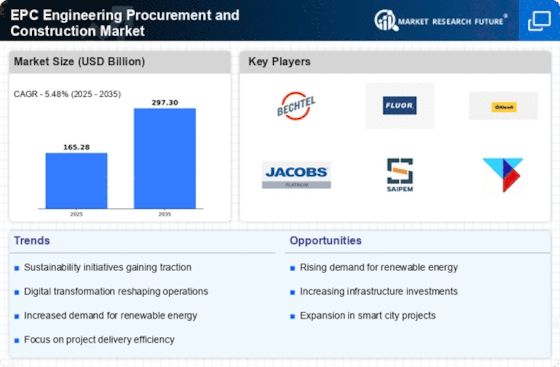

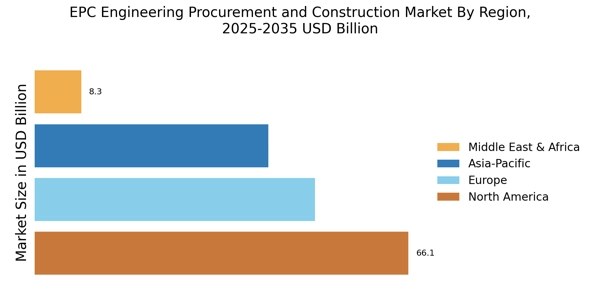

North America : Leading Innovation and Growth

North America is the largest market for EPC services, driven by significant investments in infrastructure, energy, and technology sectors. The region holds approximately 40% of the global market share, with the United States being the primary contributor, followed by Canada. Regulatory support for renewable energy projects and infrastructure upgrades is fueling demand, while government initiatives aim to enhance project efficiency and sustainability. The competitive landscape is dominated by major players such as Bechtel, Fluor Corporation, and Jacobs Engineering Group, which leverage advanced technologies and project management expertise. The presence of these key players, along with a skilled workforce, positions North America as a hub for innovative EPC solutions. The market is characterized by a focus on large-scale projects, particularly in energy and transportation sectors, ensuring continued growth and investment.

Europe : Sustainable Development Focus

Europe is witnessing a transformative phase in the EPC market, driven by stringent environmental regulations and a strong push towards sustainable development. The region accounts for approximately 30% of the global market share, with Germany and the United Kingdom leading in project investments. Regulatory frameworks, such as the European Green Deal, are catalyzing demand for EPC services in renewable energy and infrastructure projects, promoting innovation and efficiency. Key players in the European EPC market include Saipem and TechnipFMC, which are actively involved in large-scale energy and infrastructure projects. The competitive landscape is characterized by collaboration among firms to meet regulatory requirements and sustainability goals. Countries like France and Italy are also emerging as significant contributors, enhancing the region's overall market dynamics and fostering a collaborative environment for EPC service providers.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is rapidly emerging as a significant player in the EPC market, driven by urbanization, industrialization, and infrastructure development. The region holds approximately 25% of the global market share, with China and India being the largest contributors. Government initiatives aimed at enhancing infrastructure and energy efficiency are key growth drivers, alongside increasing foreign investments in the construction sector, which are expected to boost market demand further. The competitive landscape features major players like China State Construction Engineering and Larsen & Toubro, which are involved in extensive projects across various sectors, including energy, transportation, and urban development. The presence of these companies, coupled with a growing skilled workforce, positions Asia-Pacific as a vital region for EPC services, with a focus on innovative solutions to meet the demands of rapid urban growth and infrastructure needs.

Middle East and Africa : Resource-Rich Opportunities

The Middle East and Africa region is experiencing a surge in EPC market activities, driven by substantial investments in oil, gas, and infrastructure projects. This region accounts for approximately 5% of the global market share, with countries like Saudi Arabia and the UAE leading the charge. Government initiatives aimed at diversifying economies and enhancing infrastructure are key catalysts for growth, particularly in the energy sector, where renewable projects are gaining traction. The competitive landscape is characterized by the presence of key players such as JGC Corporation and Samsung Engineering, which are actively engaged in large-scale projects across the region. The focus on local partnerships and technology transfer is enhancing the capabilities of regional firms, fostering a collaborative environment that supports the growth of the EPC market. As the region continues to invest in infrastructure and energy diversification, the EPC sector is poised for significant expansion.