Market Share

Americas Cell Counting Market Share Analysis

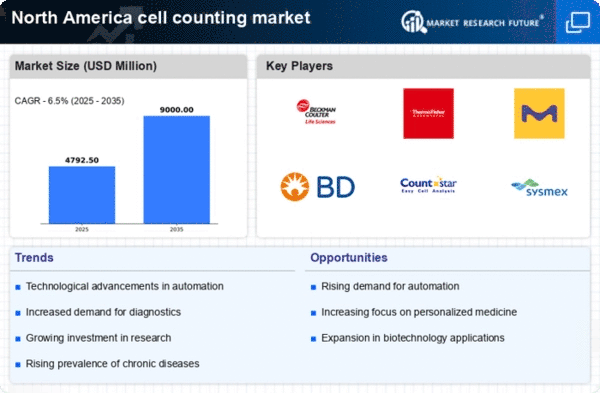

The Americas Cell Counting Market has a fundamental portion inside life sciences and medical care, and centers around giving careful and effective cell counting arrangements. Different vital methodologies are utilized by organizations to situate themselves well and gain an upper hand in this unique market. Expansion of utilizations is a critical methodology in the Americas Cell Counting Market. Organizations widen their item portfolios to take special care of different areas like drugs, biotechnology, research, and clinical diagnostics. Proposing flexible arrangements empowers them to catch a bigger market share and answer successfully to the remarkable requirements of various businesses. Laying out major areas of intensity for a presence through essential organizations and coordinated efforts is a typical methodology. By shaping unions with global wholesalers, research foundations, and key industry players, organizations grow their arrive at past territorial limits, accessing new markets and client bases. Importance in the market is frequently attached to offering smart arrangements without compromising quality. Organizations advance assembling processes, investigate economies of scale, and carry out effective store network management to convey reasonable cell counting items. This procedure requests to a more extensive scope of clients, incorporating those with financial plan requirements. As information driven approaches become more predominant, organizations center around advancement in information examination and availability highlights. Cell counting arrangements that proposition progressed information management, combination with research facility data frameworks, and similarity with computerized stages gain an upper hand, meeting the developing requirements of current labs. Viable marketing methodologies are significant for market share situating. Organizations put resources into making major areas of strength for a picture, underscoring unwavering quality, precision, and innovative predominance. Clear communication of the novel selling recommendations draws in new clients and builds up the brand dedication of existing ones. Staying up to date with arising patterns in cell counting is fundamental for supported achievement. Organizations proactively adjust to new procedures, for example, the reconciliation of artificial intelligence for image examination or the developing interest for compact and purpose in care cell counting gadgets. This flexibility guarantees organizations stay in front of market trends.

Leave a Comment