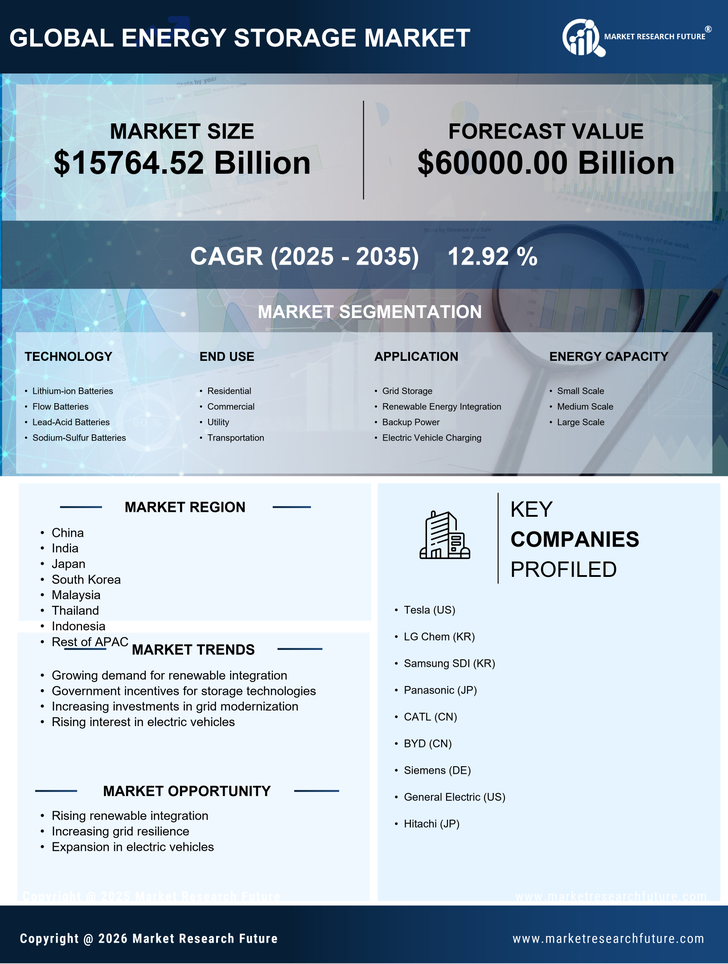

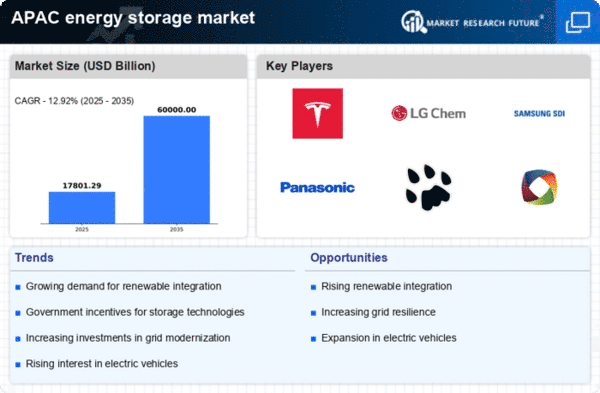

China : Unmatched Growth and Innovation

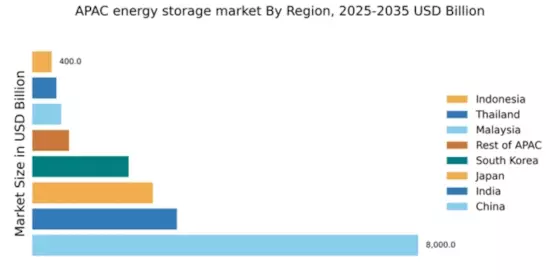

China holds a staggering 55% market share in the APAC energy storage sector, valued at $8000.0 million. Key growth drivers include government initiatives promoting renewable energy, significant investments in infrastructure, and a booming electric vehicle market. Demand trends indicate a shift towards large-scale battery storage solutions, driven by industrial applications and urbanization. Regulatory policies, such as the 14th Five-Year Plan, emphasize energy transition and sustainability, further bolstering market growth.

India : Government Support Fuels Growth

India's energy storage market is valued at $3000.0 million, capturing 20% of the APAC share. The growth is propelled by government initiatives like the National Energy Storage Mission, aimed at enhancing grid stability and renewable integration. Demand is rising in urban areas, particularly for solar energy storage solutions. The government is also incentivizing local manufacturing through production-linked incentives, fostering a conducive environment for investment and innovation.

Japan : Focus on Sustainability and Efficiency

Japan's energy storage market, valued at $2500.0 million, accounts for 16% of the APAC market. The country is witnessing a surge in demand for advanced battery technologies, driven by the need for energy resilience post-Fukushima. Government policies, such as the Strategic Energy Plan, promote renewable energy and energy efficiency. The market is characterized by a strong focus on R&D, with significant investments in lithium-ion and solid-state batteries.

South Korea : Leading in Battery Innovation

South Korea's energy storage market is valued at $2000.0 million, representing 13% of the APAC share. The growth is fueled by the government's Green New Deal, which aims to increase renewable energy adoption. Demand is particularly strong in urban centers like Seoul, where energy storage systems are integrated into smart grids. Major players like LG Chem and Samsung SDI dominate the landscape, focusing on innovative battery solutions for various applications.

Malaysia : Government Initiatives Spark Interest

Malaysia's energy storage market is valued at $600.0 million, capturing 4% of the APAC market. The government is actively promoting renewable energy through policies like the Renewable Energy Act, which encourages investment in energy storage technologies. Demand is growing in sectors such as commercial and industrial applications, where energy efficiency is a priority. The market is still developing, with opportunities for local and international players to establish a foothold.

Thailand : Focus on Renewable Integration

Thailand's energy storage market is valued at $500.0 million, accounting for 3% of the APAC share. The government is pushing for renewable energy integration through initiatives like the Power Development Plan, which emphasizes energy storage systems. Demand is rising in urban areas, particularly for solar energy storage. The competitive landscape includes local firms and international players, with a focus on innovative solutions for residential and commercial sectors.

Indonesia : Focus on Infrastructure Development

Indonesia's energy storage market is valued at $400.0 million, representing 2.5% of the APAC market. The growth is driven by increasing energy demand and government initiatives aimed at enhancing energy access. Key cities like Jakarta are witnessing rising interest in energy storage solutions, particularly for off-grid applications. The market is characterized by a mix of local and international players, with opportunities in renewable energy integration and industrial applications.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC energy storage market is valued at $764.52 million, accounting for 5% of the overall market. This sub-region includes diverse markets with varying growth drivers, such as regulatory support for renewable energy in Vietnam and emerging demand in the Philippines. The competitive landscape features both local and international players, with a focus on tailored solutions for specific regional needs. Opportunities exist in sectors like agriculture and telecommunications, where energy storage can enhance efficiency.