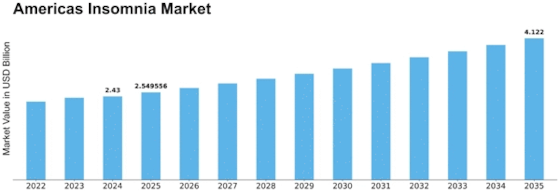

Americas Insomnia Size

Americas Insomnia Market Growth Projections and Opportunities

The Americas Insomnia market is significantly influenced by the prevalence and incidence rates of insomnia in the region. Insomnia, characterized by difficulty falling or staying asleep, is a common sleep disorder affecting a substantial portion of the population. The varying rates of insomnia contribute to the market's size and growth potential. Lifestyle conducts and the stress impact the quantity and magnitude of sleepless nights in the Americas. With modern-day habits, people usually experience high levels of stress, having irregular sleep-sleep patterns, and increased screen time which all work together in the developing as well as escalating of insomnia. The market adjusts to consumers' behavior and innovative lifestyles, considering the implications they have on sleep quality. Raise in public cognizance of sleep disorders, including insomnia, and the essence of obtaining medical assistance towards solving sleep-related afflictions, are the key driving power to this market. With a growing awareness of and anticipated subsequent solutions to sleep problems, the need for diagnostic tools, therapies, and medications will expand, which in turn will push the market for insomnia to grow. The continuous upgradation of sleep trackers and diagnostics technologies provides the basis for the transformation in the sleep industry. Wearable devices, portable homegoing spirometers and dynamic health platforms present people with the tools that allow them to record habits of sleep and tackle related problems when needed. The fact that the use of technology in the managing of insomnia has an impact on the market range is indisputable. The reputations of drug industries in the market of insomnia are dependent on the effectiveness of the drugs. Sleep aids being either prescribed by physicians or bought over the counter are the most common escape discussed by people experiencing sleep deprivation. Not only that but the patient group does change in response to the expansion of medicine offers which were various and tailored to insomnia subtypes. As non-pharmacological techniques such as CBT-I are becoming more prominent, the market of the said modalities is gradually expanding to include these kinds of approaches. The emphasis on behavior type interventions and lifestyle style modifications for developing insomnia adheres to the increasing inclination of non-drug choices. The market encompasses the demand for approaches that account for the treatment of insomnia in a comprehensive and all-encompassing manner. The market addresses the necessity of multi-faceted therapies, holistic treatment mechanisms that account for comprehensive strategies, and the treatment of sleeplessness.

Stringent regulatory standards and the approval process for sleep medications contribute to market dynamics. The regulatory environment shapes the availability and marketing of insomnia medications, influencing manufacturers' strategies and market entry. Compliance with regulatory standards is paramount for product success in the insomnia market. Public health initiatives aimed at promoting better sleep hygiene and educating the public about the consequences of untreated insomnia contribute to market factors. Increased awareness through educational campaigns influences individuals to seek timely intervention, impacting the overall market landscape for insomnia management.

Leave a Comment