All Terrain Vehicle Size

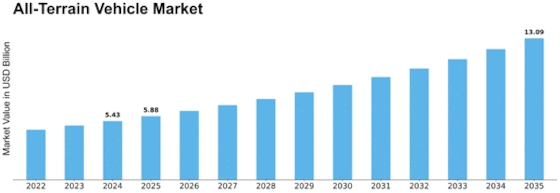

All-Terrain Vehicle Market Growth Projections and Opportunities

Purchaser request drives the all-terrain vehicle (ATV) market, which is reinforced by utility necessities, sporting tendencies, and way of life choices. ATVs have become progressively irreplaceable for various open-air pursuits, and their application in development, agribusiness, and ranger service adds to the extension of the market. The versatility of ATVs to satisfy both utilitarian and sporting targets resounds with a wide range of buyers. The ATV market is considerably affected by unofficial laws, which affect security guidelines and emanation processes. Really complying with the changed conformance prerequisites requires that makers acclimate to these guidelines across areas. Execution and security are upgraded by mechanical headways in the ATV market, like electronic fuel infusion, GPS route, and suspension frameworks; thus, producers are constrained to apportion assets towards innovative work to support seriousness. Business rates, extra cash, and steadiness are financial determinants that altogether affect the ATV market by impacting purchaser buying power. Improved monetary development animates speculation and trust in recreation pursuits. Worldwide natural worries and maintainability influence the elements of the ATV market, provoking makers to make biological models, for example, electric and hybrid ATVs with an end goal to lessen their ecological effect. The cutthroat scene of the ATV business is fundamentally affected by brand situating, market combination, and key coalitions. Rather than laid out contenders, which partake in an upper hand, new participants focus on specialty markets. The appropriation of piece of the pie and valuing procedures are both affected by union. Shopper qualities and social inclinations apply a huge effect on different parts of the ATV market. Makers should modify their showcasing techniques to really target unmistakable age gatherings and geographic locales, while additionally understanding social subtleties, to infiltrate new business sectors and keep up with purchaser interest. The business for off-road vehicles is diverse and many-sided. Shopper wants, administrative structures, mechanical headways, monetary circumstances, natural worries, corporate contest, and social patterns all apply an effect on it. To flourish in the ceaselessly developing ATV industry, makers must capably explore the heap market influences at play.

Leave a Comment