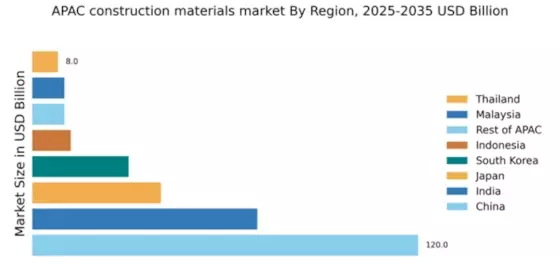

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 120.0, representing a significant portion of the APAC construction materials market. Key growth drivers include rapid urbanization, government-backed infrastructure projects, and a booming real estate sector. Demand trends indicate a shift towards sustainable materials, supported by regulatory policies aimed at reducing carbon emissions. The government has initiated several large-scale infrastructure projects, enhancing industrial development and boosting consumption patterns.

India : Infrastructure Boom Fuels Growth

India's construction materials market is valued at 70.0, driven by a robust demand for housing and infrastructure development. Key growth drivers include government initiatives like the Pradhan Mantri Awas Yojana, which aims to provide affordable housing. The consumption pattern is shifting towards eco-friendly materials, influenced by regulatory policies promoting sustainability. The ongoing infrastructure projects, such as highways and smart cities, are pivotal in shaping market dynamics.

Japan : Innovation Meets Tradition in Construction

Japan's construction materials market is valued at 40.0, characterized by a stable demand driven by ongoing urban redevelopment and disaster-resistant construction. Key growth drivers include government policies focused on earthquake-resistant infrastructure and energy-efficient buildings. The consumption pattern reflects a preference for high-quality materials, influenced by stringent regulations. The market is also adapting to an aging population, necessitating innovative construction solutions.

South Korea : Smart Solutions for Modern Needs

South Korea's market, valued at 30.0, is propelled by technological advancements and a focus on smart city initiatives. Key growth drivers include government investments in infrastructure and a rising demand for sustainable construction materials. The consumption pattern is increasingly leaning towards high-tech solutions, supported by regulatory frameworks promoting innovation. The competitive landscape features major players like LafargeHolcim and local firms specializing in advanced materials.

Malaysia : Infrastructure Development on the Rise

Malaysia's construction materials market is valued at 10.0, with growth driven by government initiatives aimed at enhancing infrastructure. Key projects include the Pan Borneo Highway and urban transit systems, which are boosting demand for construction materials. The consumption pattern is evolving towards sustainable options, influenced by regulatory policies. The competitive landscape includes both local and international players, with a focus on quality and innovation.

Thailand : Balancing Development and Sustainability

Thailand's market, valued at 8.0, is experiencing steady growth driven by infrastructure projects and tourism development. Key growth drivers include government policies promoting sustainable construction and urbanization. The consumption pattern reflects a demand for eco-friendly materials, influenced by regulatory frameworks. Key cities like Bangkok and Chiang Mai are pivotal markets, with major players like Siam Cement Group leading the competitive landscape.

Indonesia : Infrastructure Needs Drive Consumption

Indonesia's construction materials market is valued at 12.0, with growth fueled by a rising demand for housing and infrastructure. Key growth drivers include government initiatives aimed at improving connectivity and urban development. The consumption pattern is shifting towards sustainable materials, influenced by regulatory policies. Major cities like Jakarta and Surabaya are key markets, with a competitive landscape featuring both local and international players.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC construction materials market is valued at 10.0, characterized by diverse growth patterns influenced by local economic conditions. Key growth drivers include infrastructure development and urbanization in emerging markets. The consumption pattern varies significantly, with some regions focusing on traditional materials while others embrace innovation. The competitive landscape includes a mix of local and international players, adapting to regional demands.