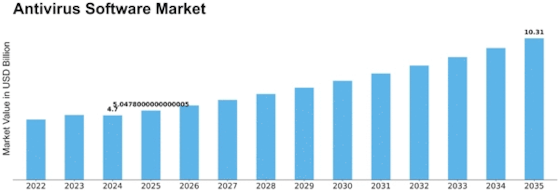

Antivirus Software Size

Antivirus Software Market Growth Projections and Opportunities

The antivirus software market is influenced by many factors that collectively shape its dynamics and growth trajectory. One crucial market factor is the ever-evolving landscape of cyber threats. As cyber criminals continually develop sophisticated techniques, the demand for advanced antivirus solutions rises in tandem. The increasing occurrences and complexity of malware attacks drive individuals and organizations to seek robust protective measures, stimulating market growth. Moreover, the proliferation of digital devices significantly expands the antivirus software market. With the widespread use of smartphones, tablets, and other internet-connected devices, the attack surface for cyber threats has expanded exponentially. Consumers and businesses recognize the necessity of safeguarding these devices, fostering a continuous demand for antivirus solutions to secure diverse platforms.

The regulatory environment is fundamental in shaping the antivirus software market. Governments and regulatory bodies increasingly emphasize cybersecurity to protect sensitive information and critical infrastructure. Compliance requirements drive organizations to invest in comprehensive antivirus solutions to meet regulatory standards, propelling market growth. Technological advancements and innovations constitute another influential factor. As antivirus vendors leverage artificial intelligence, machine learning, and behavioral analytics, the efficacy of antivirus software improves. The ability to proactively identify and mitigate emerging threats enhances the overall value proposition of these solutions, attracting consumers and organizations seeking cutting-edge protection. Market consolidation and competition contribute to the market's landscape. The industry witnesses mergers and acquisitions as established players aim to strengthen their portfolios and expand their market share. This consolidation often results in the developing of more comprehensive antivirus suites, offering a broader range of security features. Simultaneously, emerging players entering the market with innovative solutions intensify competition, driving continuous improvement and pushing established vendors to stay at the forefront of technological advancements. Consumer awareness and education also significantly impact the antivirus software market. As individuals become more informed about the risks associated with online activities, the demand for reliable antivirus protection grows.

Antivirus vendors invest in marketing and educational campaigns to communicate the importance of cybersecurity, fostering a culture of proactive threat prevention. Economic factors influence purchasing decisions within the antivirus software market. Organizations may allocate budgets for cybersecurity measures based on their financial health and economic conditions. During periods of economic growth, businesses will invest more in robust security solutions. On the flip side, economic downturns may lead to more cautious spending, affecting the market dynamics. Global events and geopolitical factors can have far-reaching effects on the antivirus software market. Cybersecurity threats often intensify during geopolitical tension, prompting increased awareness and investment in protective measures. Additionally, the interconnected nature of the global economy means that events in a region can have ripple effects on the cybersecurity landscape worldwide.

Leave a Comment