Aliphatic Hydrocarbon Size

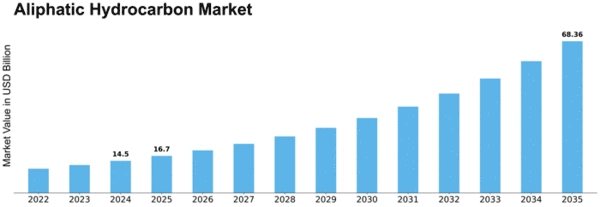

Aliphatic Hydrocarbon Market Growth Projections and Opportunities

The aliphatic hydrocarbon market is a very dynamic industry, influenced by various market forces that determine its behavior and growth trajectory. One of the major things to note here is escalating demand for petrochemicals and specialty chemicals in different sectors. Plastics, solvents and lubricants are some examples of products made from aliphatic hydrocarbons such as alkanes and alkenes which act as crucial raw materials. This will only rise with the need to cover more areas around the globe when it comes to industrialization.

For instance, the Aliphatic Hydrocarbon Market is projected at USD 4.85 Billion by 2028, growing at CAGR of 4.42% during this period (2021 - 2028).

Another thing worth stating would be oil markets’ price volatility that affects crude oil prices directly since petroleum sources them through refining processes that can be expensive at times due to unsteady conditions in this sector resulting into fluctuating costs. Therefore, players in this industry are so concerned about these trends given their past experiences where changes in oil price impacted on their income statements among other financial results. These may encompass issues surrounding geopolitical situations or global events affecting international relations on supply chains including production systems pertaining to certain oils hence indirectly modifying how they are valued together with any available inventories within commerce.

Market dynamics are shaped by automotive industry as well because it is one of the largest consumers particularly lightweight types used in car making; hence there is high demand for such chemicals from polymer composites and coatings producers. Therefore, adoption of these compounds may increase when automakers turn towards cars that are less harmful to environment with low energy consumption rates thus manufacturers have started searching for other materials capable of producing new items.

In addition, technological advancements in manufacturing processes greatly affect Aliphatic Hydrocarbon Market today. The ongoing research seeks efficient methods of production which shall reduce operating costs while increasing quality levels for aliphatic hydrocarbon products. This is what enhances competition and guarantees sustainability through catalytic procedures, extraction techniques or purification methodologies developments.

Furthermore, market competition plays a critical role in shaping this industry. Several large players who have been in existence for many years dominate the sector by virtue of their extensive distribution networks coupled with global presence. On the other hand, emerging businesses with newer technologies as well as environmental concerns are proving challenging opponents. Subsequently, M&A activities such as strategic alliances may be witnessed and then followed by research investments aimed at expanding their competitive edge to stay relevant against these rivals.

Broadly speaking, it is possible to see that there is a complex interconnection of factors ranging from industrial requirements to ecological aspects pertaining to production operations and overall health of oil markets that dictate Aliphatic Hydrocarbon Market’s growth patterns today. Consequently, adaptation to such dynamics among other global shifts will define whether or not this arm needs further expansion so that it can have a sustainable future ultimately leading into its survival on this changing worldwide landscape.

Leave a Comment