-

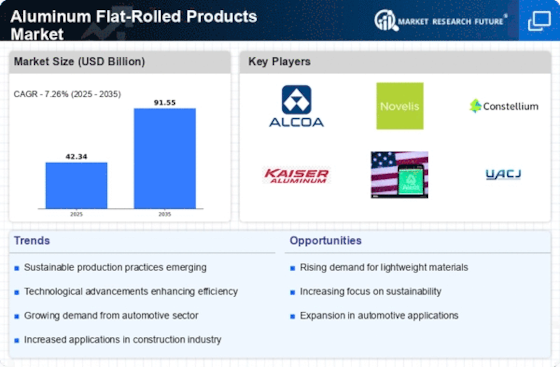

Executive Summary

-

Market Attractiveness Analysis 19

- Aluminum Flat Rolled Products Market, By Product Type 19

- Global Aluminum Flat-Rolled Products Market, End-Use Industry 20

- Aluminum Flat Rolled Products Market, By Region 21

-

Market Introduction

-

Definition 22

-

Scope Of The Study 22

-

Market Structure 23

-

Key Buying Criteria 23

-

Market Insights

-

Research Methodology

-

Research Process 27

-

Primary Research 28

-

Secondary Research 29

-

Market Size Estimation 29

-

Forecast Model 30

-

List Of Assumptions 31

-

Market Dynamics

-

Introduction 32

-

Drivers 33

- Increasing Demand For Aluminum Flat-Rolled Products In The Automotive And Aerospace Industries 33

- High Demand For Aluminum Foils In The Packaging Industry 34

- Drivers Impact Analysis 35

-

Restraints 35

- Environmental Hazards Associated With Bauxite Mining 35

- Restraints Impact Analysis 36

-

Opportunities 36

- Expanding Construction Industry 36

-

Challenges 37

- Fluctuating Raw Material Prices 37

-

Market Factor Analysis

-

Supply Chain Analysis 38

- Raw Material Suppliers 39

- Aluminum Flat-Rolled Product Manufacturers 39

- Distribution Channel 39

- End-Use Industries 39

-

Porter’s Five Forces Model 40

- Threat Of New Entrants 40

- Intensity Of Competitive Rivalry 41

- Threat Of Substitutes 41

- Bargaining Power Of Suppliers 41

- Bargaining Power Of Buyers 41

-

Cost Analysis Of Aluminum Flat-Rolled Plates 42

-

Aluminum Flat Rolled Products Market, By Product Type

-

Introduction 43

-

Plates 45

-

Sheets 47

-

Standard GEQ 48

-

Circles 49

-

Foil Stock 50

-

Can Stock 51

-

Fin Stock 52

-

Others 53

-

Aluminum Flat Rolled Products Market, By End-Use Industry

-

Introduction 55

-

Building & Construction 57

-

Automotive & Transportation 58

-

Consumer Goods 60

-

Electrical & Electronics 61

-

Industrial 62

-

Packaging 63

-

Others 64

-

Aluminum Flat Rolled Products Market, By Region

-

Introduction 66

-

North America 70

- US 73

- Canada 76

-

Europe 78

- Germany 82

- Russia 84

- UK 87

- France 89

- Spain 92

- Italy 94

- The Netherlands 96

- Belgium 99

- Poland 101

- Rest Of Europe 103

-

Asia-Pacific 106

- China 110

- Japan 112

- India 114

- South Korea 117

- Indonesia 119

- Thailand 121

- Australia & New Zealand 124

- Malaysia 127

- Rest Of Asia-Pacific 129

-

Latin America 132

- Mexico 135

- Brazil 137

- Argentina 140

- Rest Of Latin America 142

-

The Middle East & Africa 144

- North Africa 148

- Turkey 150

- GCC 152

- Israel 155

- Rest Of Middle East & Africa 157

-

Competitive Landscape

-

Introduction 70

-

North America 76

- US 79

- Canada 82

-

Europe 86

- Germany 90

- UK 93

- Russia 96

- France 99

- Spain 102

- Italy 105

- Poland 108

- Belgium 111

- The Netherlands 114

- Rest Of The Europe 117

-

Asia-Pacific 121

- China 125

- Japan 128

- India 131

- South Korea 134

- Australia & New Zealand 137

- Malaysia 140

- Thailand 143

- Indonesia 146

- Rest Of The Asia-Pacific 149

-

The Middle East & Africa 153

- Saudi Arabia 157

- UAE 160

- Israel 163

- Turkey 166

- Rest Of The Middle East & Africa 169

-

Latin America 172

- Mexico 176

- Brazil 179

- Argentina 182

- Rest Of Latin America 185

-

Company Profiles

-

Hindalco Industries Limited 165

- Company Overview 165

- Financial Overview 166

- Products/Services Offered 166

- Key Developments 167

- SWOT Analysis 167

- Key Strategies 167

-

Alcoa Corporation 168

- Company Overview 168

- Financial Overview 168

- Products/Services Offered 169

- Key Developments 169

- SWOT Analysis 169

- Key Strategies 169

-

Constellium 170

- Company Overview 170

- Financial Overview 170

- Products/Services Offered 171

- Key Developments 171

- SWOT Analysis 171

- Key Strategies 171

-

Norsk Hydro ASA 172

- Company Overview 172

- Financial Overview 172

- Products/Services Offered 173

- Key Developments 173

- SWOT Analysis 174

- Key Strategies 174

-

Aluminum Corporation Of China (Chalco) 175

- Company Overview 175

- Financial Overview 175

- Products/Services Offered 176

- Key Developments 176

- SWOT Analysis 176

- Key Strategies 176

-

Arconic 177

- Company Overview 177

- Financial Overview 177

- Products/Services Offered 178

- Key Developments 178

- SWOT Analysis 178

- Key Strategies 178

-

NALCO 179

- Company Overview 179

- Financial Overview 179

- Products/Services Offered 180

- Key Developments 180

- SWOT Analysis 180

- Key Strategies 180

-

UACJ Corporation 181

- Company Overview 181

- Financial Overview 181

- Products/Services Offered 182

- Key Developments 182

- SWOT Analysis 183

- Key Strategies 183

-

Elvalhalcor Hellenic Copper And Aluminum Industry S.A. 184

- Company Overview 184

- Financial Overview 184

- Products Offering 185

- Key Developments 185

- SWOT Analysis 185

- Key Strategies 185

-

JW Aluminum 186

- Company Overview 186

- Financial Overview 186

- Products/Services Offered 186

- Key Developments 186

- SWOT Analysis 187

- Key Strategies 187

-

Appendix

-

List Of Tables

-

LIST OF ASSUMPTIONS 31

-

ALUMINUM FLAT-ROLLED PLATES, COST ANALYSIS, 2023 42

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 44

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 45

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 46

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 46

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 47

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 47

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 48

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 48

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 49

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 49

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 50

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 51

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 51

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 52

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 52

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 53

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 53

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 54

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 56

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 57

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING & Aluminum Flat Rolled Products Market, BY REGION, 2023-2032

-

(USD MILLION) 57

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR BUILDING & Aluminum Flat Rolled Products Market, BY REGION, 2023-2032

-

(KILO TONS) 58

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR AUTOMOTIVE & Aluminum Flat Rolled Products Market, BY REGION,

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR AUTOMOTIVE & Aluminum Flat Rolled Products Market, BY REGION,

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 60

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 60

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR ELECTRICAL & Aluminum Flat Rolled Products Market, BY REGION,

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET FOR ELECTRICAL & Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 61

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 62

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 62

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 63

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 64

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 64

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 65

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (USD MILLION) 67

-

Aluminum Flat Rolled Products Market, BY REGION, 2023-2032 (KILO TONS) 67

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 68

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 68

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 ( USD MILLION) 69

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 69

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (USD MILLION) 70

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (KILO TONS) 70

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 71

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 71

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 72

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 72

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 73

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 74

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 74

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 75

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 76

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 76

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 77

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 77

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (USD MILLION) 78

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (KILO TONS) 79

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 79

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 80

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 81

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 81

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 82

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 82

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 83

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 83

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 84

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 85

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 85

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 86

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 87

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 87

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 88

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 89

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 89

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 90

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 91

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 91

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 92

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 92

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 93

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 93

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 94

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 95

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 95

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 96

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 96

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 97

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 98

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 98

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 99

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 99

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 100

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 100

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 101

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 102

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 102

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 103

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 103

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 104

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 105

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 105

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (USD MILLION) 106

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (KILO TONS) 107

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 107

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 108

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 109

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 109

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 110

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 110

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 111

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 111

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 112

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 113

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 113

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 114

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 114

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 115

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 116

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 116

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 117

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 117

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 118

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 118

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 119

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 120

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 120

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 121

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 121

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 122

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 123

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 123

-

AUSTRALIA & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 124

-

AUSTRALIA & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 125

-

AUSTRALIA & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 125

-

AUSTRALIA & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 126

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 127

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 127

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 128

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 128

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 129

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 130

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 130

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 131

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (USD MILLION) 132

-

Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (KILO TONS) 132

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 133

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 133

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 134

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 134

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 135

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 136

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 136

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 137

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 137

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 138

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 139

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 139

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 140

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 140

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 141

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 141

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 142

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 143

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 143

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 144

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (USD MILLION) 144

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY COUNTRY, 2023-2032 (KILO TONS) 145

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 145

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 146

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY,

-

THE MIDDLE EAST & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 147

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (USD MILLION) 148

-

NORTH AFRICA. Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 148

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 149

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 149

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 150

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 151

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 151

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 152

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 152

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 153

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 154

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 154

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 ( USD MILLION) 155

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 156

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (USD MILLION) 156

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 157

-

REST OF MIDDLE EAST & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032

-

(USD MILLION) 157

-

REST OF MIDDLE EAST & Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032

-

(KILO TONS) 158

-

REST OF MIDDLE EAST & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032

-

(USD MILLION) 159

-

REST OF MIDDLE EAST & Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032

-

(KILO TONS) 159

-

MERGER & ACQUISITION 161

-

AGREEMENTS 162

-

EXPANSION 162

-

INVESTMENTS 163

-

COLLABORATION 163

-

JOINT VENTURE 164

-

List Of Figures

-

MARKET SYNOPSIS 18

-

MARKET ATTRACTIVENESS ANALYSIS: GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 19

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE 19

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET ANALYSIS, END-USE INDUSTRY 20

-

Aluminum Flat Rolled Products Market, BY REGION 21

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET: MARKET STRUCTURE 23

-

KEY BUYING CRITERIA IN THE GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 23

-

NORTH AMERICA MARKET SIZE & Aluminum Flat Rolled Products Market, BY COUNTRY, (2023-2032) 24

-

EUROPE MARKET SIZE & Aluminum Flat Rolled Products Market, BY COUNTRY, (2023-2032) 24

-

ASIA-PACIFIC SIZE & Aluminum Flat Rolled Products Market, BY COUNTRY, (2023-2032) 25

-

LATIN AMERICA SIZE & Aluminum Flat Rolled Products Market, BY COUNTRY, (2023-2032) 25

-

MIDDLE EAST & AFRICA MARKET SIZE & Aluminum Flat Rolled Products Market, BY COUNTRY, (2023-2032) 26

-

RESEARCH PROCESS OF MRFR 27

-

TOP-DOWN & BOTTOM-UP APPROACH 30

-

MARKET DYNAMICS OVERVIEW 32

-

GLOBAL AUTOMOBILE PRODUCTION, MILLION UNITS (2023-2032) 33

-

GROWTH OF THE GLOBAL METAL PACKAGING INDUSTRY 34

-

DRIVERS IMPACT ANALYSIS 35

-

RESTRAINTS IMPACT ANALYSIS 36

-

GLOBAL SPENDING ON THE CONSTRUCTION INDUSTRY (2023-2032) 37

-

ALUMINUM PRICES, USD PER TON, (2023-2032) 37

-

SUPPLY CHAIN: GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 38

-

PORTER'S FIVE FORCES ANALYSIS OF THE GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET 40

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023 (% SHARE) 43

-

Aluminum Flat Rolled Products Market, BY PRODUCT TYPE, 2023-2032 (KILO TONS) 44

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023 (% SHARE) 55

-

Aluminum Flat Rolled Products Market, BY END-USE INDUSTRY, 2023-2032 (KILO TONS) 56

-

GLOBAL ALUMINUM FLAT-ROLLED PRODUCTS MARKET BY REGION, 2023-2032 (USD MILLION) 66

Leave a Comment