Global API Contract Manufacturing Market Overview

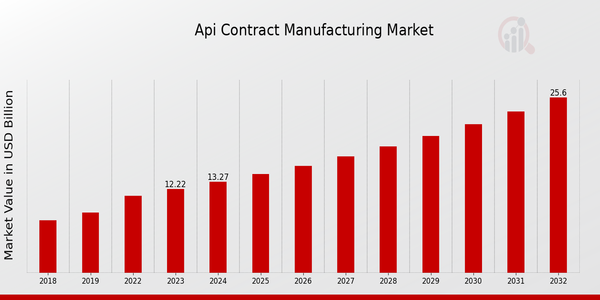

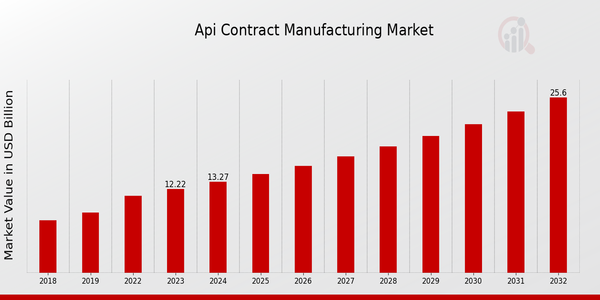

As per MRFR analysis, the API contract manufacturing market size was estimated at 7.46 (USD Billion) in 2023.

The API contract manufacturing market industry is expected to grow from 8.04 (USD Billion) in 2024 to 13.43 (USD Billion) by 2032. The API contract manufacturing market CAGR (growth rate) is expected to be around 5.87% during the forecast period (2024-2032).

Key API Contract Manufacturing Market Trends Highlighted

The rising demand for complex and specialized APIs, coupled with the increasing complexity of drug development, is driving the growth of the global API contract manufacturing market. Contract manufacturers offer a range of services, including process development, scale-up, and GMP manufacturing, enabling pharmaceutical companies to access specialized capabilities and reduce their capital investments.

The need for efficient and cost-effective API manufacturing is also a key driver, as pharmaceutical companies seek to streamline their operations and optimize costs. Contract manufacturers provide access to cutting-edge technologies and expertise, allowing companies to improve their manufacturing processes and meet regulatory requirements. Additionally, the growing emphasis on personalized medicine and the development of biologics is creating new opportunities for contract manufacturers.

Source: Primary Research, Secondary Research, MRFR Database and Analyst Review

API Contract Manufacturing Market Drivers

Growing Demand for Personalized Medicines

The growing demand for personalized medicines is one of the primary drivers of the global API contract manufacturing market. With the capacity to produce medications that are ideally suited to a patient’s individual genetic makeup, the possible uses are extensive and could result in enhanced treatment outcomes and fewer side effects. Contract manufacturing entities can take advantage of increased demand for these customized treatments due to their specialized knowledge and necessary facilities.

Increasing Complexity of APIs

One more important driver of the API contract manufacturing market is an increasing complexity of APIs. There is a rise in complexities of APIs in terms of their chemical structure and the way they are manufactured. For pharmaceutical companies, it often becomes hard to produce APIs in-house.

As the complexity of the APIs grows, the demand for contract manufacturing services increases. The main reason for it is that contract manufacturers have the requisite equipment and experience that permit producing each type of APIs on time and within the budget.

Outsourcing of API Manufacturing

The third major driver of the global API contract manufacturing market is the outsourcing of API manufacturing. Many pharmaceutical companies are increasingly outsourcing the manufacturing of their APIs to contract manufacturers to leverage their specialized expertise and reduce the cost.

This allows the pharmaceutical companies to focus on their core competencies while contract manufacturers can provide them with large economies of scale. As a result, outsourcing the API manufacturing has become a viable option for pharma companies.

API Contract Manufacturing Market Segment Insights

API Contract Manufacturing Market API Type Insights

Based on API type, the API contract manufacturing market is classified into recombinant proteins, viral vectors, plasmid DNA, and synthetic peptides. Among these, the recombinant proteins segment held a significant market share in 2023 and is anticipated to maintain its dominance throughout the forecast period.

Recombinant proteins are in high demand due to their extensive applications in the development of therapeutic drugs, vaccines, and diagnostics. The growing prevalence of chronic diseases and the increasing need for personalized medicine are key factors driving the growth of this segment.

Viral vectors, another crucial segment, is expected to witness substantial growth over the next ten years. Viral vectors are used to deliver genetic material into cells for gene therapy and vaccine development. The rising incidence of genetic disorders and the advancements in gene editing technologies are propelling the growth of this segment.

Plasmid DNA, which plays a vital role in gene therapy and DNA vaccines, is also expected to contribute significantly to the overall market growth. The increasing demand for gene-based therapies and the growing focus on personalized medicine are key factors driving the expansion of this segment.

Synthetic peptides, used in the development of peptide-based drugs and vaccines, represent a niche but rapidly growing segment. The rising prevalence of autoimmune diseases and the increasing adoption of peptide-based therapies are contributing to the growth of this segment.

Overall, the API type segment is poised for robust growth in the coming years, driven by the increasing demand for advanced therapies, personalized medicine, and the growing prevalence of chronic diseases. The market is expected to witness significant investments in research and development, leading to the introduction of innovative API manufacturing technologies and novel therapeutic applications.

Global API Contract Manufacturing Market, by API Type 2023 & 2032 (USD Billion)

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

API Contract Manufacturing Market Application Insights

By application, the API contract manufacturing market is segmented into therapeutics, diagnostics, and research tools. Therapeutics is the largest segment, accounting for over 55% revenue in 2023. This is due to the increasing demand for new and effective therapies for various diseases, such as cancer, cardiovascular diseases, and neurological disorders.

The diagnostics segment is expected to grow at a CAGR of 8.5% during the forecast period, driven by the rising demand for accurate and timely diagnostics tests. The research tools segment is also expected to witness significant growth, owing to the increasing investment in research and development activities in the pharmaceutical and biotechnology industries.

API Contract Manufacturing Market End-User Insights

By end-user, the API contract manufacturing market is classified into pharmaceutical companies, biotechnology companies, and academic institutions. Pharmaceutical companies held the largest market share in 2023, accounting for nearly 60% of the global market revenue.

This dominance is attributed to the increasing demand for outsourced API manufacturing services from pharmaceutical companies due to factors such as cost optimization, focus on core competencies, and access to specialized expertise and technologies.

Biotechnology companies are also expected to contribute significantly to the market growth, owing to the rising demand for biologics and the need for specialized manufacturing capabilities. Academic Institutions, though holding a smaller market share, play a crucial role in API development and research, often collaborating with pharmaceutical and biotechnology companies to advance drug discovery and innovation.

API Contract Manufacturing Market Business Model Insights

The global API contract manufacturing market is segmented based on business model into fee-for-service, royalty-based, and hybrid. In 2023, the fee-for-service model dominated the market, accounting for over 60% of the total API contract manufacturing market revenue. This dominance is attributed to the flexibility and transparency it offers to both clients and manufacturers.

The royalty-based model is expected to witness significant growth over the forecast period, owing to the increasing adoption of innovative technologies and therapies by pharmaceutical and biotechnology companies. The hybrid model, which combines elements of both fee-for-service and royalty-based models, is also gaining traction as it provides a balance between upfront costs and ongoing revenue sharing.

API Contract Manufacturing Market Scale Insights

In terms of scale, the global API contract manufacturing market is segmented into small-scale, medium-scale, and large-scale operations. Small-scale contract manufacturers typically have annual revenues of less than $10 million and focus on niche markets or specialized products.

Medium-scale contract manufacturers have annual revenues between $10 million and $100 million and offer a wider range of services, including product development, manufacturing, and packaging. Large-scale contract manufacturers have annual revenues exceeding $100 million and provide comprehensive services across the entire product lifecycle, from post-market support.

The large-scale segment held the largest share of the Global API contract manufacturing Market in 2023, accounting for over 55% of the total market revenue. This dominance is attributed to the extensive capabilities, global reach, and financial resources of large-scale contract manufacturers.

Large scale API contract manufacturers can handle complex projects, meet high-volume demands, and leverage economies of scale to offer competitive pricing. The medium-scale segment is expected to grow at a faster CAGR during the forecast period, driven by the increasing demand for outsourced manufacturing solutions from small and medium-sized businesses.

API Contract Manufacturing Market Regional Insights

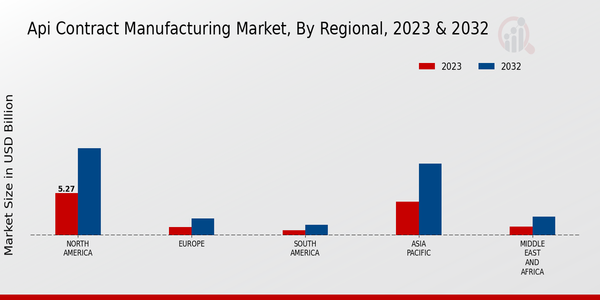

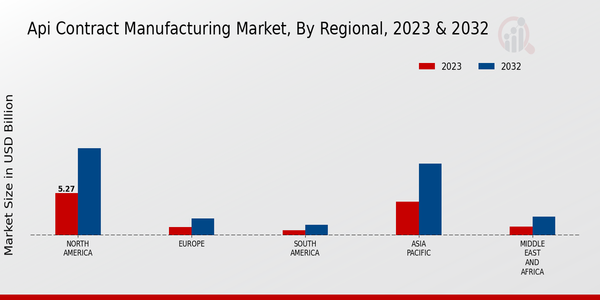

The global API contract manufacturing market is expected to grow significantly in the coming years. The market is segmented into various regions, including North America, Europe, APAC, South America, and MEA.

Among these regions, North America is expected to hold the largest market share in 2024, followed by Europe and APAC. The growth in North America is attributed to the increasing adoption of API contract manufacturing services by pharmaceutical and biotechnology companies. In Europe, the market is driven by the growing demand for high-quality and cost-effective API manufacturing services.

The APAC region is also witnessing a significant growth in the API contract manufacturing market due to the increasing number of pharmaceutical and biotechnology companies in the region. The South America and MEA regions are expected to grow at a steady pace in the coming years.

Global API Contract Manufacturing Market, by Region 2023 & 2032 (USD Billion)

Source: Primary Research, Secondary Research, Market Research Future Database and Analyst Review

API Contract Manufacturing Market Key Players and Competitive Insights

Major players in the API contract manufacturing market are focusing on expanding their production capacities, investing in research and development, and forming strategic partnerships to gain a competitive edge. Leading API contract manufacturing service providers are also adopting advanced technologies, such as artificial intelligence and machine learning, to improve efficiency and reduce costs.

The market’s competitive landscape is likely to remain fragmented, with numerous players competing for market share. However, the industry is expected to witness consolidation over time, as larger players acquire smaller companies to expand their portfolios and strengthen their market positions.

Lonza is a leading provider of API contract manufacturing services, offering a wide range of products and services to pharmaceutical and biotechnology companies. The company has a strong track record of successful collaborations with leading pharmaceutical companies and is known for its high-quality manufacturing standards and its ability to meet the specific needs of its customers.

Lonza has a global presence, with manufacturing facilities in Switzerland, the United States, and China. The company's extensive capabilities and global reach make it a valuable partner for pharmaceutical and biotechnology companies looking to outsource their Api manufacturing needs.

A competitor of Lonza in the API contract manufacturing market is Siegfried. Siegfried is a Swiss-based company that provides a range of API contract manufacturing services, including custom synthesis, process development, and scale-up.

Siegfried has a strong focus on innovation and is constantly investing in new technologies and processes to improve its efficiency and reduce costs. Siegfried has a global presence, with manufacturing facilities in Switzerland, the United States, and China. The company's strong track record of success and its commitment to innovation make it a formidable competitor in the API contract manufacturing Market.

Key Companies in the API Contract Manufacturing Market Include:

- Afton Chemical Corporation

- Momentive Performance Materials

API Contract Manufacturing Market Developments

The global API contract manufacturing market is projected to reach USD 13.43 billion by 2032, exhibiting a CAGR of 5.87% during the forecast period (2024-2032). The increasing adoption of biologics and the rising prevalence of chronic diseases are key factors driving market growth.

Recent news developments include the acquisition of Alcami by Charles River Laboratories, strengthening the latter's biologics manufacturing capabilities. Moreover, the collaboration between Lonza and Moderna to manufacture mRNA vaccines highlights the growing demand for contract manufacturing services in the biopharmaceutical industry.

API Contract Manufacturing Market Segmentation Insights

API Contract Manufacturing Market API Type Outlook

API Contract Manufacturing Market Application Outlook

API Contract Manufacturing Market End-User Outlook

API Contract Manufacturing Market Business Model Outlook

API Contract Manufacturing Market Scale Outlook

API Contract Manufacturing Market Regional Outlook

| Report Attribute/Metric |

Details |

| Market Size 2023 |

7.46 (USD Billion) |

| Market Size 2024 |

8.04 (USD Billion) |

| Market Size 2032 |

13.43 (USD Billion) |

| Compound Annual Growth Rate (CAGR) |

5.87% (2024-2032) |

| Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Base Year |

2023 |

| Market Forecast Period |

2024 - 2032 |

| Historical Data |

2019 - 2023 |

| Market Forecast Units |

USD Billion |

| Key Companies Profiled |

Afton Chemical Corporation, ExxonMobil Chemical, Momentive Performance Materials, Wacker Chemie AG, BASF SE, INEOS, Dow, Mitsui Chemicals, SABIC, Royal Dutch Shell, Merck KGaA, SIBUR, Evonik Industries, Lonza, Sinopec |

| Segments Covered |

API Type, Application, End-User, Business Model, Scale, Region |

| Key Market Opportunities |

Increased Demand for Complex APIs Expansion into Emerging Markets Adoption of Continuous Manufacturing Technological Advancements Growing Emphasis on Quality and Compliance |

| Key Market Dynamics |

Rising Demand Technological Advancements Outsourcing Trend Increasing R&D Regulatory Compliance |

| Countries Covered |

North America, Europe, APAC, South America, MEA |

Frequently Asked Questions (FAQ):

The global API contract manufacturing market is estimated to reach a valuation of USD 8.04 billion in 2024.

The global API contract manufacturing market is projected to grow at a CAGR of 5.87% from 2023 to 2032.

The global API contract manufacturing market is projected to reach a valuation of USD 13.43 billion by 2032.

North America is expected to hold the largest market share in the global API contract manufacturing market in 2023.

The pharmaceuticals segment is expected to hold the largest market share in the global API contract manufacturing market in 2023.

Some of the key competitors in the global API contract manufacturing market include Lonza, Catalent, Thermo Fisher Scientific, and Samsung Biologics.

The growth of the global API contract manufacturing market is driven by factors such as the increasing demand for APIs, the rising cost of manufacturing APIs in-house, and the need for specialized expertise in API manufacturing.

The challenges faced by the global API contract manufacturing market include the stringent regulatory requirements, the need for continuous innovation, and the intense competition from both domestic and international players.

The opportunities for growth in the global API contract manufacturing market include the increasing demand for APIs in emerging markets, the growing adoption of biologics, and the development of new technologies for API manufacturing.

The key trends in the global API contract manufacturing market include the increasing adoption of continuous manufacturing, the growing use of artificial intelligence and machine learning, and the focus on sustainability.