Aluminum Foil Packaging Size

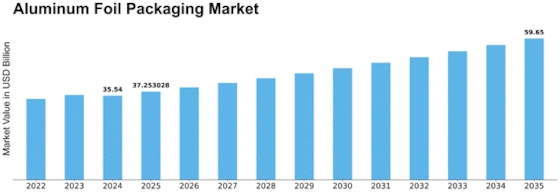

Aluminum Foil Packaging Market Growth Projections and Opportunities

The Aluminum Foil Packaging Market is affected by a number of various market factors that play significant role in determining its dynamics. One of these is the rising need for adaptable packaging solutions across different industries. This has led to substantial growth in the use of aluminum foil as food and beverage, pharmaceutical and other consumer goods due to its versatility, durability and excellent barrier properties. The increased demand results from this material’s ability to retain freshness, preserve quality, prolong shelf life and enhance overall product safety.

Additionally, sustainable packaging solutions have become critical factors in the aluminum foil packaging markets. Many companies are searching for greener options versus conventional packages due to ESG concerns being widely embraced among leading businesses. Furthermore, it is easily recyclable with least environmental effects compared to other substances used for similar reasons. Therefore, manufacturers have tapped into the sustainability aspects of aluminum foil towards meeting consumers’ needs and satisfying stricter regulations provided by regulatory bodies hence experiencing growth.

Another key driver relates to technological advancements taking place within this industry sector. Continuous manufacturing innovations coupled with advanced coatings on aluminium foil result in superior performance levels as well as more diverse areas where they can be applied. By so doing, makers can meet new user demands which then boost product attributes while gaining competitive advantage over rivals too.Additionally; printing advances support attractive labels that will make products more appealing thus driving up their popularity in these markets.

Aluminum foil packaging market is driven also by trade policies along with geopolitical factors.Trade wars or tariffs disruptions any political problems may impact supply chains thereby causing fluctuations in raw material prices and general instability within the industry’s ecosystem.This might happen when trade agreements or policies change dictating availability levels together with pricing rates for inputs such as aluminium foils amongst others into production processes.Also policy changes besides influencing cost of raw materials may lead to shortages through targeting certain countries producing them like China/Russia/Brazil according nature involved.Political risks must therefore be navigated by players who want to make informed decisions in a globally connected market.

Furthermore, consumer preferences and lifestyle changes continue to drive the demand for convenience and on-the-go packaging solutions thus positively influencing the aluminum foil packaging market. The rise in single-person households together with busy lifestyles and increased popularity of ready-to-eat meals have contributed towards this increased need for light, portable and disposable packages. It is these attributes that make aluminum foils preferred materials for packaging industries.

Leave a Comment