

The Asia Pacific region includes China, India, Japan, South Korea, and the Rest of Asia Pacific.

The Rest of the World consists of South America, the Middle East and Africa.

5. Data Analysis

Demographic parameters such as age, gender, and income level are also analyzed to gain insights into the buying patterns of customers. Various exploratory information analysis techniques are adopted such as Descriptive Analysis, regression analysis, historical trends analysis and forecasting, correlation analysis and factor analysis.