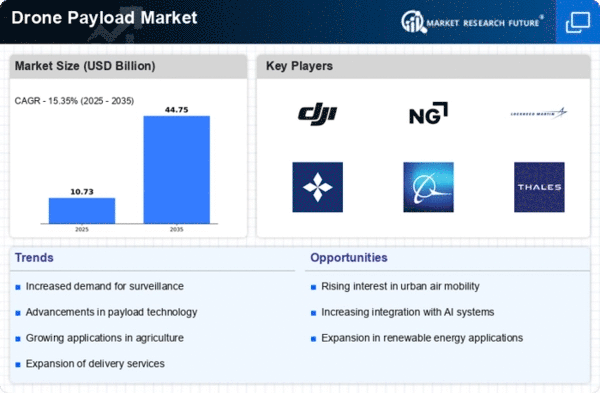

Drone Payload Market Summary

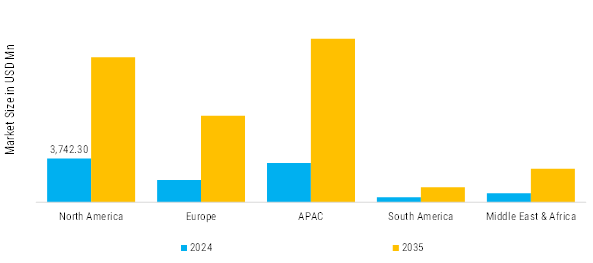

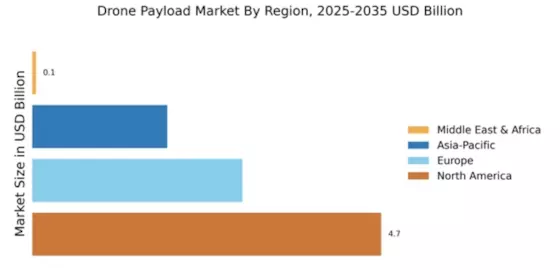

As per MRFR analysis, Drone Payload Market Size was valued at USD 10,235.9 Million in 2024. The Drone Payload Industry is projected to grow from USD 12,494.5 Million in 2025 to USD 38,030.2 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 11.8% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Drone Payload Market is rapidly evolving, driven by advancements in UAV technology, AI integration, and expanding applications across defense, commercial, and industrial sectors.

- AI-powered payloads are transforming drones into intelligent systems capable of real-time decision-making.

- Edge computing within payloads processes data onboard, reducing latency for applications like object detection in surveillance or crop health analysis in agriculture.

- Drone delivery payloads are a high-growth segment, fueled by e-commerce giants investing in autonomous logistics. Specialized compartments with secure release mechanisms handle medical supplies, groceries, and parcels, addressing urban congestion challenges.

- Military payloads remain the largest share, focusing on electro-optical/infrared (EO/IR) sensors, radars, and electronic warfare suites for ISR missions.

Market Size & Forecast

| 2024 Market Size | 10,235.9 (USD Million) |

| 2035 Market Size | 38,030.2 (USD Million) |

| CAGR (2025 - 2035) | 11.8% |

Major Players

AeroVironment Inc, Draganfly Inc, Elbit Systems Ltd, Northrop Grumman Corporation, Parrot SA, Israel Aerospace Industries Ltd, DJI Technology, AeroVironment Inc, Autel Robotics, Teledyne FLIR LLC.