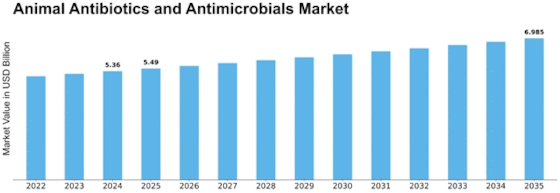

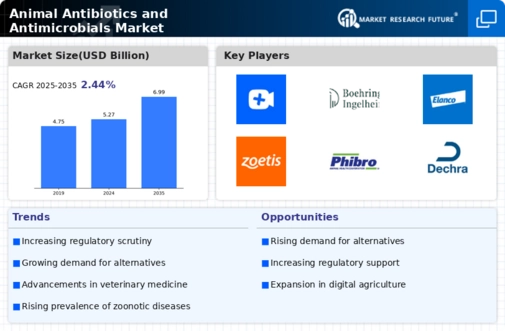

Animal Antibiotics And Antimicrobials Size

Animal Antibiotics and Antimicrobials Market Growth Projections and Opportunities

The market will grow 3.5% to USD billion by 2030. A few variables affect the Animal Antibiotics and Antimicrobials industry. Population growth and diet changes boost animal product demand. High demand for meat, milk, and other animal-derived products requires effective antibiotics and antimicrobials to keep animals healthy. Animal Antibiotics & Antimicrobials market relies on veterinary medicine industry innovation to develop and create new products. Novel antibiotics and antimicrobials, together with their practical and careful application, make animal health research competitive.

Administrative worries plague the Animal Antibiotics and Antimicrobials market. Administrative agencies are limiting animal antibiotic usage due to concerns about its impact on human health. To ensure moral and reasonable usage, animal product safety, and anti-infection resistance, drug companies selling innovative antibiotics and antimicrobials must follow these requirements.

Financial factors drive the Animal Antibiotics & Antimicrobials industry. Domesticated animal manufacturers weigh production costs, pay, and financial effect when using antibiotics and antimicrobials. Animal anti-toxin and antimicrobial use is affected by market demand, veterinarian medicine costs, and financial considerations.

Open education and education shape the Animal Antibiotics & Antimicrobials sector. Customers, ranchers, and controllers are better aware of anti-toxin blockage and safe microorganism transmission from animals to humans. Teaching partners about proper animal anti-toxin usage helps steers owners stay cautious. Veterinary and agricultural groups promote proactive and cost-effective animal health via mindfulness initiatives.

Innovative veterinarian medicine and diagnostics affect Animal Antibiotics and Antimicrobials. Rapid bacterial contamination testing and anti-microbial accuracy are signs of progress. Antibodies, probiotics, and prebiotics may replace antibiotics in some cases. These mechanical innovations aid animal medicine and antimicrobial resistance.

Leave a Comment