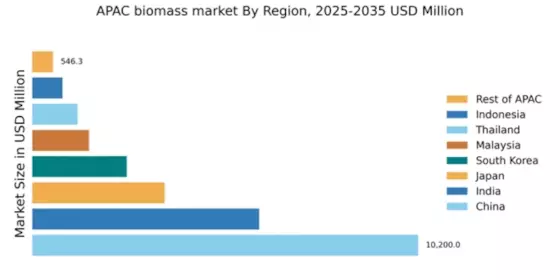

China : China's Robust Growth and Demand

China holds a commanding market share of 45.5% in the APAC biomass sector, valued at $10,200.0 million. Key growth drivers include government initiatives promoting renewable energy, increasing industrial demand, and a shift towards sustainable practices. The country is witnessing a surge in biomass consumption, particularly in urban areas, supported by favorable regulatory policies and significant investments in infrastructure development, such as biomass power plants and logistics networks.

India : India's Sustainable Energy Transition

India accounts for 27.3% of the APAC biomass market, valued at $6,000.0 million. The growth is driven by increasing energy demands, government incentives for renewable energy, and a focus on rural electrification. Biomass consumption is rising, particularly in agricultural regions, as farmers seek alternative income sources. Regulatory frameworks, such as the National Biofuel Policy, are fostering a conducive environment for biomass energy development.

Japan : Japan's Technological Advancements

Japan holds a 15.9% share of the APAC biomass market, valued at $3,500.0 million. The market is propelled by technological innovations in biomass conversion and a strong governmental push for energy diversification. Demand is particularly high in urban centers like Tokyo and Osaka, where biomass is integrated into waste management systems. The competitive landscape features both domestic and international players, focusing on advanced biomass technologies and sustainable practices.

South Korea : South Korea's Energy Security Focus

South Korea represents 10.9% of the APAC biomass market, valued at $2,500.0 million. The growth is fueled by strategic investments in renewable energy to enhance energy security and reduce carbon emissions. Demand is increasing in industrial sectors, particularly in cities like Busan and Incheon. Major players, including local firms and international companies, are actively participating in the market, supported by government policies promoting biomass energy.

Malaysia : Malaysia's Green Energy Initiatives

Malaysia captures 6.8% of the APAC biomass market, valued at $1,500.0 million. The market is driven by government initiatives aimed at promoting sustainable energy and reducing reliance on fossil fuels. Demand is growing in the palm oil sector, where biomass waste is increasingly utilized. Key regions include Selangor and Penang, where local companies are collaborating with international players to enhance biomass production and utilization.

Thailand : Thailand's Renewable Energy Goals

Thailand holds a 4.5% share of the APAC biomass market, valued at $1,200.0 million. The growth is supported by national policies aimed at increasing renewable energy contributions to the energy mix. Demand is particularly strong in agricultural areas, where biomass is used for energy generation. The competitive landscape includes both local and foreign companies, with a focus on sustainable practices and innovative biomass technologies.

Indonesia : Indonesia's Resource Utilization Focus

Indonesia accounts for 2.9% of the APAC biomass market, valued at $800.0 million. The market is driven by the need for energy diversification and the utilization of agricultural waste. Demand is rising in regions like Java and Sumatra, where biomass is increasingly seen as a viable energy source. The competitive landscape features local players and international firms, with a focus on sustainable biomass production and energy generation.

Rest of APAC : Regional Variations in Biomass Use

The Rest of APAC represents a small segment of the biomass market, valued at $546.3 million. Growth is driven by varying local policies and energy needs across countries. Demand trends are influenced by agricultural practices and local energy requirements. The competitive landscape is fragmented, with numerous small players focusing on niche markets and sustainable biomass solutions tailored to local conditions.

Leave a Comment