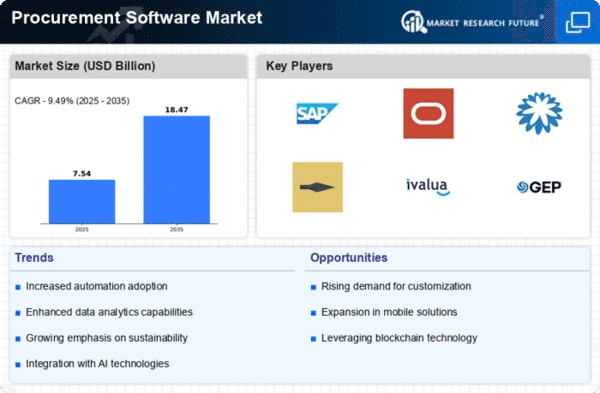

The Procurement Software Market is currently characterized by a dynamic competitive landscape, driven by the increasing need for efficiency and transparency in supply chain management. Leading procurement software companies are investing in AI, cloud platforms, and advanced analytics. SAP Ariba’s market share reflects its strong presence in enterprise procurement and supplier networks. Key players such as SAP (DE), Oracle (US), and Coupa Software (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. SAP (DE) focuses on integrating advanced analytics and AI capabilities into its procurement solutions, thereby facilitating data-driven decision-making. Oracle (US) emphasizes cloud-based solutions, aiming to streamline procurement processes and enhance user experience through digital transformation. Coupa Software (US) is leveraging partnerships with various technology firms to expand its ecosystem, thereby enhancing its service offerings and customer reach. Collectively, these strategies indicate a trend towards innovation and collaboration, shaping a competitive environment that prioritizes technological advancement and customer-centric solutions. In terms of business tactics, companies are increasingly localizing their operations and optimizing supply chains to respond to regional demands effectively. The market structure appears moderately fragmented, with several players vying for market share while also collaborating through strategic alliances. This fragmentation allows for a diverse range of solutions, catering to various customer needs, while the influence of key players remains substantial in setting industry standards and driving innovation. In November 2025, SAP (DE) announced a strategic partnership with a leading AI firm to enhance its procurement analytics capabilities. This move is likely to bolster SAP's position in the market by providing clients with more sophisticated tools for predictive analytics, thereby improving procurement efficiency and decision-making processes. The integration of AI into procurement solutions is expected to be a game-changer, allowing organizations to anticipate market trends and adjust their strategies accordingly. In October 2025, Coupa Software (US) launched a new sustainability module within its procurement platform, aimed at helping organizations track and reduce their carbon footprint. This initiative reflects a growing trend towards sustainability in procurement practices, as companies increasingly seek to align their operations with environmental goals. By offering tools that facilitate sustainable procurement, Coupa Software positions itself as a leader in this emerging market segment, potentially attracting environmentally conscious clients. In September 2025, Oracle (US) expanded its cloud procurement solutions to include enhanced mobile capabilities, allowing users to manage procurement processes on-the-go. This strategic enhancement is indicative of the increasing demand for mobile accessibility in procurement software, as organizations seek to empower their teams with flexible and efficient tools. By prioritizing mobile functionality, Oracle is likely to improve user engagement and satisfaction, thereby strengthening its competitive edge. As of December 2025, the competitive trends in the Procurement Software Market are increasingly defined by digitalization, sustainability, and AI integration. Strategic alliances are playing a crucial role in shaping the landscape, as companies collaborate to enhance their technological capabilities and service offerings. Looking ahead, competitive differentiation is expected to evolve, with a notable shift from price-based competition towards innovation, technology, and supply chain reliability. This transition underscores the importance of adaptability and forward-thinking strategies in maintaining a competitive advantage in a rapidly changing market.