Airport IT Systems Market

Introduction

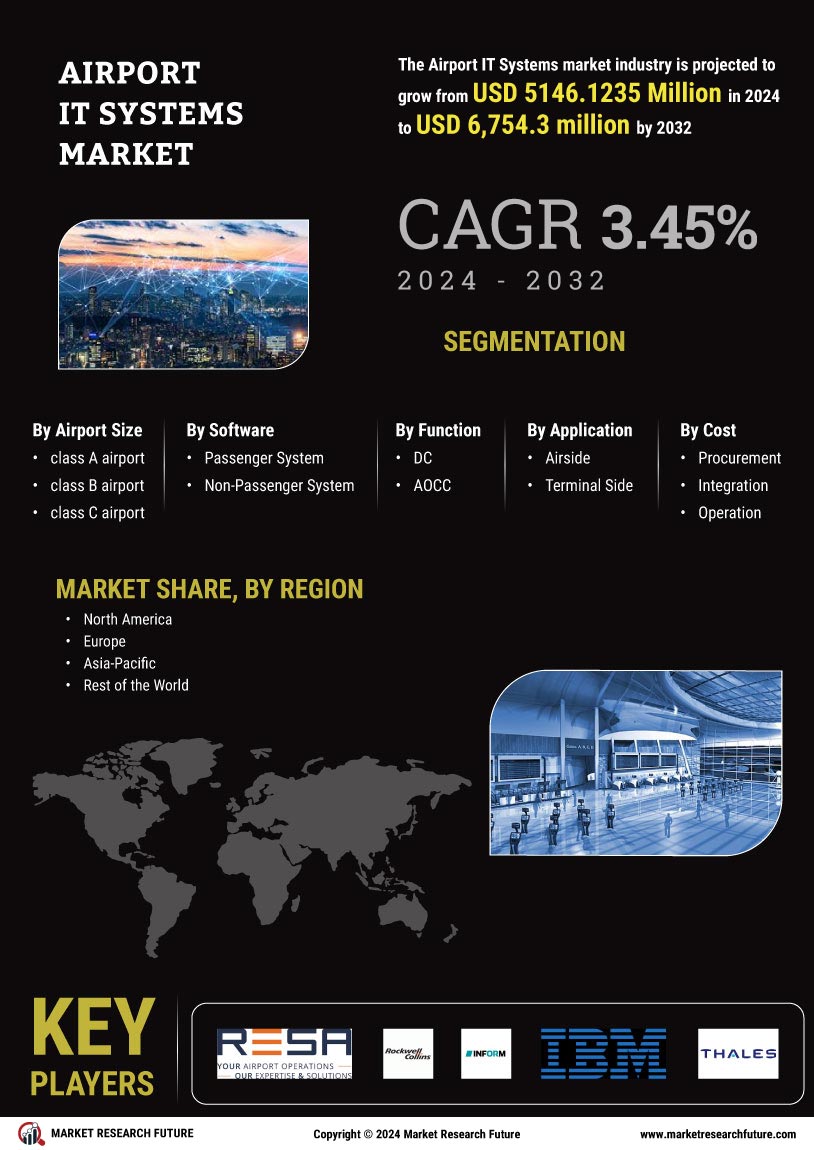

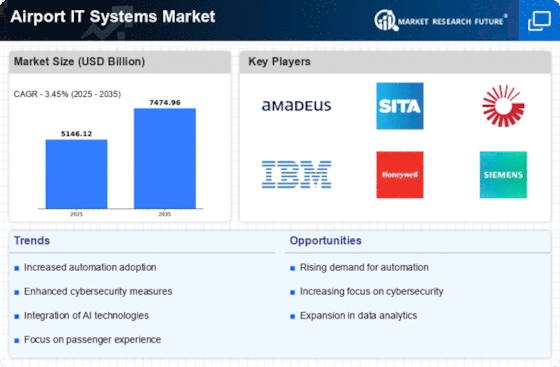

The Airport IT Systems Market is estimated to reach its all-time high valuation at impeccable during the forecast period 2023 to 2030, according to the latest research study by Market Research Future (MRFR). Airport IT systems are mainly based on wide area networks (WANs) that cover the entire airport. The system is expected to help airports and airlines to provide better customer services, increase operational efficiency, increase their revenue and reduce costs.

Research Methodology

The research methodology of this study focuses on obtaining the needed information, including primary and secondary research. Primary research provides the foundation for the study and acts as a source of direct information on the use of airport IT systems. Secondary research provides findings on the uses of airport IT systems and their current trends and practices.

Sources

The research process for this study incorporates sources such as reports, journals, articles, and books. Other sources such as academic institutional websites, University websites, whitepapers, industry journals, magazine articles and blogs were also used.

Databases

To obtain the necessary market intelligence, the researchers used the search engine Google as well as other industry databases, such as IBIS World, Reuters, Bloomberg, Factiva, and MarketWatch.

Data Collection

The researchers gathered qualitative and quantitative data from both offline and online sources. Qualitative data is collected through face-to-face interviews, direct conversations, seminars, industry meets, and survey responses from industry experts. The research team conducted focus group interactions and online interviews to gather an understanding of the current trends and practices in the use of airport IT systems. The researchers collected quantitative data through secondary research sources. These include market reports, industry databases, periodicals, publications, and various directories.

Primary Research

The primary research aims to obtain in-depth information about the use of airport IT systems and the current trends and practices prevailing in the industry. The research team conducts online interviews, direct conversations, and focus group discussions. Participants were asked focused questions related to their experiences and observations in the use of airport IT systems. The collected data was analyzed to get a better understanding of the user’s requirements and the need for the services offered by airport IT systems.

Secondary Research

The secondary research of this study was conducted to get a better understanding of the current trends and practices in the use of airport IT systems. The various secondary sources used for this research included market reports, industry databases, periodicals, publications, tertiary resources, and various directories. The qualitative and quantitative data collected from secondary research sources were used to obtain a better understanding of the trends in airport IT systems.

Factors Analysis

In order to understand the usage and market trends of airport IT systems in the aviation industry, several factors such as revenue share of IT systems, demand-side factors, supply-side factors, economic and socio-political factors, and technological factors had to be studied in detail. The research team used a factor analysis approach to understand how these factors affect the airport IT systems market. The researchers analyzed all the factors and their impact on the market in detail before formulating the final results.

Time Series Analysis

To understand the market trends of airport IT systems over a period of time, the research team used time series analysis. The team looked at the historical and future usage data of airport IT systems to get an understanding of the market dynamics over several years. This helped the researchers to understand the trends and identify the key drivers of the airport IT systems market.

Data Triangulation

In order to gain an accurate picture of the airport IT systems market, the research team used the Data Triangulation method. The technique included breaking down the market into various segments such as the demand side and supply side. The researchers conducted interviews, surveys and focus group discussions with industry experts in each market segment and collected data from both demand and supply sides. This data is then analyzed and used to formulate a comprehensive analysis of the airport IT systems market.

Conclusion

The research conducted in this study is aimed at obtaining a detailed understanding of the usage and market trends of airport IT systems in the aviation industry. The research team used both primary and secondary research sources to collect the necessary data. The data collected through the primary and secondary research sources were analyzed by using factor analysis, time series analysis, and data triangulation techniques to identify the key drivers of the Airport IT Systems Market. After a comprehensive analysis of the data, the researchers formulated the findings of the Airport IT Systems Market and predicted the forecast for 2023 to 2030.