Top Industry Leaders in the Aircraft Wheels Brakes Market

Strategies Adopted:

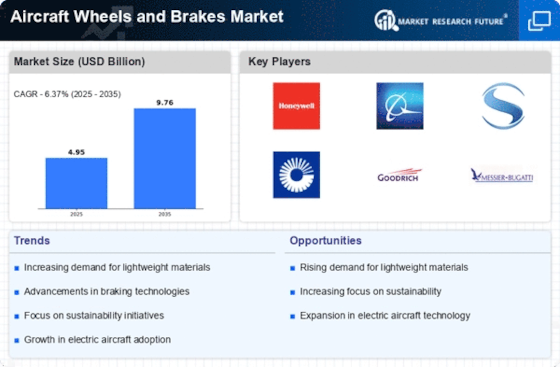

Technological Innovation: Key players invest significantly in research and development to enhance the performance, reliability, and safety of aircraft wheels and brakes. This includes the development of lightweight materials, advanced heat management systems, and digital monitoring solutions to optimize braking performance and reduce maintenance costs.

Global Expansion: Companies focus on expanding their geographic presence through strategic partnerships, joint ventures, and acquisitions. This enables them to strengthen their market position, access new customers, and capitalize on emerging opportunities in regional markets such as Asia-Pacific and the Middle East.

Aftermarket Services: Offering comprehensive aftermarket services such as maintenance, repair, and overhaul (MRO) solutions is a key strategy for market leaders. By providing tailored aftermarket support packages, companies can enhance customer satisfaction, increase operational efficiency, and generate recurring revenue streams.

Strategic Partnerships: Collaborating with aircraft manufacturers, airlines, and MRO providers to co-develop innovative wheel and brake solutions tailored to specific aircraft platforms and operational requirements. Strategic alliances enable companies to leverage complementary expertise, resources, and distribution networks to address evolving market demands.

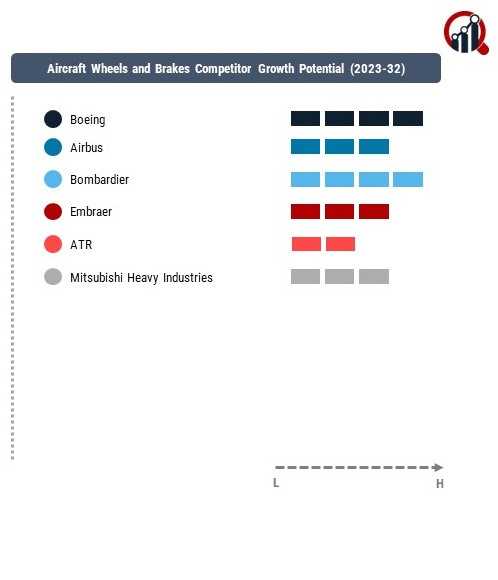

Key Players:

Boeing

Airbus

Bombardier

Embraer

ATR

Mitsubishi Heavy Industries

Factors for Market Share Analysis:

Product Portfolio: The breadth and depth of the product portfolio, including a wide range of wheels, brakes, and braking systems for various aircraft types and applications, are critical factors influencing market share. Companies offering comprehensive solutions tailored to specific aircraft platforms and mission profiles have a competitive advantage.

Technology Leadership: Companies that develop proprietary technologies and hold patents for innovative wheel and brake systems have a competitive edge. Differentiated offerings such as carbon-carbon brakes, integrated brake control systems, and wireless tire pressure monitoring systems contribute to market leadership.

Customer Relationships: Building strong relationships with aircraft OEMs, airlines, leasing companies, and MRO providers is essential for securing contracts and winning repeat business. Companies that offer responsive customer support, technical expertise, and aftermarket services differentiate themselves in the market.

Regulatory Compliance: Compliance with stringent regulatory standards and certification requirements, including FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency) regulations, is critical for market access and competitiveness. Companies that maintain high levels of product quality, safety, and reliability gain market share and customer trust.

New and Emerging Companies:

UTC Aerospace Systems (Collins Aerospace) (US)

Parker Hannifin Corporation (US)

Beringer Aero (France)

Lufthansa Technik (Germany)

Magellan Aerospace Corporation (Canada)

Crane Aerospace & Electronics (US)

Mabs Aviation (India)

Circor Aerospace & Defense (US)

Honeycomb Company of America (US)

Avcorp Industries Inc. (Canada)

Current Company Investment Trends:

Research and Development: Continued investment in R&D to develop next-generation wheel and brake technologies that enhance performance, reliability, and safety while reducing weight and maintenance costs.

Manufacturing Capabilities: Investment in advanced manufacturing capabilities such as automated production lines, robotics, and digital manufacturing technologies to improve efficiency, quality, and flexibility in meeting customer demand.

Aftermarket Services: Expansion of aftermarket service offerings, including the establishment of new MRO facilities, deployment of mobile repair teams, and development of digital maintenance solutions to support predictive maintenance and fleet management.

Overall Competitive Scenario:

Intense Competition: The aircraft wheels and brakes market is highly competitive, with several established players competing for market share. Competition is driven by technological innovation, product differentiation, aftermarket support, and customer relationships.

Market Consolidation: Consolidation through mergers, acquisitions, and strategic alliances is expected to continue as companies seek to strengthen their market position, expand their product portfolios, and enhance their global

Aircraft Wheels and Brakes Industry Developments

For Instance, March 2023Financiadora de Estudos e Projetos (Finep) is a Brazilian government agency that provides public money for Science, Technology, and Innovation to further Brazil's economic and social development.

For Instance, May 2023Bombardier has announced that all Challenger 3500 aircraft will come standard with Iridium Certus connectivity, giving customers a stable and fast internet connection. This new offering results from the partnership between Bombardier and Collins Aerospace, the company's preferred service provider for fleetwide connectivity services.