Market Trends

Key Emerging Trends in the Anesthesia Drugs Market

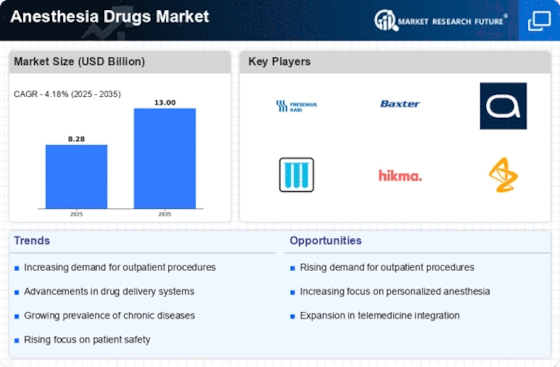

Factors affecting this industry shape its landscape thereby making it dynamic altogether. One key trend in this regard has been an increase in global requirements for Anaesthesia Services around the world. This rise in surgical cases alongside ageing worldwide populations has led to greater need for Anaesthesia Drugs. The medical industry continues to experience this surge due to advancement in medical technologies and consequently the rise of complicated surgeries.

The anesthesia drugs market is also impacted by the increasing emphasis on outpatient and ambulatory surgeries. Moreover, there is a noticeable trend towards the use of regional anesthesia techniques and multimodal analgesia. This allows surgeons to perform less invasive procedures with shorter recovery times resulting in rapid induction, minimal post operative complications. This corresponds with other efforts by healthcare stakeholders to cut down on health care costs through shorter hospital stays.

In addition to pharmaceutical R&D, there is a rise of interest in the inclusion of technology in anesthesia delivery and monitoring. The depth of anesthesia monitors and automated drug delivery systems are some of the integrated monitoring capabilities that are becoming part of modern operating rooms. This makes sure that efficiency, safety, and precision are improved in anesthetic management.

The market dynamics are also influenced by factors such as the increasing prevalence of chronic diseases and comorbidities. For example, patients with preexisting health conditions may need specialized anesthetic protocols thus necessitating development of drugs for use by specific patient populations. In a way, this shows a swing towards personalized therapy in the field of anesthesia. Furthermore, strategic partnerships and collaborations between pharmaceutical companies and healthcare organizations are evident in the market today. Such alliances intend to pool resources together, share knowledge base, hasten the development process as well as commercialization process for anesthesia drugs. These collaborative efforts underscore how intricate anesthesiology research is as well as demonstrating how important it is to synergize when addressing changing clinical needs. But despite these positive developments, challenges still exist in the markets for anesthetics. Drug shortages; tough regulatory requirements; complications linked to anesthetic administration remain among major threats facing this sector. On top of these issues is global economic situation and limitedness on healthcare budgets which may make it difficult for patients to afford or get access to such drugs especially within developing regions.

Leave a Comment