Market Share

Alloys for Automotive Market Share Analysis

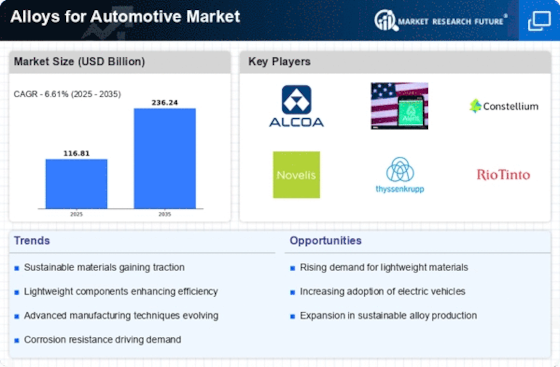

In recent years, the automotive industry has witnessed a significant shift in its materials landscape, with alloys playing a pivotal role in shaping the market trends. Alloys, which are combinations of two or more elements, often including metals, have gained prominence for their ability to enhance the performance, durability, and overall efficiency of automotive components. One of the key market trends in the alloys for the automotive sector is the growing demand for lightweight materials. As global concerns about fuel efficiency and environmental impact intensify, automakers are increasingly turning to lightweight alloys to reduce the overall weight of vehicles. This not only contributes to improved fuel efficiency but also aligns with stringent emission regulations.

Aluminum alloys have emerged as the frontrunners in the pursuit of lightweight automotive solutions. These alloys offer a compelling combination of strength and low density, making them an ideal choice for various components, including body panels, engine blocks, and suspension systems. The market trend towards aluminum alloys is driven by the need for lightweighting without compromising structural integrity. Furthermore, aluminum's corrosion resistance adds to the durability of automotive parts, extending the lifespan of vehicles.

Another notable market trend is the rising interest in advanced high-strength steel (AHSS) alloys. AHSS alloys provide an excellent balance between strength and formability, addressing safety concerns while meeting the demands of modern vehicle design. Automakers are increasingly incorporating AHSS in structural components, such as chassis and safety-critical parts, to enhance crashworthiness without sacrificing weight savings. The market for AHSS is expected to grow as manufacturers seek to meet stringent safety standards and improve overall vehicle performance.

In the realm of electric vehicles (EVs), alloys play a crucial role in addressing specific challenges associated with battery technologies. The automotive market is witnessing an increasing shift towards electric propulsion systems, demanding innovative solutions for heat dissipation and thermal management. Alloys with enhanced thermal conductivity, such as copper-based alloys, are gaining traction for their ability to efficiently dissipate heat generated during battery operation. This trend is poised to intensify as the electric vehicle market expands, necessitating alloys that can withstand the unique demands of electric powertrains.

Furthermore, the alloys market is witnessing advancements in the development of hybrid materials, combining different metals or metal-matrix composites to achieve superior performance characteristics. These hybrid alloys offer a tailored approach to meet specific requirements, whether it be in terms of strength, conductivity, or corrosion resistance. As automotive technology continues to evolve, the demand for custom-tailored alloys is expected to rise, fostering a market environment where versatility and adaptability become key factors.

In conclusion, the market trends of alloys for the automotive industry reflect a dynamic landscape shaped by the pursuit of lightweight solutions, advancements in material technology, and the growing prominence of electric vehicles. Aluminum alloys and advanced high-strength steel are at the forefront, addressing the industry's need for lighter yet stronger materials. Simultaneously, alloys with enhanced thermal conductivity are gaining significance in the context of electric vehicles. As the automotive sector continues to navigate challenges related to sustainability, efficiency, and safety, the alloys market is poised to play a pivotal role in driving innovation and shaping the future of automotive engineering.

Leave a Comment