Market Analysis

In-depth Analysis of Alternative Fuel Vehicles Market Industry Landscape

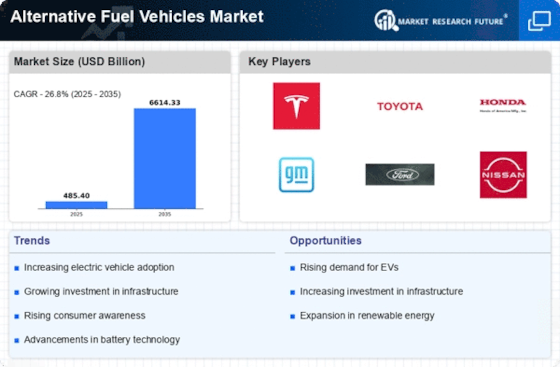

The market elements of alternative fuel vehicles (AFVs) have been encountering an extraordinary change lately, determined by a conjunction of variables that mirror a developing consciousness of ecological manageability and a push towards decreasing reliance on conventional non-renewable energy sources. As worries about environmental change, customers and states the same are progressively looking for cleaner and more supportable transportation choices, cultivating a powerful interest for AFVs. The alternative fuel vehicles market envelops a different scope of innovations, including electric vehicles (EVs), hydrogen fuel cell vehicles, and cross breed vehicles. Electric vehicles have arisen as a leader in the AFV market, with headways in battery innovation adding to expanded range, diminished charging times, and declining costs. States overall are offering motivators to prod electric vehicle reception, further supporting business sector development. The administrative scene assumes a critical part, with severe emanations guidelines driving automakers to put resources into AFV innovations to meet administrative prerequisites. Moreover, the expansion of charging foundation is a pivotal variable impacting buyer trust in embracing electric vehicles, and states are effectively putting resources into extending charging organizations to address this worry. Crossover vehicles, joining conventional gas-powered motors with electric drive, have likewise cut out a critical offer in the alternative fuel vehicles market. Offering a split, the difference among regular and completely electric vehicles, mixtures give a reasonable answer for consumers looking for expanded fuel proficiency without completely focusing on an electric vehicle. The market for hydrogen fuel cell vehicles, however in a beginning stage contrasted with EVs and cross breeds, is picking up speed, with headways in hydrogen creation and dissemination innovations. It is becoming standard to collaborate on creative projects, share innovations, and work together to establish a standard billing framework. These initiatives aim to tackle challenges related to innovation standardization, interoperability, and the overall global growth of the AFV sector. The ability of partners to overcome obstacles and take advantage of opportunities is what drives the AFV market's unceasing growth, ultimately shaping an ecosystem-safe and sustainable future for the automotive industry.

Leave a Comment