Growing Adoption in Agriculture

The agricultural sector's increasing adoption of UAVs for precision farming is a key driver for the UAV Payload-Subsystems Market. UAVs equipped with specialized payloads, such as crop health monitoring sensors and aerial imaging systems, enable farmers to optimize yields and reduce resource wastage. In 2025, the agricultural UAV market is anticipated to surpass $1.5 billion, with a significant portion attributed to the demand for advanced payload subsystems. This trend underscores the potential of UAVs to revolutionize agricultural practices, thereby contributing to the expansion of the uav payload-subsystems market.

Expansion of Commercial Applications

The expansion of commercial applications for UAVs is a significant driver of the UAV Payload-Subsystems Market. Industries such as logistics, construction, and telecommunications are increasingly utilizing UAVs for tasks like delivery, site surveying, and infrastructure inspection. This trend is expected to propel the market, with commercial UAV applications projected to account for over 30% of the total market share by 2025. The versatility of UAVs in various commercial sectors highlights their potential to transform traditional business operations, thereby driving demand for advanced payload subsystems.

Emergence of Advanced Sensor Technologies

The UAV Payload-Subsystems Market is significantly influenced by the emergence of advanced sensor technologies, which enhance the operational capabilities of UAVs. Innovations in LiDAR, thermal imaging, and multispectral sensors allow for more precise data collection and analysis. As of 2025, the market for UAV sensors is expected to account for nearly 40% of the overall uav payload-subsystems market, indicating a robust growth trajectory. These advancements not only improve the effectiveness of UAVs in various applications but also attract investments from both public and private sectors, further stimulating market growth.

Rising Investment in Research and Development

Investment in research and development (R&D) within the UAV Payload-Subsystems Market is on the rise, driven by the need for innovative solutions and enhanced performance. Government agencies and private companies are allocating substantial funds to develop next-generation UAV technologies, including improved payload capabilities and autonomous systems. In 2025, R&D spending in this sector is projected to reach approximately $500 million, reflecting a growing recognition of the strategic importance of UAVs. This influx of investment is likely to accelerate technological advancements, thereby fostering growth in the uav payload-subsystems market.

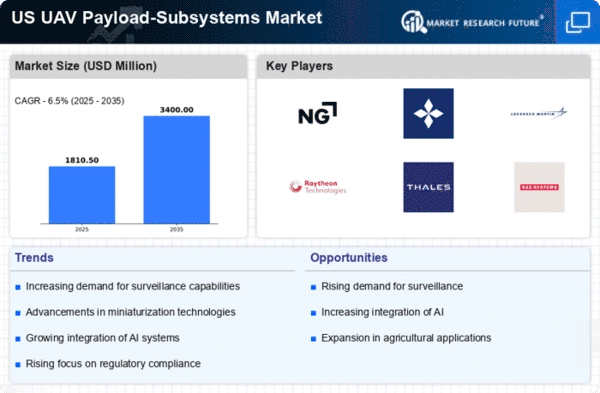

Increased Demand for Surveillance Applications

The UAV Payload-Subsystems Market experiences heightened demand due to the growing need for surveillance applications across various sectors, including defense, law enforcement, and border security. The integration of advanced sensors and imaging technologies into UAVs enhances their capabilities, making them indispensable for real-time monitoring and reconnaissance. In 2025, the market for UAV surveillance systems is projected to reach approximately $3 billion, reflecting a compound annual growth rate (CAGR) of around 15%. This surge is driven by the increasing emphasis on national security and the need for efficient surveillance solutions, thereby propelling the uav payload-subsystems market forward.