Market Trends

Key Emerging Trends in the Aluminum Aerosol Cans Market

The aluminum aerosol can market is undergoing noteworthy transformations influenced by consumer preferences, sustainability concerns, and advancements in technology. A significant trend in this market is the rising demand for sustainable packaging solutions. Aluminum aerosol cans, being infinitely recyclable, are gaining popularity as an environmentally friendly alternative to other packaging materials. Consumers are increasingly gravitating towards products with minimal environmental impact, prompting manufacturers to focus on aluminum as a sustainable choice for aerosol packaging.

Moreover, customization is becoming a key trend in the aluminum aerosol can market. Brands are recognizing the importance of packaging as a powerful marketing tool, and they are leveraging customizable features to create distinctive and visually appealing aerosol can designs. This trend caters to consumer preferences for unique and aesthetically pleasing products, fostering brand loyalty and recognition. Customized printing, vibrant colors, and innovative shapes are being employed to make aluminum aerosol cans stand out on store shelves.

The market is also witnessing a surge in demand for aluminum aerosol cans as a preferred choice over traditional plastic alternatives. With growing concerns about plastic pollution and an increasing awareness of its environmental impact, consumers are actively seeking packaging options that minimize their carbon footprint. Aluminum aerosol cans, being lightweight and fully recyclable, align with the global push towards reducing plastic usage, contributing to a shift in consumer preferences towards more sustainable choices.

Technological advancements are playing a pivotal role in shaping the aluminum aerosol can market. Manufacturers are exploring innovative coating technologies to enhance the performance and barrier properties of aluminum, ensuring the integrity of the products inside. Advanced coatings not only preserve the contents of the aerosol cans but also extend their shelf life, meeting the expectations of both consumers and producers. This emphasis on technological innovation positions aluminum aerosol cans as a versatile and reliable packaging solution.

E-commerce is influencing market trends in the aluminum aerosol can sector, as online retail continues to grow. The robust and durable nature of aluminum makes it an ideal choice for packaging in the e-commerce space. Aluminum aerosol cans provide protection for products during transit, minimizing the risk of damage and ensuring that consumers receive intact and functional products. As the e-commerce landscape expands, the demand for secure and resilient packaging, such as aluminum aerosol cans, is expected to rise.

Furthermore, the market is witnessing efforts towards reducing the carbon footprint associated with aluminum production. Manufacturers are investing in sustainable practices, such as using recycled aluminum and improving energy efficiency during the manufacturing process. These initiatives contribute to the overall sustainability profile of aluminum aerosol cans, addressing concerns related to the environmental impact of raw material extraction and production.

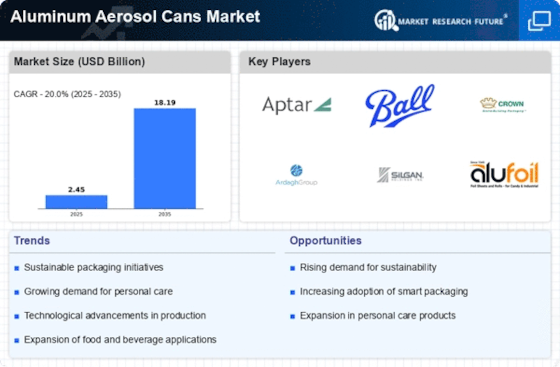

In terms of market dynamics, the competition among aluminum aerosol can manufacturers is intensifying. Companies are investing in research and development to enhance the recyclability, strength, and design flexibility of aluminum aerosol cans. Meeting regulatory standards and certifications for sustainable packaging is also becoming a key differentiator in the market. As consumers continue to prioritize environmentally friendly options, the aluminum aerosol can market is expected to witness sustained growth and innovation.

Leave a Comment