Anti-Drone Market Summary

As per Market Research Future analysis, the Anti-Drone Market Size was estimated at 0.6875 USD Billion in 2024. The Anti-Drone industry is projected to grow from USD 0.8594 Billion in 2025 to USD 8.004 Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 25.0% during the forecast period 2025 - 2035

Key Market Trends & Highlights

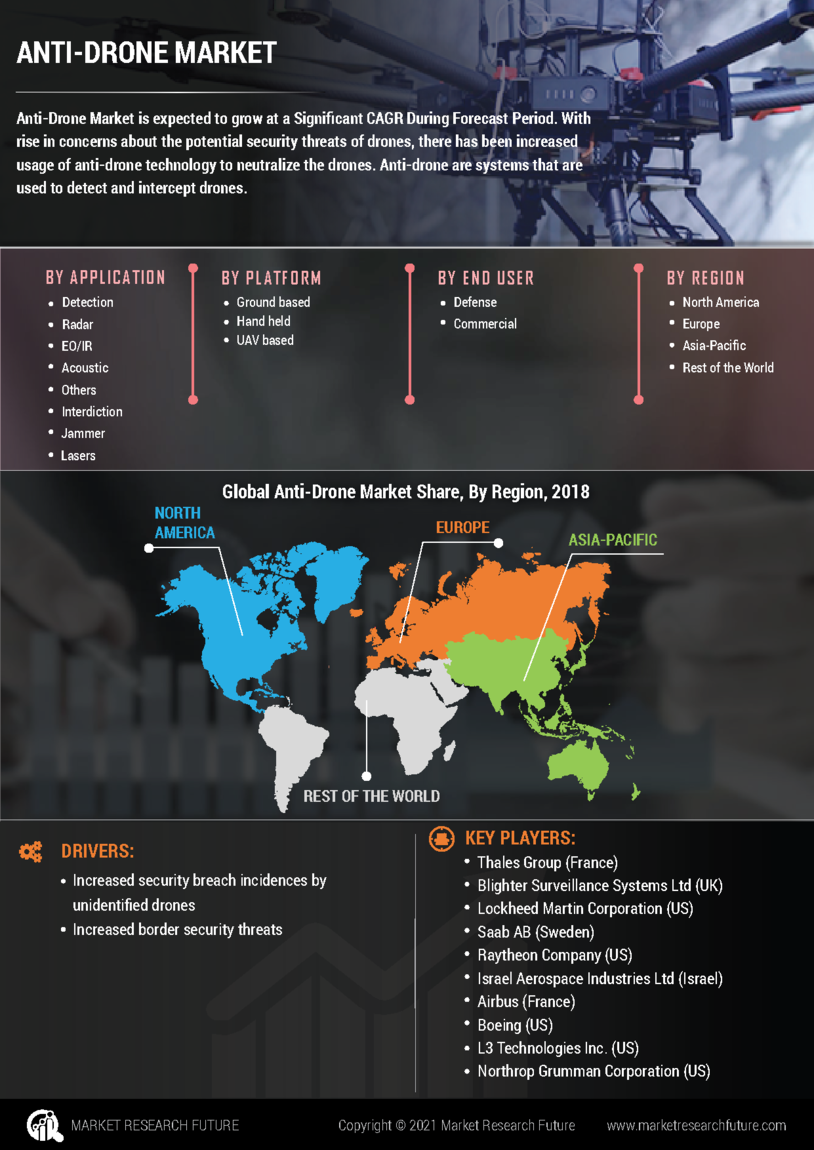

The Anti Drone Market is poised for substantial growth driven by technological advancements and increasing security concerns.

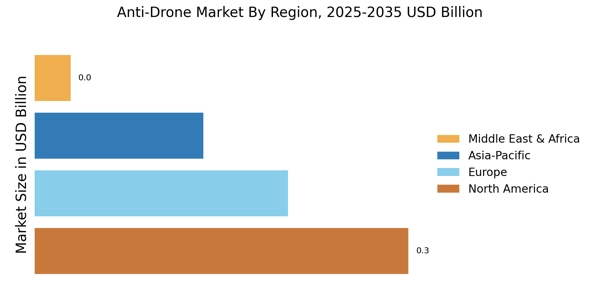

- North America remains the largest market for anti-drone solutions, reflecting a robust demand for security technologies.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization and rising drone usage.

- Detection radar systems dominate the market, while EO/IR technologies are witnessing the fastest growth due to their enhanced surveillance capabilities.

- Rising security concerns and increased investment in defense are key drivers propelling the anti drone market forward.

Market Size & Forecast

| 2024 Market Size | 0.6875 (USD Billion) |

| 2035 Market Size | 8.004 (USD Billion) |

| CAGR (2025 - 2035) | 25.0% |

Major Players

Lockheed Martin (US), Northrop Grumman (US), Raytheon Technologies (US), BAE Systems (GB), Thales Group (FR), Leonardo (IT), DroneShield (AU), Dedrone (US), Airbus (DE)