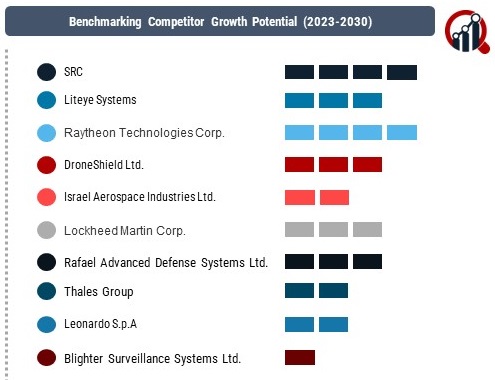

Top Industry Leaders in the Anti-Drone Market

Key Players

SRC (US)

Liteye Systems (US)

Raytheon Technologies Corp. (US)

DroneShield Ltd. (Australia)

Israel Aerospace Industries Ltd. (Israel)

Lockheed Martin Corp. (US)

Rafael Advanced Defense Systems Ltd. (Israel)

Thales Group (France)

Leonardo S.p.An (Italy)

Blighter Surveillance Systems Ltd. (UK)

Strategies Adopted

To stay ahead in the Anti-Drone market, companies employ a spectrum of strategies aligned with technological advancements and evolving threats. Innovation is a cornerstone, with key players investing heavily in research and development to enhance detection and mitigation capabilities. Raytheon Technologies, for instance, focuses on integrating artificial intelligence and machine learning into its systems for more accurate threat identification.

Strategic partnerships and collaborations are another crucial aspect of the competitive landscape. Lockheed Martin's collaboration with startups and technology companies demonstrates the industry's recognition of the need for diverse expertise to address the multifaceted nature of drone threats. Moreover, market leaders are engaging in mergers and acquisitions to consolidate their positions and acquire specialized capabilities. Northrop Grumman's acquisition of Orbital ATK is a notable example, highlighting the strategic importance of expanding technological capabilities.

Factors for Market Share Analysis

Several factors contribute to the analysis of market share within the Anti-Drone sector. Technological prowess, demonstrated through the effectiveness of detection and mitigation solutions, is a primary determinant. Companies with cutting-edge technologies that can adapt to a variety of drone threats and scenarios are more likely to capture a significant market share.

Global reach and partnerships with defense and security agencies worldwide also play a pivotal role. Companies that establish themselves as reliable and preferred suppliers for governments and critical infrastructure entities enhance their market share. Reputation and past performance in delivering successful counter-drone solutions contribute to building trust among clients, influencing their decision-making processes.

The ability to provide comprehensive solutions is a distinguishing factor. Market leaders offer end-to-end capabilities, from early detection and tracking to mitigation and neutralization, providing clients with integrated security solutions. This holistic approach not only ensures a broader market appeal but also positions companies as comprehensive security partners.

New and Emerging Companies

The Anti-Drone market is witnessing the emergence of new and specialized companies that focus exclusively on countering drone threats. Citadel Defense, for instance, has gained attention for its advanced mitigation systems and adaptability to various environments. Emerging companies often bring agility and niche expertise, challenging established players to stay innovative and responsive to evolving threats.

DroneShield, another noteworthy entrant, specializes in acoustic detection and has demonstrated success in deploying its solutions for critical infrastructure protection. These emerging companies contribute to the diversity of the competitive landscape, offering specific solutions that cater to unique challenges posed by drones.

Industry News

Staying abreast of industry news is essential to understanding the competitive dynamics of the Anti-Drone market. Recent developments include the integration of anti-drone technologies into broader defense systems, reflecting the recognition of drones as a significant security concern. Additionally, collaborations between governments and private entities to establish regulatory frameworks for counter-drone measures signal the increasing importance of this market in the overall security landscape.

The use of artificial intelligence and machine learning algorithms for more sophisticated threat detection is a prevalent theme in recent news. Companies are continuously refining their technologies to differentiate themselves in a market where staying ahead of emerging threats is imperative. Furthermore, the Anti-Drone market is closely tied to advancements in drone technology itself, creating a dynamic interplay between offensive and defensive capabilities.

Current Company Investment Trends

Investment trends within the Anti-Drone market underscore the industry's commitment to innovation and growth. Companies are allocating significant resources to research and development, aiming to enhance their technological capabilities. Investment in artificial intelligence, machine learning, and sensor technologies is particularly prominent, reflecting the industry's recognition of the need for advanced and adaptive solutions.

Strategic partnerships and collaborations with technology startups are on the rise, allowing established companies to tap into the agility and creativity of emerging players. Moreover, companies are investing in global expansion, establishing a strong presence in regions where the drone threat is more pronounced. This geographical diversification not only broadens market reach but also ensures a more comprehensive understanding of regional threats and challenges.

Overall Competitive Scenario

the Anti-Drone market is marked by the presence of key players with global reach, innovative strategies, and a commitment to technological excellence. The competitive landscape is enriched by emerging companies that bring agility and niche expertise to address specific challenges. Factors such as technological prowess, global partnerships, and comprehensive solutions contribute to market share analysis.

Industry news reflects the evolving nature of drone threats and the industry's response to emerging challenges. Current investment trends emphasize the importance of innovation, with a focus on artificial intelligence, machine learning, and strategic collaborations. As the Anti-Drone market continues to evolve, companies that can balance technological innovation with strategic partnerships and a comprehens

Recent News

DroneShield Ltd (DRO.AX)

Secured a multi-million dollar contract with the U.S. Army to deploy their signature "Dronebuster" system for base defense, showcasing its effectiveness against rogue drones.

Launched a new counter-drone platform leveraging satellite communication for global drone detection and disruption, expanding their operational reach.

Leonardo S.p.A. (LEODO)

Unveiled a multi-layered anti-drone defense system integrating radars, jammers, and laser technology, providing comprehensive protection against diverse UAV threats.

Partnered with a leading research institute to develop AI-powered counter-drone algorithms for faster threat identification and automated mitigation.

Raytheon Technologies Corp. (RTX)

Successfully tested their high-powered laser weapon capable of disabling drones at long distances, marking a significant advancement in non-kinetic counter-drone solutions.

Developed a portable anti-drone system targeting critical infrastructure protection and law enforcement applications.

Lockheed Martin Corp. (LMT)

Won a contract with the U.S. Navy to integrate their Skyfire counter-drone system onto warships, bolstering maritime defense capabilities.

Collaborating with a tech startup to explore counter-drone applications of quantum radar technology, aiming for enhanced detection and tracking of stealthy drones.