- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

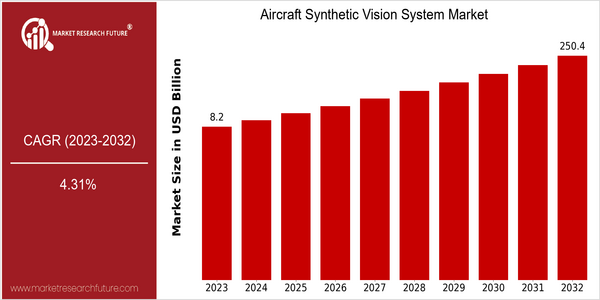

| Year | Value |

|---|---|

| 2023 | USD 8.2 Billion |

| 2032 | USD 250.4 Billion |

| CAGR (2024-2032) | 4.31 % |

Note – Market size depicts the revenue generated over the financial year

The Aircraft Synthetic Vision System (SVS) market is poised for significant growth, with the current market size estimated at USD 8.2 billion in 2023 and projected to reach USD 250.4 billion by 2032. This remarkable expansion reflects a compound annual growth rate (CAGR) of 4.31% from 2024 to 2032. The increasing demand for enhanced situational awareness and safety in aviation, driven by advancements in technology and regulatory requirements, is a primary factor propelling this market forward. As airlines and aircraft manufacturers prioritize safety and efficiency, the integration of synthetic vision systems into cockpit displays has become a critical focus area. Key technological trends, such as the development of augmented reality (AR) applications and improved sensor technologies, are further stimulating market growth. Companies like Honeywell, Rockwell Collins, and Garmin are at the forefront of innovation in this space, actively engaging in strategic initiatives such as partnerships and product launches to enhance their offerings. For instance, recent collaborations aimed at integrating artificial intelligence with SVS technology are expected to provide pilots with unprecedented levels of situational awareness, thereby driving adoption rates and expanding the market landscape.

Regional Market Size

Regional Deep Dive

The Aircraft Synthetic Vision System (SVS) market is experiencing significant growth across various regions, driven by advancements in aviation technology, increasing safety regulations, and the demand for enhanced situational awareness in aircraft operations. Each region exhibits unique characteristics that influence market dynamics, including regulatory frameworks, technological adoption rates, and economic conditions. As the aviation industry continues to recover and expand post-pandemic, the integration of synthetic vision systems is becoming a priority for both commercial and military applications, leading to a robust competitive landscape and innovation in product offerings.

Europe

- The European Union Aviation Safety Agency (EASA) has introduced new safety regulations that encourage the implementation of synthetic vision systems in commercial aircraft, prompting manufacturers like Airbus and Thales to innovate and enhance their SVS offerings.

- The growing emphasis on sustainability in aviation has led to the development of eco-friendly SVS solutions, with companies like Safran focusing on reducing the environmental impact of their technologies while maintaining high safety standards.

Asia Pacific

- Countries in the Asia-Pacific region, particularly China and India, are rapidly modernizing their aviation infrastructure, leading to increased demand for advanced synthetic vision systems to support new aircraft and improve air traffic management.

- The rise of low-cost carriers in the region has spurred competition, prompting airlines to invest in SVS technologies to enhance operational efficiency and passenger safety, with companies like Mitsubishi and Embraer actively participating in this market.

Latin America

- The Latin American aviation market is witnessing a surge in demand for synthetic vision systems as regional airlines seek to modernize their fleets and comply with international safety standards, with companies like Embraer leading the charge in SVS integration.

- Government initiatives aimed at improving aviation safety and infrastructure, such as Brazil's National Civil Aviation Plan, are fostering an environment conducive to the growth of synthetic vision technologies in the region.

North America

- The Federal Aviation Administration (FAA) has been actively promoting the adoption of synthetic vision systems through updated regulations and guidelines, which has led to increased investment from major aerospace companies like Boeing and Lockheed Martin in developing advanced SVS technologies.

- Recent collaborations between technology firms and aviation manufacturers, such as the partnership between Honeywell and Textron Aviation, are focusing on integrating artificial intelligence with SVS to enhance pilot decision-making and improve flight safety.

Middle East And Africa

- The Middle East's strategic position as a global aviation hub has led to significant investments in airport infrastructure and aircraft modernization, with airlines like Emirates and Qatar Airways adopting synthetic vision systems to enhance their fleet's operational capabilities.

- Regulatory bodies in the region are increasingly aligning with international aviation standards, which is driving the adoption of advanced technologies, including SVS, to improve safety and efficiency in air travel.

Did You Know?

“Synthetic vision systems can significantly reduce pilot workload by providing a clear, 3D representation of the terrain and obstacles, even in low visibility conditions, which can enhance safety during critical phases of flight.” — Aviation Safety Network

Segmental Market Size

The Aircraft Synthetic Vision System (SVS) segment plays a crucial role in enhancing situational awareness and safety in aviation, currently experiencing stable growth. Key drivers of demand include increasing regulatory requirements for safety enhancements, such as the FAA's mandate for advanced cockpit technologies, and the rising need for improved navigation capabilities in challenging weather conditions. Technological advancements in sensor integration and data processing are also propelling the adoption of SVS solutions. Currently, the adoption stage of SVS is in the scaled deployment phase, with companies like Garmin and Honeywell leading the charge in integrating these systems into new aircraft models. Notable regions include North America and Europe, where regulatory frameworks support the implementation of advanced avionics. Primary applications of SVS include commercial aviation, military operations, and general aviation, with examples such as the use of SVS in Boeing's 787 Dreamliner and military fighter jets. Trends such as the push for sustainability in aviation and the increasing focus on pilot training and safety are further catalyzing growth, while technologies like augmented reality and machine learning are shaping the future of SVS development.

Future Outlook

The Aircraft Synthetic Vision System (SVS) market is poised for significant growth from 2023 to 2032, with the market value projected to surge from $8.2 billion to $250.4 billion, reflecting a robust compound annual growth rate (CAGR) of 4.31%. This growth trajectory is underpinned by increasing demand for enhanced safety and situational awareness in aviation, driven by advancements in technology and regulatory support. As the aviation industry continues to recover and expand post-pandemic, the integration of synthetic vision systems into both commercial and military aircraft is expected to become more prevalent, with penetration rates potentially reaching over 60% in new aircraft by 2032, compared to approximately 20% in 2023. Key technological drivers include the development of more sophisticated algorithms, improved sensor technologies, and the integration of artificial intelligence, which enhance the accuracy and reliability of SVS. Additionally, regulatory bodies are increasingly mandating the adoption of advanced avionics systems, further propelling market growth. Emerging trends such as the rise of urban air mobility and the increasing focus on pilot training and simulation are also expected to shape the market landscape. As stakeholders prioritize safety and efficiency, the Aircraft Synthetic Vision System market is set to evolve into a critical component of modern aviation infrastructure, ensuring that both commercial and military operations can navigate increasingly complex environments with confidence.

Aircraft Synthetic Vision System Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.