Research Methodology on Aircraft Synthetic Vision System Market

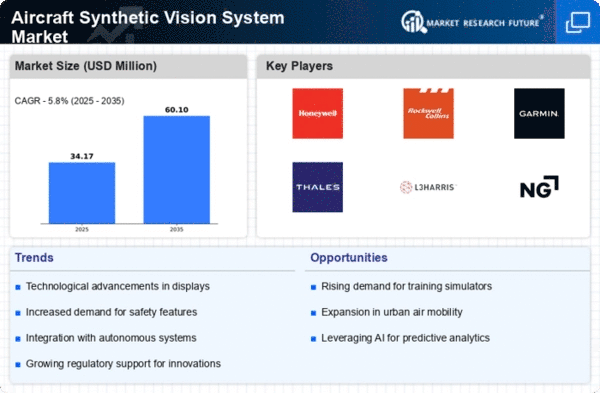

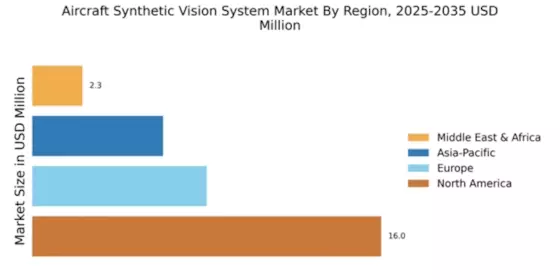

This research is being conducted to assess the Aircraft Synthetic Vision System market status and trends, as well as the prospects and future of aircraft synthetic vision system technology in the global market. The objective of this research is to evaluate the performance of the market, current and future trends, scope, opportunities and expected growth of the Aircraft Synthetic Vision System. Moreover, this research will focus on the recent developments, strategies, and policies being implemented in the Aircraft Synthetic Vision System market.

Market Research Methodology

The Aircraft Synthetic Vision System market research report is based on an extensive market analysis that covers both quantitative and qualitative aspects of this industry. The market estimation of the Aircraft Synthetic Vision System market consists of both primary and secondary research activities. The research is conducted by following a structured and unique research methodology, which involves collecting data through extensive secondary research and interviews with leading industry experts.

The primary research focuses on gathering data from the market stakeholders, such as manufacturers, distributors, and suppliers. Secondary research focuses on researching the industry’s standard and annual reports and verified news publications. The Aircraft Synthetic Vision System market report also leverages primary interviews with industry experts, who represent key companies working in this industry across the globe.

Information Procurement Process

To obtain the research data, various information sources were used, such as primary and secondary sources. The sources of information include published literature, trade & industry journals, market databases, and international trade association publications. For further exploratory data analysis, the external research agencies had been deployed to provide industry-level insights concerning the Aircraft Synthetic Vision System market. Additionally, a detailed industry-level analysis – bottom-up approach – was then undertaken to arrive at the overall market estimation.

Primary Research

Primary research involves extensive data collection to understand the detailed market scenarios. Secondary research involves collecting data from trusted sources, such as company websites, government organizations, publications, and industry associations. Primary research involves interviewing industry experts and market stakeholders, such as chief executive officers (CEOs), vendors, suppliers, and distributors. The primary research was carried out through interviews and telephonic conversations.

Secondary Research

Secondary research strategies were undertaken to gain an in-depth knowledge of the Aircraft Synthetic Vision System industry. Secondary sources of information include industry magazines and publications, corporate annual reports, published research papers, and company websites. The data supplied by these sources are then analyzed using various techniques such as SWOT analysis, Porter’s five force models, bottom-up and top-down approaches, and factor analysis.

Approaches Used:

The Aircraft Synthetic Vision System market report used a range of approaches for the market estimation. These approaches include bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand side and supply side data triangulation. The time-series analysis was used to understand the historical data, existing market dynamics, and future market growth prospects.

Bottom-up Approach - Under this approach, the report was built from the ground up by compiling data for individual segments. The bottom-up approach focuses on revenue numbers for individual segments of the market and adds them up to a global number.

Top-down Approach - In this approach, the Aircraft Synthetic Vision System report was framed based on the size of the market. The top-down approach was used to calculate the market size for individual application and region segments of the Aircraft Synthetic Vision System market.

Demand Side and Supply Side Data Triangulation - A demand and supply side data triangulation was carried out to double-check the accuracy of the calculation of the market size. This approach involved analyzing the global Maritime VSAT market through input from both the demand and supply sides.

Conclusion

Through a comprehensive, detailed research methodology, this research report aims to assess the Aircraft Synthetic Vision System market status and trends, as well as the prospects and future of aircraft synthetic vision system technology in the global market. Primary and secondary research activities were undertaken extensively in order to gain an in-depth knowledge of the Aircraft Synthetic Vision System industry. A range of approaches for the market estimation were used, such as bottom-up approach, top-down approach, factor analysis, time-series analysis, and demand side and supply side data triangulation.