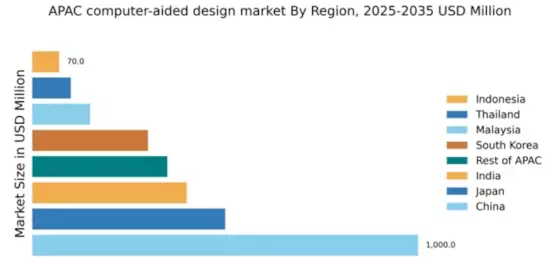

China : Unmatched Growth and Innovation

China holds a commanding 40% market share in the APAC CAD market, valued at $1000.0 million. Key growth drivers include rapid industrialization, increased investment in infrastructure, and a booming manufacturing sector. The demand for advanced design software is fueled by the government's push for smart manufacturing and digital transformation initiatives. Regulatory policies favoring technology adoption further enhance market potential, while significant infrastructure projects create a robust demand for CAD solutions.

India : Rapid Growth in Design Solutions

India accounts for an 8% market share, valued at $400.0 million in the CAD sector. The growth is driven by the expanding IT and engineering services industry, alongside increasing adoption of CAD tools in sectors like automotive and construction. Government initiatives like 'Make in India' promote local manufacturing, enhancing demand for CAD solutions. The rise of startups and tech hubs in cities like Bengaluru and Hyderabad further fuels consumption patterns.

Japan : Precision and Quality in Design

Japan holds a 10% market share, valued at $500.0 million, characterized by a strong emphasis on precision engineering and quality. The growth is driven by advancements in robotics and automation, with CAD tools being integral to these sectors. Government policies supporting R&D in technology and manufacturing bolster market demand. The aging population also drives innovation in healthcare design applications, creating new opportunities for CAD solutions.

South Korea : Tech-Driven Design Solutions

South Korea captures a 6% market share, valued at $300.0 million, with a focus on high-tech industries such as electronics and automotive. The growth is propelled by strong government support for technology innovation and smart city initiatives. Demand for CAD solutions is rising in urban development projects, with cities like Seoul leading the charge. Major players like Samsung and LG are significant users of CAD tools, enhancing the competitive landscape.

Malaysia : Strategic Location for Design Firms

Malaysia holds a 3% market share, valued at $150.0 million, with growth driven by the expanding manufacturing sector and government initiatives to attract foreign investment. The demand for CAD solutions is increasing in industries such as construction and electronics. The government's focus on developing the digital economy supports infrastructure improvements, enhancing the business environment for CAD providers. Key markets include Kuala Lumpur and Penang, which are tech hubs.

Thailand : Manufacturing and Design Synergy

Thailand accounts for a 2% market share, valued at $100.0 million, with growth driven by the automotive and electronics sectors. The government’s 'Thailand 4.0' initiative promotes innovation and technology adoption, boosting demand for CAD solutions. Key cities like Bangkok and Chonburi are central to this growth, with a competitive landscape featuring both local and international players. The focus on smart manufacturing enhances the local business environment.

Indonesia : Investment in Infrastructure Development

Indonesia holds a 1.4% market share, valued at $70.0 million, with growth driven by significant investments in infrastructure and urban development. The demand for CAD solutions is increasing in construction and manufacturing sectors, supported by government initiatives to improve connectivity and industrial capabilities. Key markets include Jakarta and Surabaya, where local players are emerging alongside international firms, creating a competitive landscape.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for a 7% market share, valued at $350.0 million, with diverse growth driven by varying industrial needs. Countries like Vietnam and the Philippines are witnessing increased CAD adoption in manufacturing and construction. Government policies promoting technology and infrastructure development enhance market potential. The competitive landscape features both local and international players, catering to sector-specific applications across the region.