Increased Urbanization

The rapid pace of urbanization is a key driver for the Air Taxi Market. As cities expand and populations grow, traditional ground transportation systems become increasingly congested. This congestion leads to longer commute times and a demand for alternative transportation solutions. Air taxis offer a potential remedy by providing a faster, more efficient means of travel within urban areas. According to recent data, urban populations are projected to reach 68% by 2050, further intensifying the need for innovative transport solutions. The Air Taxi Market is poised to capitalize on this trend, as urban dwellers seek convenient and time-saving travel options.

Technological Innovations

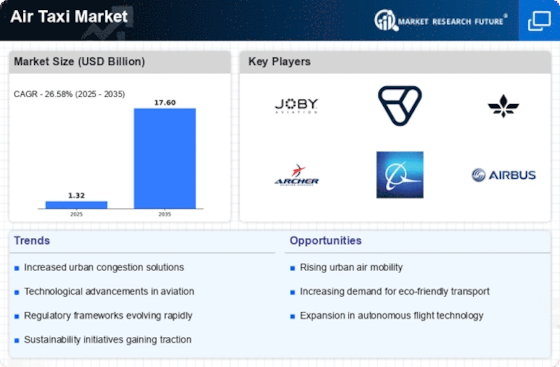

Technological advancements play a pivotal role in shaping the Air Taxi Market. Innovations in electric vertical takeoff and landing (eVTOL) aircraft are at the forefront of this transformation. These aircraft are designed to operate in urban environments, offering reduced noise and emissions compared to traditional helicopters. Furthermore, advancements in autonomous flight technology are expected to enhance safety and operational efficiency. The market for eVTOL aircraft is anticipated to reach USD 1.5 billion by 2030, indicating a robust growth trajectory. As these technologies mature, they are likely to drive the Air Taxi Market forward, attracting investment and interest from various stakeholders.

Regulatory Support and Frameworks

The establishment of supportive regulatory frameworks is crucial for the growth of the Air Taxi Market. Governments are increasingly recognizing the potential of air taxis to alleviate urban congestion and improve transportation efficiency. Regulatory bodies are working to create guidelines that ensure safety, air traffic management, and integration with existing transportation systems. For instance, the Federal Aviation Administration (FAA) has initiated programs to develop air taxi regulations, which could pave the way for commercial operations. This regulatory support is essential for fostering public trust and encouraging investment in the Air Taxi Market, ultimately facilitating its expansion.

Investment and Funding Opportunities

The Air Taxi Market is witnessing a surge in investment and funding opportunities, which is a significant driver of its growth. Venture capital firms and private investors are increasingly interested in the potential of air taxi services, recognizing the market's capacity for innovation and profitability. In 2025, investments in urban air mobility are projected to exceed USD 5 billion, highlighting the financial backing available for startups and established companies alike. This influx of capital is likely to accelerate research and development efforts, enhance operational capabilities, and ultimately expand the Air Taxi Market. As funding continues to flow, the industry may experience rapid advancements and increased competition.

Environmental Concerns and Sustainability

Growing environmental concerns are driving the Air Taxi Market towards more sustainable practices. As urban populations increase, so do the challenges associated with air pollution and greenhouse gas emissions. Air taxis, particularly those powered by electric or hybrid technologies, present a viable solution to these issues. The shift towards sustainable transportation is not only a response to regulatory pressures but also a reflection of changing consumer preferences. A recent survey indicates that 70% of consumers are willing to pay a premium for eco-friendly transportation options. This trend suggests that the Air Taxi Market could benefit from aligning its offerings with sustainability goals.

.png)